What Is Coast FIRE? Coasting to Financial Independence Explained

TL;DR – Coast FIRE

Coast FIRE means you’ve saved enough in your retirement accounts that, without adding more, your investments will naturally grow to fund retirement by a traditional age (around 60–65). You still work now, but only to cover current expenses, not to save aggressively for retirement. It’s like putting your retirement on “autopilot” – you can take lower-stress jobs, work fewer hours, or even switch careers, knowing your future retirement is already secured.

The FIRE movement which stands for Financial Independence, Retire Early is a lifestyle and investing approach centered on aggressive saving and smart investing to achieve financial freedom at a younger age than traditional retirement.

In a nutshell, people pursuing FIRE aim to build up enough wealth (often calculated as 25× their yearly expenses, per the 4% rule) so they can ditch their jobs long before 65 and live off investments.

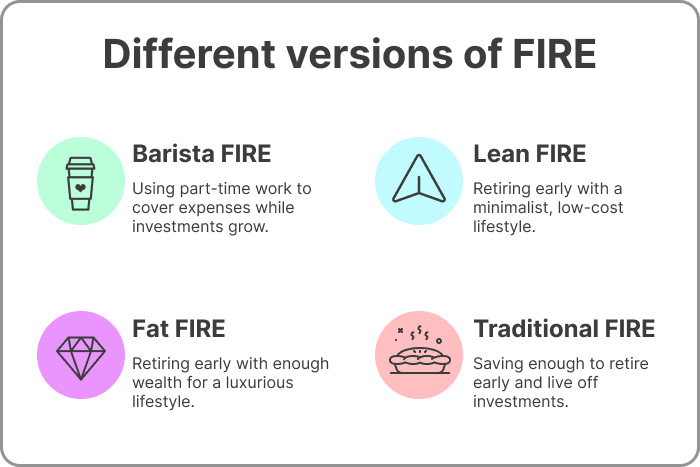

Over the years, the FIRE movement has evolved into different flavors to fit various lifestyles from Lean FIRE (ultra-frugal early retirement) to Fat FIRE (retiring early with a fat nest egg for luxury living).

Coast FIRE is one of these flexible FIRE strategies gaining popularity. It offers a more balanced, low-stress approach for those who want financial security without extreme frugality or needing to quit work in their 30s.

What Does “Coast FIRE” Mean?

In simple terms, Coast FIRE is about doing the heavy financial lifting early in your life, then coasting the rest of the way to retirement. Instead of continually saving for retirement throughout your career, you save aggressively in your 20s and 30s until you reach a certain “coast” savings target (your Coast FIRE number). At that point, you no longer need to contribute new money to your retirement investments you can literally coast and let compound interest do the work.

Your nest egg grows on autopilot to reach your ultimate retirement goal by the time you hit traditional retirement age. In other words, Coast FIRE means you’ve saved enough early that future growth (without additional contributions) will fund your retirement comfortably.

Unlike classic FIRE, Coast FIRE doesn’t require you to retire early or quit working in your 30s; it simply gives you the option to retire comfortably later, with far less pressure in the meantime.

How Does Coast FIRE Work?

The key to Coast FIRE is timing and compound growth. The strategy hinges on reaching a big savings milestone by mid-career, after which you let time and investment returns carry you to your retirement goal.

Here’s how it works step by step: you determine how much money you’ll need at retirement (say at age 60-65), then work backwards to figure out how much you need to have invested now to grow to that amount without any more deposits. For example, if your goal is a $1,000,000 nest egg by age 65, and you’re 40 today, you might calculate that you need roughly $184,000 invested now (assuming a 7% annual return) to hit that $1M by 65 with no further contributions.

Once you’ve got that coast number saved, you can stop saving for retirement altogether and just maintain your current expenses. Your investment portfolio is on cruise control time and compound interest will gradually boost that $184K to $1 million by retirement.

To illustrate, imagine an avid saver who aggressively contributes to retirement in their 20s and 30s. By age 40, they’ve accumulated enough in investments to fully fund a comfortable retirement at 65. At this point, they switch gears. They no longer need to stash away large chunks of each paycheck for 401(k)s or IRAs those accounts can grow untouched for 25 more years. Instead, our Coast FIRE individual can focus on enjoying life and covering day-to-day bills with their regular income.

