Coast Fire Calculator – Find Your Coast FIRE Number & Retire Smarter

Coast FIRE is achieved when your retirement savings are large enough to grow on their own, without further contributions, to fully fund your retirement by a traditional retirement age.

What Is a Coast Fire Calculator?

A Coast FIRE Calculator is a tool that helps you pinpoint the exact balance your investments must reach to “coast” to retirement. Instead of saving aggressively for decades, you can build an initial portfolio and then let time and compound returns do the heavy lifting. With our Coast FIRE Calculator, you can:

- Find your Coast FIRE number in seconds.

- Understand how investment returns and inflation affect your plan.

- Explore scenarios for different retirement ages and spending levels.

Coast FIRE Calculator

Results

How to Use the Coast Fire Calculator

- Enter your age and retirement goal.

- Add your current portfolio value.

- Set your expected annual spending in retirement (in today's dollars).

- Adjust return and inflation assumptions.

- Instantly see your Coast FIRE number and projected growth chart.

Pro Tip: Already at your Coast FIRE number? You can lower your savings rate, pursue passion projects, or simply enjoy more freedom while still being on track for FI.

What Is Coast FIRE?

Coast FIRE is the point where the heavy lifting is over: your existing nest egg can, with conservative market returns, grow large enough to fund retirement by your chosen age without further contributions. You still cover everyday expenses with active income, but retirement savings can drop to zero.

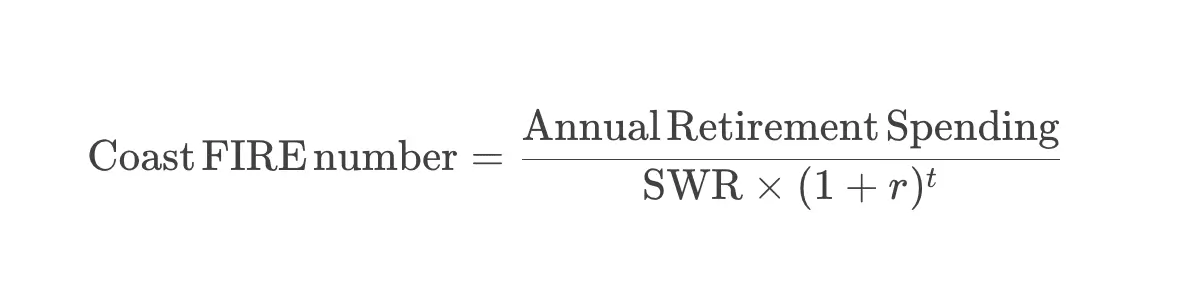

The Formula

- SWR – Safe Withdrawal Rate (commonly 3.5 – 4%)

- r – expected real rate of return (investment return − inflation)

- t – years until retirement

Our calculator crunches these numbers instantly and factors in inflation automatically.

To learn more about the details and math behind Coast FIRE, checkout my post: What is Coast FIRE?.

Why Aim for Coast FIRE?

- Career Freedom: Take a sabbatical, pivot into passion projects, or cut back to part‑time.

- Lifestyle Today: Redirect former retirement contributions toward travel, property, or hobbies.

- Built‑in Inflation Hedge: Equities tend to outpace inflation over long horizons.

- Mental Clarity: Knowing “the number” eliminates retirement stress and decision fatigue.

Coast FIRE vs. Traditional FIRE

| Traditional FIRE | Coast FIRE | |

|---|---|---|

| Savings Rate | 50–70% of income | Heavy early savings, then 0% |

| Retirement Goal | Stop working early | Work becomes optional earlier |

| Risk Profile | Sensitive to early market drops | More resilient due to longer growth horizon |

Example Scenario

Maria, 30, wants work to be optional at 65 and expects to spend $50,000 a year in retirement.

| Input | Value |

| Current invested assets | $120,000 |

| Monthly contribution | $1,000 |

| Nominal return | 7% |

| Inflation | 3% |

| SWR | 4% |

Result: Maria’s Coast FIRE number is $316,769. She’ll hit it by age 57 if she keeps contributing $1,000 per month. From that point forward, retirement is fully funded; additional savings become optional.

Frequently Asked Questions

How accurate is the Coast FIRE Calculator?

Our math mirrors industry‑standard formulas and rounds to the nearest dollar. Remember, all projections rely on assumptions, update them regularly.

Does the calculator account for taxes?

We assume tax‑advantaged growth for retirement accounts and show pre‑tax dollar targets. For a post‑tax view, reduce your expected retirement spending accordingly.

Can I include rental properties or crypto?

Yes. Any asset with an expected growth rate can be entered as part of your current invested assets.

What happens if market returns are lower?

Use the slider to drop the return assumption (e.g., 5%). You’ll see your Coast FIRE number rise, which acts as a built‑in stress test.

Is Coast FIRE a good idea if I want to retire before 55?

Possibly. The shorter your timeline, the larger the up‑front investment needed.

How often should I revisit my numbers?

Aim for a quick check‑in every six months or whenever your income, spending, or market conditions shift significantly.

Ready to Start Coasting?

Plug in your numbers above and see how small tweaks like upping contributions for just a few years can shave decades off your savings timeline. Then share the calculator with a friend who could use a little breathing room too.