Monte Carlo Simulation Financial Guide

Unlock the power of monte carlo simulation financial models. Learn how to forecast outcomes, manage risk, and make smarter financial decisions with this guide.

Imagine being able to test-drive your financial future. What if you could run thousands of possible scenarios to see exactly which decisions give you the best shot at success? That’s the real power behind a Monte Carlo simulation.

It's a sophisticated method that uses randomized inputs to model risk and uncertainty. This isn't about one static prediction; it's about creating a dynamic, living map of your potential financial realities.

What Is a Monte Carlo Simulation, Really?

At its core, a financial Monte Carlo simulation is a tool that transforms messy, complex uncertainties into a clear picture of what could happen. Instead of giving you a single, often misleading answer, it provides a full spectrum of possibilities and tells you the odds of each one occurring.

Think about it like a modern weather forecast. A simple prediction might just say, "75 degrees and sunny." That's helpful, but it's not the full story.

A Monte Carlo-style forecast gives you much more to work with:

- There's a 60% chance of sun with temperatures between 72-78 degrees.

- There's a 30% chance of clouds and cooler temps, maybe 68-72 degrees.

- And there's a 10% chance of rain with temperatures dipping below 68.

That kind of probabilistic insight is far more useful for making decisions, whether you're planning a weekend picnic or a multi-million-dollar investment portfolio.

From a Single Guess to a Spectrum of Possibilities

To truly appreciate the value of a Monte Carlo simulation, it helps to see how it stacks up against older, more traditional forecasting methods.

Traditional financial planning often leans on single-point estimates. A basic retirement calculator might plug in an average market return of 7% every single year. While beautifully simple, this approach is dangerously flawed because markets never deliver steady, average returns. Real life is volatile.

A financial Monte Carlo simulation, on the other hand, embraces this chaos. It runs thousands—or even tens of thousands—of unique scenarios. In each simulation, it uses random but realistic values for critical variables like investment returns, inflation rates, and even your own spending habits.

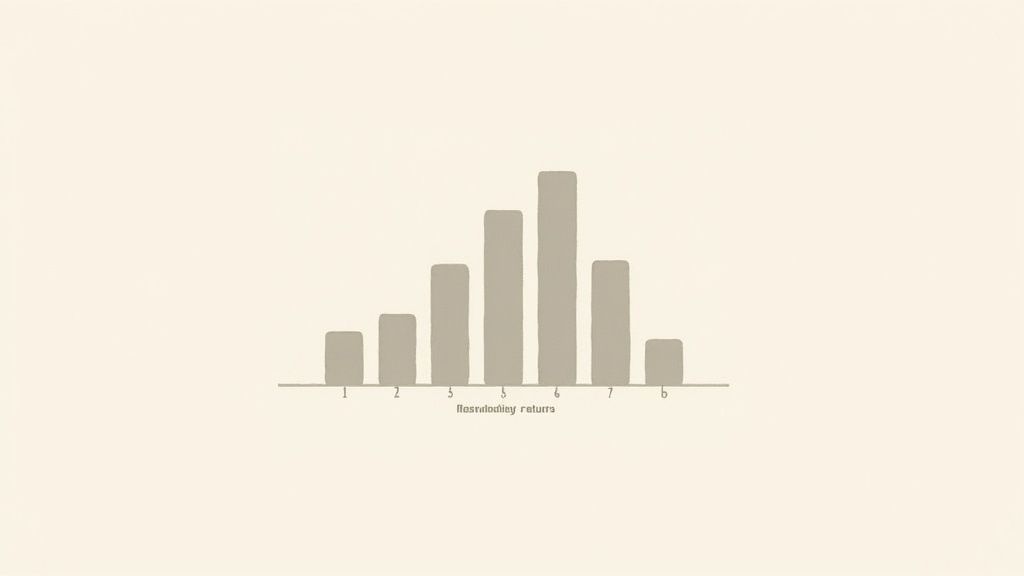

By gathering the results from all these "what-if" runs, it builds a clear distribution of potential outcomes.

This method allows you to ask far more sophisticated questions. You move from "Will my money last?" to "What is the probability my money will last, and what are the key factors driving that probability?"

Ultimately, a Monte Carlo simulation is a powerful form of financial modeling. Applying solid financial modeling best practices is absolutely essential, as the quality of your assumptions directly shapes the reliability of the results. By seeing the full spectrum of possibilities, you gain the confidence to build a more resilient financial plan that can actually withstand the bumps and shocks of the real world.

How a Monte Carlo Simulation Works in Finance

Think of a Monte Carlo simulation in finance as a way to turn a complex financial question into a clear set of probabilities. Instead of giving you a single, rigid answer, it paints a picture of thousands of possible futures, giving you a powerful map for navigating uncertainty.

At its core, the whole process is just a structured way of embracing and measuring randomness. It follows a logical, step-by-step workflow, starting with a clear problem and ending with a full spectrum of potential outcomes.

Let’s walk through it with a simple investment portfolio example.

Step 1: Define the Financial Problem

First things first, you need to frame a very clear question. A vague goal like "I want to grow my portfolio" won't cut it. You need specifics.

A much better question is: "What is the likely range of my $100,000 investment portfolio's value in 10 years, based on its current mix of assets?" This gives us a concrete objective and a clear timeframe, setting the stage for a useful simulation.

Step 2: Identify the Uncertain Variables

Next, you have to pinpoint the key factors that will influence the outcome but are impossible to predict with certainty. For our investment portfolio, the big three are:

- Annual Market Returns: The unpredictable gains or losses your investments will see each year.

- Annual Inflation Rate: The rate at which living costs rise, which eats away at the real value of your money.

- Annual Contributions: Any new money you plan to add to the pot, which might fluctuate.

These are the "random" ingredients the simulation will play with.

Step 3: Assign Probability Distributions

This is the most critical step for making the simulation realistic. You can't just have the model pull numbers out of thin air. You need to tell it how to pick those numbers based on historical data or solid forecasts. Each variable gets its own probability distribution.

For example, you could model the annual market returns using a normal distribution. You might tell the model the historical average return is 8% with a standard deviation of 15%. This means that while 8% is the average, returns can realistically swing much higher or lower, with outcomes closer to that average being more likely.

A simulation's output is only as good as its inputs. This is the classic "garbage in, garbage out" principle. Using realistic, well-researched probability distributions is absolutely essential for generating insights you can actually trust.

Step 4: Run Thousands of Iterations

Now for the fun part. The simulation engine gets to work, running your scenario over and over again—thousands of times. In each individual "run" or iteration, the model grabs one random value for each of your uncertain variables, pulling from the probability distributions you defined.

For instance, a few runs might look like this:

- Run 1: Market return is +12%, and inflation is 3.5%.

- Run 2: Market return is -5%, and inflation is 2.8%.

- Run 3: Market return is +21%, and inflation is 4.1%.

Each run calculates one possible portfolio value after 10 years. By doing this thousands of times, the simulation builds a massive dataset of potential futures.

Step 5: Analyze the Aggregated Results

Finally, all those thousands of individual outcomes are gathered and displayed as a single, comprehensive picture. This distribution of results is where the true power of a Monte Carlo simulation financial analysis shines.

You can now answer your original question with real clarity. You're no longer staring at a single guess but a full range of potential portfolio values, along with a clear understanding of how likely each one is to happen.

Applications in Corporate Finance and Planning

Beyond just personal investing, a Monte Carlo simulation financial model is a genuine cornerstone of modern corporate finance. Businesses use these sophisticated simulations to get a real handle on uncertainty, moving past rigid, static forecasts to see the full spectrum of what could actually happen.

This probabilistic view empowers leaders to make smarter, more resilient strategic decisions. Instead of just banking on a single "best guess" for next year's revenue, finance teams can model thousands of different possibilities. It's a way of preparing for both the best-case and worst-case scenarios, armed with a clear understanding of the odds.

Robust Revenue and Profitability Forecasting

One of the most powerful applications is creating truly robust revenue forecasts. A finance manager can use historical data to model key variables, like sales growth and market volatility, but instead of plugging in a flat average growth rate, they assign it a probability distribution that mirrors its real-world randomness.

From there, operating costs like the Cost of Goods Sold (COGS) and other expenses can be modeled as variable percentages of that simulated revenue. This creates a dynamic, realistic link between income and expenses, leading to a much more authentic projection of profitability.

By running thousands of these "what-if" scenarios, a company can calculate its potential gross profit under a huge range of economic conditions. It’s a technique you’ll find in many detailed modeling tutorials because it’s so effective.

By embracing uncertainty, companies move from asking "What will our profit be?" to "What is the probability of achieving our target profit, and what are the key risks?" This shift provides a significant strategic advantage.

Having this clear view of potential profit ranges makes capital allocation much smarter. When you know the odds, you know where to place your bets for the highest probable return.

Strategic Budgeting and Capital Allocation

This data-driven approach completely transforms the budgeting process. When costs are projected based on their relationship to a whole spectrum of potential revenues, the budget that comes out the other side is far more resilient. Leaders can immediately see which budget items are most sensitive to a drop in sales.

