What Is Fat FIRE? A Guide to a High-End Early Retirement Lifestyle

What is Fat FIRE? It’s an early retirement strategy aimed at living luxuriously, with annual spending of $100k+ supported by a $2.5M–$5M portfolio. Unlike Lean FIRE, it focuses on comfort and financial freedom rather than frugality.

TL;DR Fat FIRE means retiring early with a luxurious lifestyle, typically requiring $2.5M–$5M in savings and $100k+ annual spending. It’s slower to achieve but offers greater comfort and security than Lean FIRE.

Introduction to the FIRE Movement

FIRE, or Financial Independence, Retire Early, is a strategy focused on saving and investing aggressively to achieve financial freedom years before the traditional retirement age. The goal is to build a nest egg typically 25 times your annual expenses allowing you to live off investment returns by withdrawing around 3–4% per year.

FIRE followers often save 50% or more of their income, embracing frugality to accelerate their path. The reward? The freedom to retire or work by choice in your 30s, 40s, or 50s instead of waiting until 65.

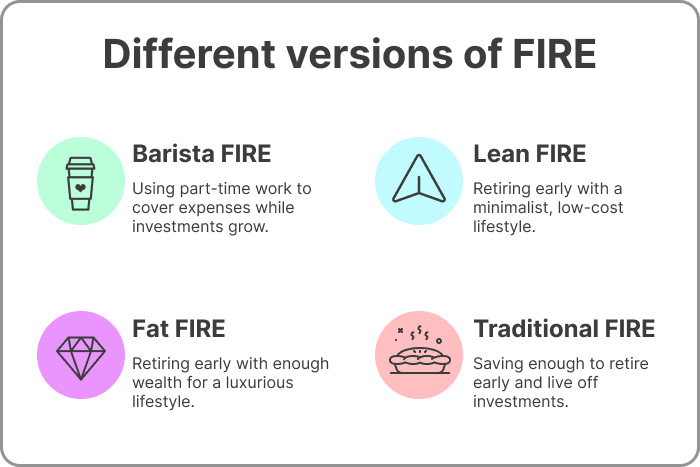

Over time, FIRE has evolved into variations like Lean FIRE (minimalist living) and Fat FIRE (early retirement with a luxurious lifestyle). Fat FIRE is for those who want financial independence without sacrificing comfort or quality of life.

What Is Fat FIRE?

Fat FIRE is an early retirement strategy built around a large financial cushion that supports a comfortable or luxurious lifestyle, unlike the frugal budgets of traditional FIRE. Instead of downsizing, Fat FIRE allows you to maintain or even upgrade your standard of living after retiring.

Typically, Fat FIRE is defined by aiming for $100,000+ in annual retirement spending, which requires a sizeable portfolio. Using the 4% rule, this means having at least $2.5 million invested, though many aim for $3–5 million or more to cover high costs or family needs.

Achieving Fat FIRE usually involves a mix of high income, aggressive savings (50–70% of income), and smart investing. While many Fat FIRE followers are professionals in tech, medicine, or entrepreneurship, the key is building enough wealth for financial abundance, even if it takes a few extra years of work.

In short, Fat FIRE is about retiring early without pinching pennies enabling extensive travel, fine dining, and freedom to enjoy life fully. It’s for those who want early retirement and a lifestyle upgrade, not just financial independence.

Who Is Fat FIRE Right For?

Fat FIRE is best suited for those who want early retirement without cutting back on lifestyle. It typically appeals to:

- High earners with big goals: Professionals like doctors, tech workers, lawyers, entrepreneurs, or dual-income couples who can save aggressively while still enjoying life.

- Disciplined savers (but not ultra-frugal): Fat FIRE followers often save 50–70% of their income and invest for growth, but they focus on earning more rather than cutting every expense.

- People who want to maintain or upgrade their lifestyle: Ideal for those planning for family needs, big-city living, travel, or luxury hobbies that require a higher retirement budget.

- Hustlers willing to work longer: Because the savings target is higher (often $2.5–5M+), