A Guide to PinkLion's Scenario Simulation Tool

Comparing a common investment consideration US vs. European Stocks.

I. Introduction

As someone who is passionate about investing, I know how challenging it can be to stay on top of market trends and make informed decisions. That's why I'm excited to introduce you to PinkLion, an AI-based Copilot for your investments.

PinkLion is a digital assistant that collects, harmonizes, and aggregates scattered market data and performs reasoning on the collected information. But it's not just another investment tool. PinkLion has a unique feature that sets it apart from the rest - the scenario simulation tool.

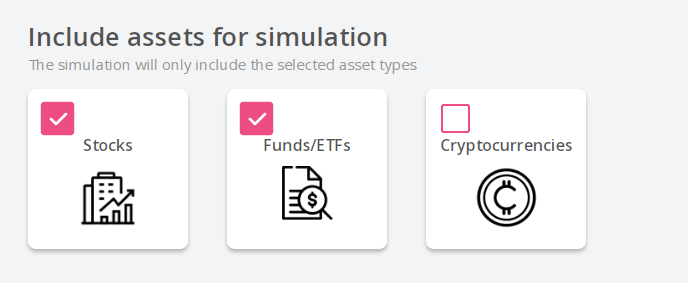

The scenario simulation tool helps you to test and validate your investment hypotheses by adjusting various parameters such as asset classes, country focuses, sectors, and ESG criteria to create different scenarios and see how they would have performed in the past and might perform in the future. This allows for more informed decisions and helps you identify risks before making actual investments.

As someone who has made my fair share of mistakes in investing, I wish I had a tool at my disposal when I first started out.

But don't just take my word for it. In this blog post, we'll explore the scenario simulation tool in more detail and how it can benefit you as an investor. So sit back, grab a cup of coffee, and let's dive in!

II. How-To Scenario Simulation

Have you ever found yourself wondering how your investments would perform under different scenarios? Maybe you've considered investing in a different sector or region, but you're not sure if it's the right move for your portfolio. This is where PinkLion's scenario simulation tool comes in handy.

As an AI-based investment Copilot, PinkLion is equipped with a powerful simulation feature that allows you to test and validate your investment hypotheses. By adjusting various parameters such as asset classes, country focuses, sectors, and ESG criteria, you can create different investment scenarios and see how they would have performed in the past and might perform in the future.

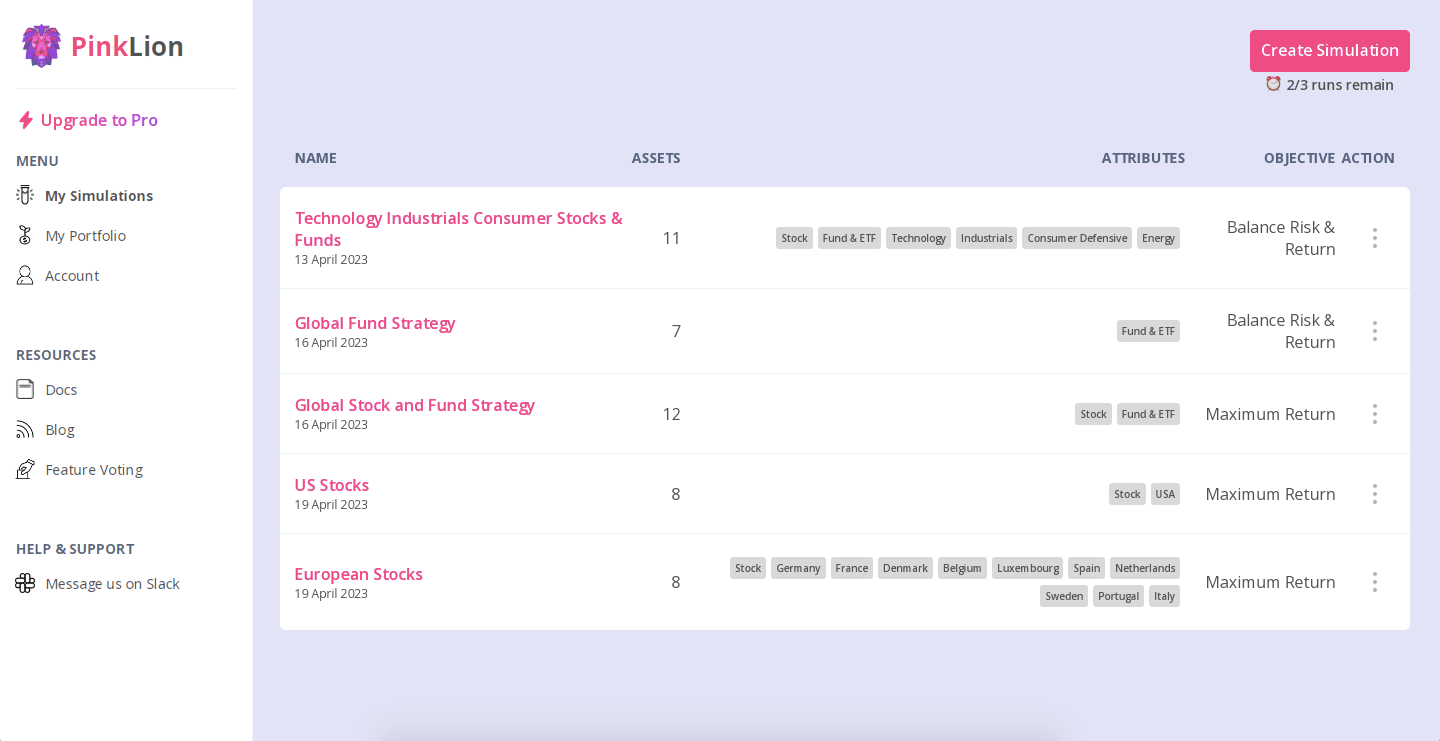

To get started with the scenario simulation tool, simply log in to your PinkLion account and navigate to the simulation section.

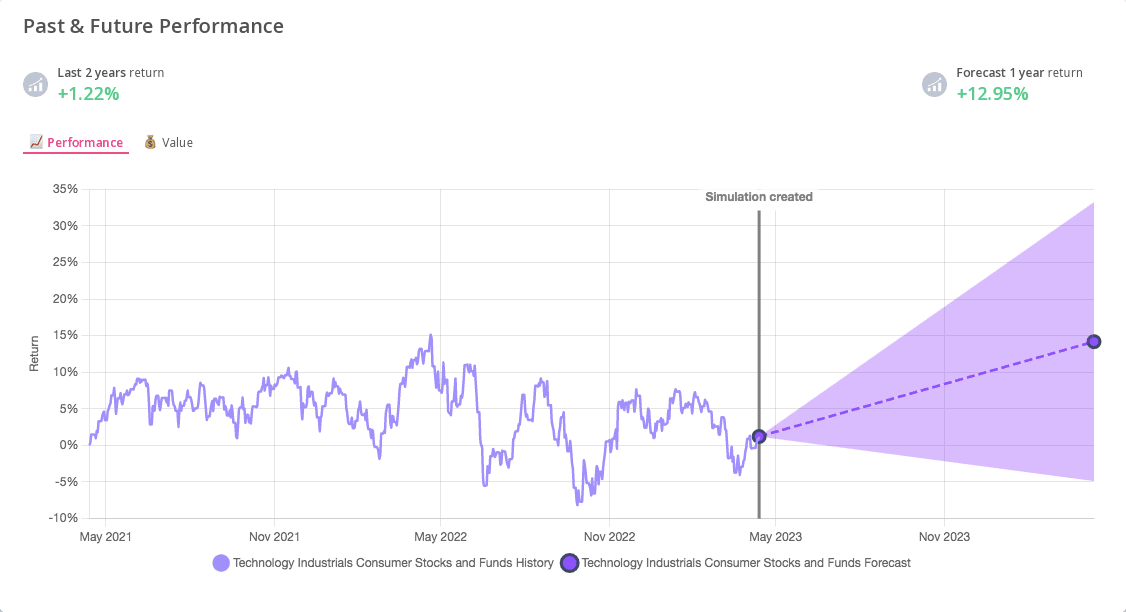

Once there the tool will provide you with historical performance data for a scenario. Additionally, PinkLion provides you with 1-year future market expectations so you can see how your investments might perform under those conditions.

One of the great benefits of using the simulation tool is that it allows for more informed decision-making. By simulating different scenarios, you can identify potential risks before making actual investments, minimizing potential losses and increasing your chances of success in the market.

Moreover, each simulation can be created with different risk levels, allowing you to get an idea of how much risk you are willing to take for the chance of higher returns. This helps you manage your risk more effectively and ensures that you are investing in line with your risk appetite.

