What Is the Discounted Cash Flow Method of Valuation?

The discounted cash flow (DCF) method calculates a company’s true value by projecting future cash flows and discounting them to today. This guide explains DCF in simple terms, with examples like Apple, to help investors spot undervalued stocks.

TL;DR – Discounted Cash Flow Method of Valuation: The discounted cash flow (DCF) method estimates a company’s intrinsic value by projecting future cash flows and discounting them back to the present using a required rate of return. If the DCF value is above the stock price, it may be undervalued; if it’s lower, the stock might be overpriced.

The Discounted Cash Flow (DCF) method is one of the most powerful ways to find a company’s intrinsic value. It estimates what a stock (or any investment) is truly worth by projecting future cash flows and discounting them to today’s value, considering the time value of money.

For investors, this method cuts through short-term market noise and focuses on fundamentals:

- If the DCF value is higher than the current price, the stock may be undervalued (a buy opportunity).

- If the DCF value is lower, it might be overpriced.

Why DCF Matters for Investors

Unlike price-to-earnings ratios or market hype, DCF looks at real cash the business generates. It helps answer the question:

“Is this stock’s current price justified by its future cash potential?”

The time value of money is key: $1 today is worth more than $1 tomorrow because it can earn returns if invested.

Core Components of DCF

A DCF model has three main parts:

1. Free Cash Flows (FCF)

This is the cash available to investors after covering all operating costs and reinvestments. Analysts project a company’s FCF for 5–10 years using realistic assumptions about growth, margins, and expenses.

2. Discount Rate (WACC)

The discount rate converts future cash flows into today’s value, accounting for risk. Often, the Weighted Average Cost of Capital (WACC) is used, which reflects both the cost of debt and equity.

Higher risk = higher discount rate = lower present value.

3. Terminal Value

Since you can’t forecast cash flows forever, the terminal value estimates all cash flows beyond the forecast period.

- Perpetual Growth Model: Assumes cash flows grow at a stable long-term rate (e.g., 2%).

- Exit Multiple Method: Applies a market-based multiple (e.g., 10× EBITDA).

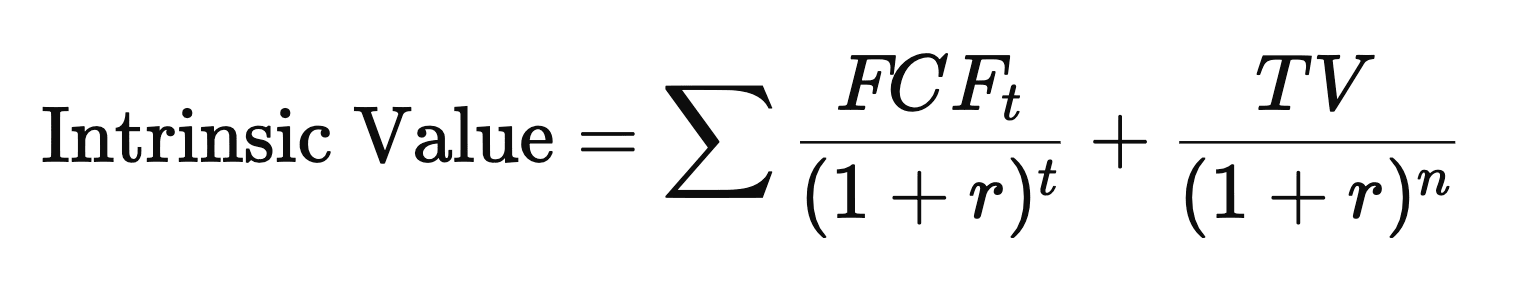

DCF Calculation – Step by Step

- Project free cash flows for 5–10 years.

- Estimate terminal value (using perpetual growth or exit multiples).

- Choose a discount rate that reflects risk and cost of capital.

- Discount each cash flow to present value:

- Sum the values to find the total intrinsic value. For stock valuation, divide by shares outstanding to get the per-share value.

Real-World Example: Apple (AAPL)

Using a DCF model:

Analysts project Apple’s 2025 FCF at ~$123B, rising to ~$219B by 2034.

A 7.3% discount rate and 2.5% terminal growth rate value Apple’s future cash flows at $3.5 trillion total.

Dividing by shares gives ~$233/share (close to Apple’s actual market price of ~$235 in late 2024).

This shows how assumptions (growth, discount rate) can drastically influence the DCF result.

Key Assumptions and Sensitivity Analysis

DCF results are sensitive to inputs, so investors should:

- Test multiple scenarios: Adjust growth rates (optimistic vs. conservative).

- Change the discount rate: Even a 1% change can shift the valuation significantly.

- Be conservative: Overly optimistic terminal values can mislead.

Advantages of DCF

- Focuses on fundamentals: Based on a company’s actual ability to generate cash.

- Versatile: Works for stocks, real estate, or any asset with predictable cash flows.

- Great for long-term investors: Helps avoid being swayed by market sentiment.

Limitations of DCF

- Garbage in, garbage out: Unreliable inputs = unreliable valuation.

- Complexity: Requires financial knowledge to model cash flows accurately.

- Heavy reliance on terminal value: Often 50–70% of total valuation comes from this assumption.

Common Mistakes to Avoid

- ❌Unrealistic growth assumptions.

- ❌ Ignoring capital expenditures or reinvestments.

- ❌ Using arbitrary discount rates (e.g., 10%) without justification.

- ❌ Not cross-checking with market multiples (P/E, EV/EBITDA).

How Investors Can Use DCF

- ✅ Identify undervalued stocks: Compare DCF value to current price.

- ✅ Calculate margin of safety: Look for at least 20–30% difference between price and intrinsic value.

- ✅ Combine with other methods: Use DCF alongside P/E ratios and qualitative analysis.

Conclusion

The discounted cash flow method of valuation is one of the best tools for determining whether a stock’s price makes sense. For investors, mastering DCF provides a long-term edge, helping to avoid hype and focus on intrinsic value. While it requires careful assumptions, combining DCF with a margin of safety and other valuation tools can significantly improve investment decisions.

FAQ

What is the discounted cash flow (DCF) method of valuation?

DCF projects a company’s future free‑cash flows and discounts them back to today using a required rate of return, revealing the present‑value (intrinsic) worth of the business.

Which cash‑flow metric should I use in a DCF?

Most investors start with unlevered free cash flow (FCFF) because it excludes financing decisions and reflects the cash available to all capital providers.

How do I choose the discount rate?

Use the company’s weighted‑average cost of capital (WACC) for FCFF models; if discounting equity cash flows (FCFE), use the required return on equity derived from CAPM.

Why is the terminal value so important?

Terminal value often accounts for 50 – 70 % of total DCF value, so realistic long‑run growth and discount assumptions are crucial to avoid over‑ or under‑valuation.

How sensitive is a DCF to small input changes?

Very! Minor tweaks to growth, margin, or WACC can shift intrinsic value dramatically. Always run a sensitivity table or Monte Carlo simulation.

When does a DCF break down?

DCF is less reliable for early‑stage firms with negative or volatile cash flows, companies in cyclical industries, or businesses facing rapid disruption.