They might even take a lower-stress job or reduce hours, knowing that as long as they earn enough to pay current expenses, their retirement is essentially prepaid and compounding quietly in the background.

In essence, you keep working in some capacity (unlike traditional FIRE, you’re not fully retired yet), but you’re “working to live” now not frantically saving for the future. This approach is more about gaining freedom and flexibility in your working years: you could switch to a passion career, go part-time, or become a digital nomad, without worrying that you’re falling behind on retirement savings.

Who Is Coast FIRE For?

Coast FIRE appeals to people who want financial peace of mind early on, but who don’t necessarily mind working to cover current expenses. It’s often ideal for those who value work-life balance and time freedom now, rather than an all-or-nothing early retirement.

For example, if you’re a new parent who wants to scale back to spend more time with your kids, hitting Coast FIRE could let you downshift your career without jeopardizing your retirement security. It’s great for mid-career professionals who feel burned out by relentless saving and investing once you’ve reached your coast number, you can breathe easier knowing your future is taken care of. Many freelancers, entrepreneurs, and part-time workers find Coast FIRE attractive, since it allows them to pursue passion projects or less stressful jobs while still being on track for a solid retirement.

Essentially, Coast FIRE is for anyone who likes the idea of “work optional” in mid-life: you keep working in some form, but on your terms, because you want to, not because you have to save more for the future.

On the flip side, Coast FIRE might not be the best fit if your goal is to retire extremely early or never work again until old age. By design, coasters typically continue some level of work (even if it’s fun or low stress work) until traditional retirement age. Also, achieving Coast FIRE usually requires front-loading a lot of savings early in life.

That means it works best if you start in your 20s or 30s with a high savings rate. Those who discover the FIRE movement later in life (say in their 50s) may find coasting less feasible, because there’s less time for compounding to work its magic and they’d need a very large sum saved up already. Overall, Coast FIRE is an attractive middle path for people who want financial independence on the horizon but also want to enjoy life today without extreme penny-pinching. It’s all about balance securing tomorrow without sacrificing today.

Calculating Your Coast FIRE Number (Are You on Track?)

Calculating your Coast FIRE number is a crucial step to know if you’re on track to coast into retirement. This number represents how much you need invested now to reach your future retirement target without any further contributions. Here’s how to figure it out:

- Set Your Retirement Goal: First, estimate how big of a nest egg you’ll need at retirement (your target retirement fund). Many FIRE followers use the classic 25× rule: plan for a portfolio about 25 times your expected annual expenses in retirement. For example, if you want $40,000 per year in retirement income, you’d aim for roughly $1,000,000 saved by retirement (since $40k × 25 = $1M). This is based on the 4% safe withdrawal rate commonly used in retirement planning.

- Choose Your Timeline (Retirement Age): Decide by what age you plan to retire or start drawing on your investments. Coast FIRE doesn’t require this to be early retirement often it’s around age 60-65 (traditional retirement age), but it’s your choice. The number of years between your current age and target retirement age will determine how long your investments can compound.

- Estimate Your Investment Growth Rate: Pick a reasonable annual rate of return to model your investments’ growth. Historically, a diversified stock portfolio might return around 7% per year on average (after inflation, perhaps ~5-7% is a safe assumption). Being conservative is okay you can use a range (5% to 7%) to see different scenarios. The idea is to use compound interest to calculate how today’s money grows over time.

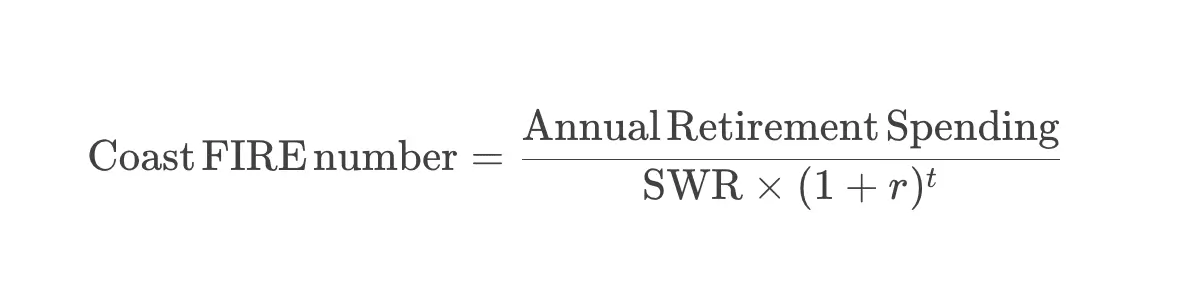

- Calculate the Required Present Amount: Now use the compound growth formula (or a financial calculator) to find out how much invested money today would grow to your target amount by your retirement age. The formula looks like:

Where r is the annual return (in decimals, so 0.05 for 5%, 0.07 for 7%, etc.) and t is the number of years you have to grow.

Check Your Current Savings: Finally, compare that required amount to what you’ve already saved and invested. If your current investment balances are at or above your calculated Coast FIRE number, congratulations you’ve effectively reached Coast FIRE! Your portfolio should grow to fund your retirement without any additional inputs. If you’re not there yet, you now have a concrete savings target to aim for.

Coast FIRE vs. Lean FIRE vs. Fat FIRE: A Comparison

How does Coast FIRE stack up against other popular FIRE paths like Lean FIRE

and Fat FIRE? Here’s a side‑by‑side look at the three main approaches to

Financial Independence:

| Aspect | Coast FIRE | Lean FIRE | Fat FIRE |

|---|---|---|---|

| Retirement timeline | Traditional (60–65). Keep working to cover expenses. | Very early (30s/40s). Quit work entirely. | Early (40s/50s). Quit work entirely. |

| Lifestyle | Moderate, comfortable. | Bare‑bones, minimalist. | High comfort/luxury. |

| Nest egg needed | Medium. | Low (~$800k–$1M). | High ($2M–$4M+). |

| Work requirement | Yes, to pay current bills. | No. | No. |

| Ideal for | Flexibility seekers (career shifts, part-time). | Ultra‑frugal minimalists. | High earners wanting luxury. |

| Risk level | Moderate (market returns matter). | High (little cushion). | Low (big buffer, harder to reach). |

As you can see, Lean FIRE and Fat FIRE sit at opposite ends of the spectrum:

one favors speed and frugality, the other luxury and a larger nest egg.

Coast FIRE lands comfortably in the middle—you’re not retiring super early,

but you’re also not grinding until 65 with nothing but hope. It’s a hybrid

approach: enjoy a reasonable lifestyle now and secure a solid retirement

later. The trade‑off is continued work during the interim years, ideally on

your own terms. Many consider Coast FIRE the most flexible, lifestyle‑friendly path in the FIRE universe.

For personalized numbers, try the Coast‑FIRE Calculator.

Pros and Cons of Coast FIRE

Like any financial strategy, Coast FIRE has its upsides and downsides. Here are some common pros and cons to consider:

Pros (Advantages of Coast FIRE)

Peace of Mind Early On

Achieving Coast FIRE means your retirement is essentially taken care of well ahead of time. This can provide tremendous peace of mind and security in your 30s or 40s. You know that if you just leave your investments alone, you’re on track to retire comfortably at a conventional age. That mental relief is priceless you’re no longer racing against the clock or stressing about “not saving enough for retirement.”

Work-Life Flexibility

Once you hit Coast FI, you can afford to chase a fulfilling or lower-stress career without worrying about the paycheck so much You might reduce to part-time, switch to a passion project, or take a job that pays less but gives you joy. Since you only need to cover current expenses (not pad your 401k), you have freedom to design your work life. This can lead to a happier, healthier lifestyle long before typical retirement.

Enjoy the Present More

Because you front-loaded your savings, you don’t have to maintain an extremely high savings rate forever. After coasting, you can spend more time or money on things you enjoy now (within reason, since you still need to cover expenses). Want to travel more in your 40s, or spend weekends with family instead of hustling for extra money? Coast FIRE lets you focus on living your life, knowing your future is on auto-pilot. In short, it offers a nice balance between living for tomorrow and living for today.