Once you've identified successful investment strategies through the simulation tool, you can optimize them by adjusting various parameters and testing them again in the simulation tool. This allows you to refine your investment approach and ultimately improve your investment performance.

At PinkLion, we believe in providing our users with the tools they need to make informed decisions. While we cannot provide financial advice, our scenario simulation tool is a powerful resource that can help you make better decisions and achieve your financial goals.

III. US Stocks vs. European Stocks Scenario

Now that we understand how to use PinkLion's scenario simulation tool, let's put it to use by considering a common investment decision of US vs. European stocks.

As a global investor, I am always on the lookout for investment opportunities in different parts of the world. With the US stock market being the largest in the world, it's only natural that it garners a lot of attention from investors. However, European stocks have been gaining popularity in recent years, with their strong economies and potential for growth.

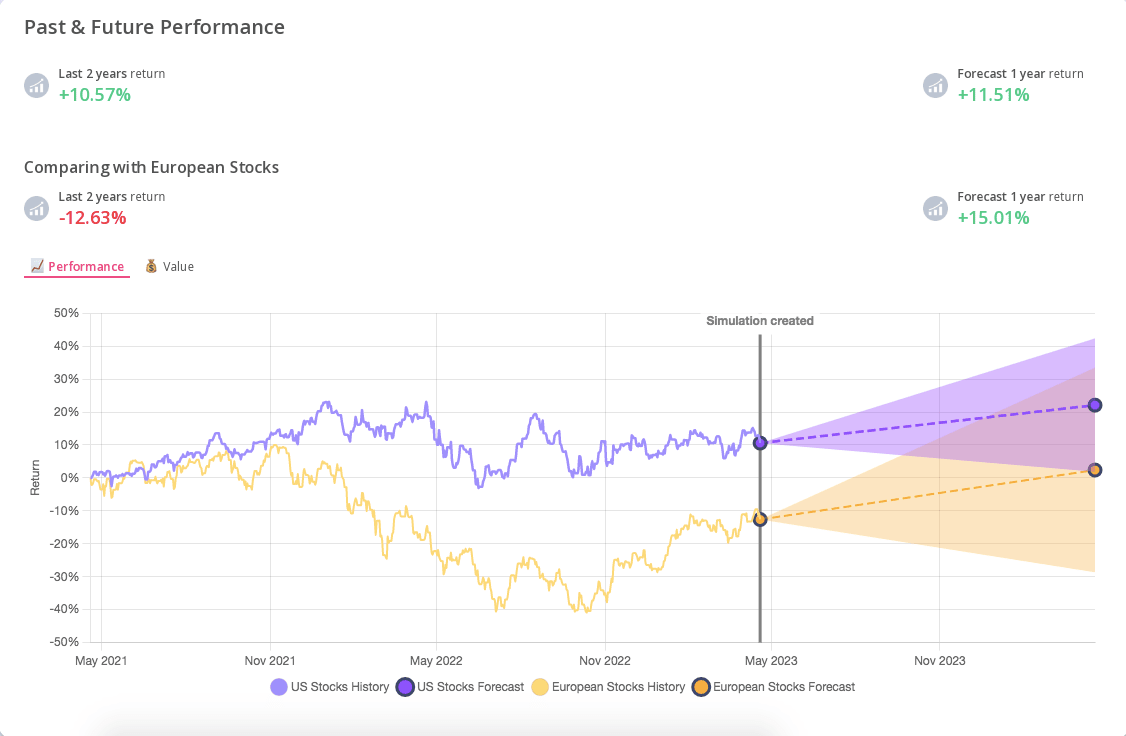

Using PinkLion's scenario simulation tool, I decided to compare the performance of US stocks and European stocks over the past two years and project their future market expectations for the next year.

To start, I selected the asset classes, country focuses, and sectors I wanted to compare. After adjusting the parameters, I was able to create two different simulations one for the US stocks and one for the European stocks.

What I found was interesting. Over the past two years, the US stock market outperformed the European stock market by a significant margin. However, when looking at the projected market expectations for the next year, the European stock market is expected to outperform the US stock market.

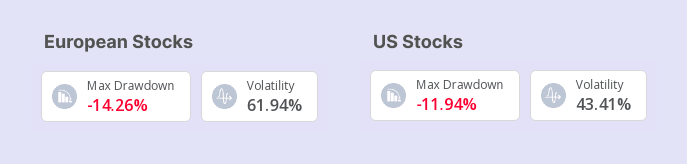

In addition, to the market having higher return expectations for the European stock market, it is worth while looking at the associated risk that US and European stocks have. In the past European stocks present significant higher levels of risk. In the last 2 years, European stocks when optimizing for maximum return have an unproportionately higher volatility and also have experienced a greater drawdown. Meaning that the higher return expectations for Europa comes with with a cost of higher risk.

