How Do I Calculate Compound Annual Growth Rate in Excel? – A Complete Step‑by‑Step Guide

Need to calculate Compound Annual Growth Rate in Excel? This guide walks you through the CAGR formula, RATE function, and common pitfalls so you can analyze growth with confidence.

TL;DR – Quick Answer

To calculate Compound Annual Growth Rate (CAGR) in Excel, use either of these formulas:=(Ending_Value / Beginning_Value)^(1/Years) - 1

or=RATE(Years, , -Beginning_Value, Ending_Value)

Both return the annualized growth rate that smoothly turns your beginning value into your ending value over a set period.

Introduction: Why You Need CAGR in Excel

Investors, analysts, and even small‑business owners often ask, “How do I calculate Compound Annual Growth Rate in Excel?” CAGR shows the true year‑over‑year growth of an investment or metric, smoothing out volatility. With a single formula, you can compare performance across different time spans and assets—something a simple average can’t do.

What Is Compound Annual Growth Rate?

CAGR answers: “If my investment grew at a steady annual rate, what rate would take me from my starting value to my ending value over X years?”

- Accounts for compounding (unlike arithmetic averages).

- Works for any metric—sales, subscribers, portfolio value.

Core Formula: How Do I Calculate Compound Annual Growth Rate in Excel?

Manual CAGR Formula

=(Ending_Value / Beginning_Value)^(1/Years) - 1Variables

- Beginning_Value (BV) – starting amount

- Ending_Value (EV) – ending amount

- Years (n) – total periods in years

Example

Investment grows from $10,000 to $18,000 over 5 years:

=(18000/10000)^(1/5)-1 → 0.126 → 12.6 %RATE Function Method

Excel’s built‑in RATE function can serve as a CAGR shortcut:

=RATE(Years, , -Beginning_Value, Ending_Value)- Make Beginning Value negative (cash outflow) and Eending Value positive (cash inflow).

- Returns the identical CAGR percentage.

Step‑by‑Step CAGR Formula Walkthrough

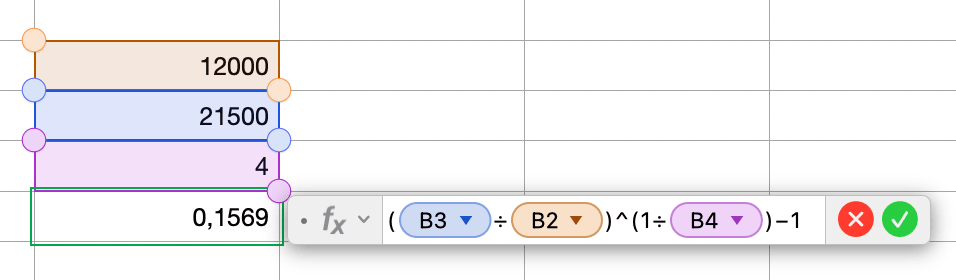

| Step | Action | Excel Entry |

|---|---|---|

| 1 | Enter Start $12,000 in B2 | 12000 |

| 2 | Enter End $21,500 in B3 | 21500 |

| 3 | Enter Years 4 in B4 | 4 |

| 4 | In B6, type manual CAGR formula | =(B3/B2)^(1/B4)-1 |

| 5 | Format B6 as Percent | → 15.69 % |

| 6 | Optionally, in B7 use RATE |

=RATE(B4,,-B2,B3) |

Calculating CAGR for Uneven Time Frames

Problem: Dates don’t align to full years.

Solution: Calculate fractional years using YEARFRAC.

=YEARFRAC(Start_Date, End_Date)

Insert that decimal into the CAGR formula:

=(End/Start)^(1/YEARFRAC(Start_Date,End_Date))-1

Troubleshooting: Common Mistakes

| Mistake | Fix |

|---|---|

| Ending value < beginning value | Expect a negative CAGR (decline). |

| Missing “‑1” in the formula | You’ll return the growth factor, not the growth rate. |

Same sign in RATE |

Beginning must be negative, ending positive. |

| Not formatting as percent | Format the cell or multiply result by 100. |

| Using simple averages | CAGR incorporates compounding; averages do not. |

CAGR vs. Average Annual Return

| Mistake | Fix |

|---|---|

| Ending value < beginning value | Expect a negative CAGR (decline). |

| Missing “‑1” in the formula | You’ll return the growth factor, not the growth rate. |

Same sign in RATE |

Beginning must be negative, ending positive. |

| Not formatting as percent | Format the cell or multiply result by 100. |

| Using simple averages | CAGR incorporates compounding; averages do not. |

Conclusion & Key Takeaways

- How do I calculate compound annual growth rate in Excel? Use either the manual formula or

RATE. - Validate by formatting as a percentage.

- Use YEARFRAC for partial years.

- Apply CAGR to investments, revenue streams, or user growth for apples‑to‑apples comparisons.

FAQ – CAGR in Excel

What is the CAGR formula in Excel?

Use =(Ending_Value / Beginning_Value)^(1/Years) - 1

or RATE: =RATE(Years, , -Beginning_Value, Ending_Value)

How do I calculate CAGR for partial years?

Compute Years with =(End_Date-Start_Date)/365.25 , then plug that value into the CAGR formula.

Why does the RATE formula need a negative beginning value?

RATE treats cash outflows (investments) as negative and inflows as positive, so beginning value must be entered as a negative number.

How can I avoid common CAGR mistakes?

Ensure Ending Value is greater than Beginning Value, include the -1 in the formula, format results as a percentage, and subtract excess cash in RATE.

Is CAGR the same as average annual return?

No. CAGR accounts for compounding; a simple average ignores the effect of year‑to‑year fluctuations.

What if my beginning value is zero or negative?

You can’t compute CAGR with a zero start; use revenue growth techniques or exclude the period.

How do I calculate CAGR for monthly data?

Count months, divide by 12 to get years, then use the same formula.

Can I calculate CAGR for negative growth?

Yes, the formula returns a negative rate when EV < BV.

Is CAGR better than IRR?

For a single cash‑in, single cash‑out scenario, they’re identical. IRR handles multiple cash flows.