Reduced Drawdown Risk

With Coast FIRE, you typically don’t start withdrawing from your investments until traditional retirement age, unlike someone who retires at 35 and needs to live off their portfolio for 50+ years. This shorter withdrawal period can reduce the risk of outliving your money. You give your nest egg maximum time to grow and only tap it when you’re older, which can be financially safer (less chance of depleting it early).

Cons (Downsides or Challenges of Coast FIRE)

Still Dependent on Work

Coast FIRE is not complete financial independence you still need a source of income to pay your bills until you actually retire. If you lose your job or can’t work for some reason during your coasting years, you might face financial strain since you weren’t planning to withdraw from investments yet. In that sense, you’re not truly “retired early”; you’ve just eliminated the need to save more. Some critics even argue that Coast FIRE is just a fancy term for a normal retirement savings plan, since you’re essentially still working until ~60.

Market Risk and Uncertainty

Coast FIRE leans heavily on the assumption that your investments will grow as expected over time. If the market underperforms for a long stretch or there’s a major crash early in your coasting period, your portfolio might not reach the target by retirement. For example, if our earlier $184K at 40 doesn’t actually grow to $1M due to weak returns, you could end up short. Nothing is guaranteed, so coasting requires faith in the long-term market (and diligence to adjust if needed). As Financial Samurai bluntly puts it, “the risk is that [your portfolio] does not grow [at the expected rate] for 30 years”, which would delay or derail your plans.

Inflation and Lifestyle Creep

If you set your Coast FI target in your 30s and then decades pass, the cost of living might rise or your desired lifestyle might become more expensive. There’s a risk that the target nest egg you aimed for might no longer be sufficient by the time you’re 60, especially if inflation or lifestyle changes (kids, medical needs, etc.) occur. You have to periodically check that your coast number is still aligned with reality and maybe adjust by saving a bit more if needed.

High Savings Early (Sacrifice Required)

To reach Coast FIRE relatively young, you must save a lot in your early years. This can mean living well below your means in your 20s and 30s, potentially sacrificing some experiences or luxuries when you’re young and your peers are spending freely. Not everyone can manage a high savings rate due to income or family responsibilities. If you push too hard to save early, you might experience burnout or miss out on youthful adventures. It’s a bit front-loaded in terms of effort you have to be disciplined early on to enjoy the coast phase later.

Not “Retired” Until Later

If your dream was to tell your boss “I quit!” at 40 and sip cocktails on a beach, Coast FIRE might feel anticlimactic. You’re still working in your 40s and 50s (even if in a better situation than before). Some passionate FIRE enthusiasts view Coast FIRE as “the weakest type of FIRE” because you’re not actually financially independent until you’re a senior. It’s more of a mental win (knowing you’re secure later) than an actual early exit from the workforce. So if early retirement is the priority, Coast FIRE could be disappointing.

Despite these cons, many find that the pros outweigh the cons. Coast FIRE can be a sensible compromise for those who want to enjoy life during their prime working years and still retire comfortably at a normal age. It’s all about personal preference and financial situation each person should evaluate what balance of now vs. later works for them.

Conclusion: The Value of Coast FIRE

Coast FIRE proves that the journey to financial independence isn’t one-size-fits-all. For those who crave more freedom and flexibility long before 65, but also desire the security of a well-funded retirement, coasting can be a perfect fit.

The value of Coast FIRE lies in its balance: it gives you your time back now without sacrificing your future. By front-loading your savings and letting time and compound interest do the heavy lifting, you essentially buy yourself options. Want to change careers at 45? Go for it your retirement is already on track. Need to scale down to spend time with family or travel in your 50s? No problem, you’re not depending on every paycheck to build your nest egg anymore.

In essence, Coast FIRE offers a middle path in the FIRE movement. It reminds us that financial independence is not a race to the quickest retirement, but a way to align money with life goals. As long as you’ve “set the table” for your future by hitting that coast number, you can live life on your terms in the interim. This approach can lead to greater happiness and less financial anxiety, because you’re enjoying the present and confident about the future.

Ultimately, whether Coast FIRE is “worth it” comes down to what you value. If you value a flexible, low-stress lifestyle and are okay with working in a capacity you enjoy until a traditional retirement age, Coast FIRE is extremely rewarding. It’s about having peace of mind and freedom together. By coasting to FIRE, you’re telling yourself that financial independence is on the horizon, but you don’t have to postpone living a good life until you get there. And that’s a powerful place to be.