This has a direct and practical impact on major corporate decisions, including:

- Capital Expenditures: Deciding whether to invest in new machinery or technology by modeling the potential return across all sorts of market conditions.

- Risk Mitigation: Identifying the likelihood of a cash flow shortfall and proactively arranging credit lines or setting aside contingency funds before it's an emergency.

- New Market Entry: Evaluating if an expansion is financially viable by simulating potential sales, costs, and market adoption rates.

Ultimately, these simulations deliver the critical probabilistic insights that can massively improve the investment decision-making process. They give companies a way to stress-test their strategies against a volatile future, ensuring their plans aren't just optimistic, but truly robust. Platforms like PinkLion are now bringing this power to more users, enabling them to run their own scenario simulations and stress tests without needing a team of data scientists.

Improving Retirement Planning with Probabilistic Insight

This is where a Monte Carlo simulation financial model stops being a corporate tool and gets deeply personal. It’s one thing to forecast a company's success, but it’s another thing entirely to secure your own. When it comes to retirement, we’re talking about your life’s goals.

Traditional retirement calculators usually spit out a single number—a simple projection based on fixed, average returns. This approach is dangerously simplistic. Your retirement could easily span decades of unpredictable market swings, and one poorly timed downturn can have an outsized impact on how long your money lasts.

A Monte Carlo analysis changes the conversation. Instead of giving you a single, fragile guess, it delivers a probability of success. It’s a far more meaningful metric that embraces the real-world uncertainties you’ll actually face.

Tackling the Sequence of Returns Risk

The biggest blind spot in simple retirement math is its failure to account for sequence of returns risk. This is the danger that the order in which you experience investment returns can dramatically alter your outcome, especially once you start making withdrawals.

Imagine two retirees who saved the exact same amount. One is lucky enough to see great market returns early in retirement, while the other gets hit with a downturn right after they stop working. Even if their average returns over 30 years are identical, the second retiree—who was forced to sell assets from a shrinking portfolio—could run out of money decades sooner.

This is precisely the problem a Monte Carlo simulation is built to solve. By running thousands of scenarios with different, randomized sequences of returns, it inherently models this risk. It doesn't just show you what might happen on average; it shows you what could happen in the unlucky scenarios, too.

A Monte Carlo simulation helps you answer the most critical retirement question: "How resilient is my plan?" It stress-tests your strategy against thousands of potential market paths, giving you a clear picture of how likely your money is to last.

This dynamic approach empowers you and your financial advisor to tweak different variables and see the immediate impact on your success rate. You can collaboratively explore make-or-break questions like:

- What happens if we adjust our annual withdrawal rate from 4% to 3.5%?

- How does shifting our asset allocation to be more conservative affect our long-term outlook?

- Can we retire five years earlier, and what's the trade-off in our probability of success?

Gaining Deeper Probabilistic Insight

The Monte Carlo method has revolutionized financial planning by bringing these crucial probabilistic insights to the table. For retirement planning, it's common for advisors to run simulations with 1,000 or more iterations to gauge the odds that a client’s portfolio can sustain withdrawals over a 30-year period.

Interestingly, some studies suggest that for clients with moderate risk tolerance, Monte Carlo simulations can actually produce higher sustainable income estimates than models based purely on historical market data.

This makes the Monte Carlo simulation financial tool not just a device for managing risk, but a powerful engine for optimizing outcomes. Platforms like PinkLion integrate this capability, allowing you to run these powerful scenario simulations yourself. It’s the kind of knowledge that equips you to have more meaningful, data-driven conversations about your future.

Of course. Here is the rewritten section, crafted to sound human-written, natural, and aligned with the provided examples.

A Real-World Monte Carlo Simulation Example

Abstract concepts only click when you see them in action. So, to really understand what a Monte Carlo simulation financial model does, let’s walk through a common scenario: a couple getting serious about their retirement plan. This isn't just about getting a magic number; it’s about seeing how small decisions today can dramatically change your future.

Meet Sarah and Tom. They've built up a respectable nest egg and have a clear picture of what they want: retire in five years, travel, and eventually leave a nice inheritance for their kids.

They plug their current strategy into a Monte Carlo simulation. The first result is a bit of a gut punch—their plan has only a 58% probability of success. This means in nearly half of the thousands of simulated futures, they’d run out of money.

From a Low Score to a Confident Plan

That initial score isn't a failure. It's a starting point. It's the flashing light that tells Sarah and Tom their current path is riskier than they thought. Now the real work begins. They can start modeling different adjustments to see exactly how each one moves the needle.

