Fat FIRE Calculator: See Your Number for a Luxurious Early Retirement

Use our Fat FIRE Calculator to determine how much you need to retire early with a luxury lifestyle. Find your number, plan smarter, and live big.

Why Use a Fat FIRE Calculator?

If you dream of retiring early without compromising your lifestyle, a Fat FIRE Calculator is essential. It shows you how much you need to achieve financial independence with a high annual spending budget, so you can:

- Calculate your Fat FIRE number instantly.

- Plan for luxury travel, premium healthcare, and lifestyle upgrades.

- Visualize how investment growth and time affect your path to early retirement.

TL;DR: The Fat FIRE Calculator helps you determine the amount you need invested to retire early while maintaining a high-spending, comfortable lifestyle. Simply input your age, savings, and spending goals to get a precise target.

Fat FIRE Calculator

Our interactive Fat FIRE Calculator estimates the exact portfolio size required for a high-quality retirement. Enter details like your current savings, target annual spending, and expected return rate, and see real-time results.

Results

How the Calculator Works

- Enter your age and desired retirement age.

- Input your current savings and investments.

- Add your annual spending goal for retirement.

- Adjust assumptions for growth rate, inflation, and safe withdrawal rate (SWR).

- Get results instantly, including how much you need and how close you are.

What Counts as Fat FIRE?

Fat FIRE is financial independence with a bigger cushion. It means having enough savings and investments to retire early while maintaining an upscale lifestyle, often with annual spending well above $100,000.

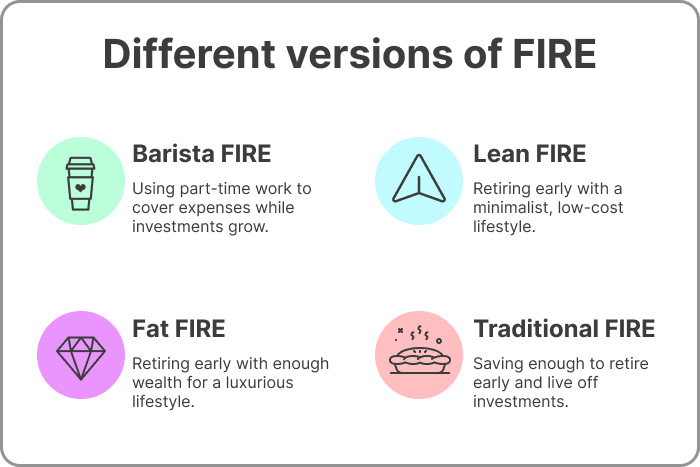

Fat FIRE vs. Lean and Traditional FIRE

- Lean FIRE: Retiring early on a minimalist budget.

- Traditional FIRE: Retiring early with moderate spending.

- Fat FIRE: Retiring early with luxury and financial comfort.

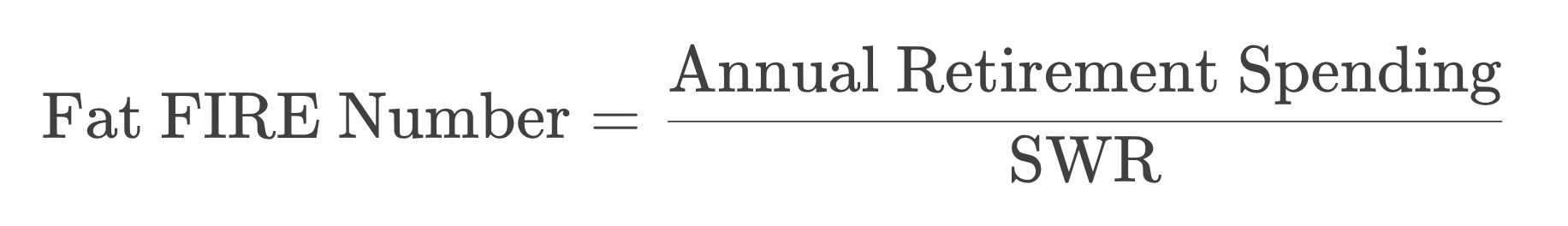

The Fat FIRE Formula

- SWR: Safe Withdrawal Rate (commonly 3–4%).

- Adjusted for inflation and expected investment returns.

Example: Reaching Fat FIRE by 55

Sarah, 35, wants to retire at 45 with $120,000 annual spending.

Result: Sarah’s Fat FIRE number is $3 million. She will hit her goal by 55 if she continues contributing $5,000 per month.

How to Accelerate Your Path to Fat FIRE

- Boost income streams (e.g., side businesses, real estate).

- Maximize tax-advantaged accounts (401k, IRA).

- Invest in higher-yield assets with balanced risk.

- Avoid lifestyle creep by keeping expenses under control.

Risks to Watch Out For

- Market volatility and sequence-of-returns risk.

- Healthcare and unexpected big-ticket expenses.

- Inflation exceeding projections.

- Overspending due to a luxury lifestyle.

Fat FIRE Calculator FAQ

What is Fat FIRE?

Fat FIRE is financial independence with a high spending plan, allowing for luxury and comfort.

How is the Fat FIRE Calculator different?

It accounts for higher spending goals and conservative returns.

Is 4% SWR safe for Fat FIRE?

Many aim for 3–4% SWR, but high spenders may prefer a lower rate for safety.

How often should I recalculate?

Check every 6–12 months or when your income or expenses change.

Can I include real estate or side income?

Yes, add all investable assets to get the most accurate results.

Ready to Start Your Fat FIRE Journey?

Use our Fat FIRE Calculator now to see how much you need for a worry-free, luxury retirement. A few smart moves today can bring you closer to your dream lifestyle tomorrow.

Disclaimer

This content is for educational purposes only and does not constitute financial advice. Always consult with a certified financial planner for tailored advice.