FAQ: Common Questions About Coast FIRE

What does “Coast FIRE” stand for?

Coast FIRE isn’t an acronym – “coast” is a metaphor for coasting along. It refers to “coasting” to Financial Independence, Retire Early. Essentially, you do the hard work of saving early, then coast on those savings’ growth until you reach full financial independence at retirement. The term highlights that you’re letting your invested money glide you into retirement without further effort, as opposed to continually pushing (saving) throughout your whole career

How is Coast FIRE different from Barista FIRE?

Both Coast FIRE and Barista FIRE involve continuing to work in some fashion instead of a full early retirement, but they have different approaches. Barista FIRE generally means you’ve saved enough to retire partially – you quit your high-power career but take a lighter part-time job (like a barista) to cover the gap in expenses and maybe get benefits, so you can semi-retire early. The extra income bridges the difference between your investment income and expenses.

Coast FIRE, on the other hand, implies you aren’t drawing down your investments at all until later – you’re simply not adding to them anymore. With Coast FIRE you still work to pay 100% of current expenses (often full-time in a lower-stress job or a passion field), whereas Barista FIRE folks might actually tap their portfolio for some expenses and just work part-time to supplement.

Also, Coast FIRE assumes your portfolio will grow to fully support a traditional retirement later, whereas Barista FIRE is often a strategy to retire earlier than traditional by combining savings + a bit of ongoing work. In short, Barista FIRE is like semi-retirement now, Coast FIRE is about securing full retirement later while making your work life easier in the meantime

Do you still need to work if you achieve Coast FIRE?

Yes – during the coasting period, you still work to cover your day-to-day living expenses. The idea of Coast FIRE is that you no longer need to save extra for retirement, but you haven’t actually retired yet. You’re effectively work-optional in terms of choice of job or hours, not work-free. Many people who reach Coast FI choose to downshift to more enjoyable or less demanding work, since their paycheck only needs to pay the bills, not pad their investments.

The big difference from regular FIRE is you don’t quit working entirely (until you’re older). You continue working in some capacity until you reach retirement age, at which point your investments should be sufficient to allow full retirement. The upside is you can often choose work that you find fulfilling without worrying as much about the salary. The downside is you haven’t escaped the need for an income until that later retirement date.

What are the risks of Coast FIRE?

The main risks of Coast FIRE involve market and life uncertainties. Because you stop contributing new savings, you’re relying on your current investments to perform well over many years. Poor market returns, a recession, or long periods of low growth could mean your portfolio doesn’t reach the target by retirement leaving you short.

There’s also inflation risk (the cost of living might rise more than expected, eroding your purchasing power). Another risk is personal: if you have a health issue or job loss in your 40s or 50s, you might be forced to dip into retirement funds early or go back to saving, since Coast FIRE assumed you wouldn’t touch investments until later.

Basically, you have less wiggle room if things don’t go according to plan, compared to someone who kept aggressively saving. Mitigating these risks means being conservative in your calculations (maybe aiming for a bit more than 25× expenses, or checking your progress every few years) and maintaining some financial flexibility, like an emergency fund or backup plan. While Coast FIRE is a moderate approach, it’s not without risk so it’s wise to periodically review your plan and adjust if needed to stay on track

Is Coast FIRE worth it?

That depends on your personal goals and situation. For many, Coast FIRE is absolutely worth it because it delivers a best-of-both-worlds scenario: you get to enjoy a freer lifestyle in your middle years while still knowing you’ll have a solid retirement fund later. It can greatly reduce financial stress and burnout, since you’re not in a perpetual rat race once you’ve hit your number. People who value flexibility and quality of life often find Coast FIRE very rewarding.

However, if your heart is set on quitting work completely as soon as possible, Coast FIRE might feel too slow. Also, if you don’t start saving early, you might never reach a coast point where stopping contributions is feasible. In the end, it’s a personal choice – but for those who achieve it, Coast FIRE can be a fantastic way to balance living for today and planning for tomorrow. It allows you to “stop saving and start living,” while still knowing your future is secure