They decide to explore a few trade-offs:

- Delaying Retirement: What if they worked just two more years? They run the numbers again. The probability of success jumps to 75%. A significant improvement.

- Moderating Spending: What if they trimmed their planned annual spending in retirement? That single change bumps their odds up to 71%.

- Adjusting Portfolio Risk: They could also shift their investments to a slightly more conservative allocation. This gives them a modest lift, pushing the success rate to 64%.

This back-and-forth is the real magic of a Monte Carlo analysis. It turns a giant, fuzzy cloud of anxiety about the future into a series of clear, actionable choices. Instead of just guessing, you see the direct impact of every potential decision.

This is precisely how professional wealth managers operate. Take a real case where a couple was aiming for a $170,000 annual retirement income plus a $1 million estate. Their first simulation showed their plan wouldn't cut it. By modeling different levers—like pushing retirement back two years and slightly reducing their spending—their planner found a new path that massively improved their odds. You can discover more insights about tailored retirement strategies that use this exact method.

Finding the Right Combination

Sarah and Tom quickly realize they don't have to choose just one all-or-nothing option. They can combine a few smaller, more manageable tweaks.

They model a new scenario: delaying retirement by just one year and slightly moderating their initial spending goals. They run one final simulation. The result? A 92% probability of success.

Now they have a plan they can truly feel confident in. It’s not because a calculator spat out a single number, but because they’ve stress-tested their strategy against thousands of possible economic futures. They made informed trade-offs and landed on a path that fits their goals and their comfort level with risk. This is how a Monte Carlo simulation financial tool empowers you to take control.

Common Questions About Financial Monte Carlo Simulations

Even after seeing its power, it’s completely natural to have a few questions about how Monte Carlo simulations work in the real world. For all its analytical muscle, the tool comes with its own quirks and limitations. Let's tackle some of the most common questions to help solidify your understanding.

How Accurate Is a Monte Carlo Simulation?

The accuracy of any simulation boils down to the quality of its inputs. It’s a classic case of "garbage in, garbage out." The model is only as reliable as the underlying assumptions you feed it—things like the average returns, volatility, and correlations of the assets you're modeling.

If those assumptions are flawed or out of touch with reality, the results will be misleading, no matter how many thousands of times you run the simulation. This is precisely why financial professionals stress-test their models using a range of different assumptions. They use the probabilistic results as one piece of the puzzle, combining it with other analyses to build a more balanced and robust forecast.

Can I Run a Monte Carlo Simulation Myself?

Absolutely. You don’t need to be a Wall Street quant to get started. Running these simulations is more accessible today than ever before.

Here are a few ways you can run one yourself:

- Microsoft Excel: You can actually build and run basic simulations using Excel’s built-in functions. It’s a fantastic way to get a hands-on feel for the fundamentals.

- Specialized Software: Many financial planning platforms now offer user-friendly Monte Carlo tools, making it easy to run complex scenarios without any of the heavy lifting.

- Coding Languages: For total flexibility, programming languages like Python and R have powerful libraries designed specifically for building and running highly customized simulations.

What Is the Biggest Limitation of This Method?

The single biggest limitation of a financial Monte Carlo simulation is its deep-seated reliance on historical data to predict the future. While it’s brilliant for modeling known, quantifiable risks based on past behavior, it simply cannot account for true "Black Swan" events.

A Black Swan is an unprecedented, outlier event that falls completely outside the realm of normal historical expectations, like a novel global crisis or a sudden technological shift that upends an entire industry.

By its very nature, the simulation assumes that the future will, statistically speaking, look a lot like the past. Its results should be seen as a guide to probabilities under a wide range of normal conditions—not as an infallible crystal ball. It’s a tool for managing uncertainty, not for eliminating it entirely.

How Many Iterations Are Needed for a Reliable Result?

The ideal number really depends on your model's complexity, but a good rule of thumb is that more is generally better—up to a point. For most financial planning applications, running between 1,000 to 10,000 iterations is considered more than enough to get a stable and reliable distribution of outcomes.

The goal is to run enough simulations so that adding more doesn't meaningfully change the final results. Modern computers make running tens of thousands of iterations fast and easy, so there's little reason to cut this short. At the end of the day, though, the focus should always be on the quality of your inputs. That will always be the biggest driver of your model's accuracy.

Ready to move beyond guesswork and see your financial future with true clarity? The powerful scenario simulations and stress tests inside PinkLion are built to give you a clear, probabilistic view of your investment outcomes. Stop wondering and start planning with confidence. Explore PinkLion for free.