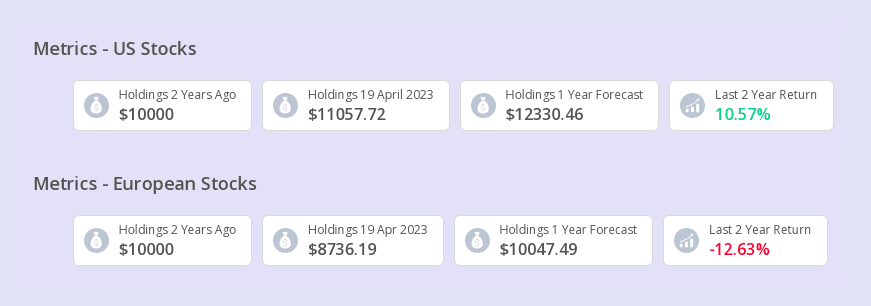

Furthermore, additional information are provided such us how the holdings would change over time to better evaluate the information provided.

This information allowed me to make more informed investment decisions. I was able to identify the potential risks and benefits of investing in both markets and adjust my risk appetite accordingly.

Overall, PinkLion's scenario simulation tool helps to make better investment decisions by allowing to test different scenarios and identify potential risks and benefits. – Feel free to give it a try!

In the next section, we'll take a closer look at the benefits of using PinkLion's scenario simulation tool.

IV. Benefits of Using Scenario Simulations

Now that we've explored the scenario simulation tool and compared US Stocks vs. European Stocks, let's summaries the overall benefits of validating investment hypotheses.

Better Decision Making

By simulating different scenarios, investors can make rational decisions about their investments. Rather than blindly following a hunch or intuition, a solid simulation allows investors to test their investment hypotheses against real market data. This can help identify risks and opportunities that may have otherwise gone unnoticed, and allow investors to adjust their strategies accordingly.

For example, let's say an investor is considering investing in a particular stock. By using scenario simulation, they can test how the stock would have performed under different market conditions, such as a recession or an economic boom. This can help them make a more informed decision about whether or not to invest in the stock, and how much to invest.

Risk Management

Investing always involves some level of risk. Each simulation can be created with different risk levels, allowing investors to get an idea of how much risk they are willing to take for the chance of higher returns. This can help investors avoid making overly risky investments that could lead to significant losses.

Strategy Optimization

Once an investor has identified successful investment strategies through scenario simulation, they can further optimize those strategies by adjusting various parameters and testing them again in the simulation tool. This iterative process allows investors to fine-tune their strategies and maximize their chances of success in the market.

Accessibility

Finally, one of the biggest benefits of scenario simulation in PinkLion is accessibility. The tool is user-friendly and easy to use, even for investors who may not have a lot of experience with investing. This means that more people can benefit from the insights and data provided by scenario simulation, and potentially improve their investment outcomes.

V. Disclaimer

As much as we’d like to, PinkLion cannot predict the future and we provide an AI-based investment Copilot that helps investors make more rational and informed decisions by providing data-driven insights and tools. However, we cannot guarantee that the scenarios you simulate using our platform will match future market outcomes.

It is essential to remember that investing involves risk, and you should only invest money you can afford to lose. PinkLion is a research tool that aims to provide investors with more data. We do not provide financial advice, and you should always consult with a licensed financial advisor before making investment decisions.

While the scenario simulation tool can help identify potential risks and opportunities, it is essential to note that past performance is not a reliable indicator of future results. Therefore, you should use the simulation tool to supplement your investment research.

VI. Conclusion

We hope this article has given you a good overview of PinkLion's scenario simulation tool and how it can help you make better investment decisions. By simulating different investment scenarios, you can test and validate your hypotheses, identify potential risks, and optimize your strategies.

At PinkLion, our goal is to empower investors with the latest AI-based technology, and increase your chances of success in the market. Whether you're an experienced investor or just starting out, our simulation tool can help you gain valuable insights into your portfolio's performance.

We're constantly working to improve our tools and services, and we welcome your feedback and suggestions. Stay tuned for more exciting updates and features in the future. Happy investing!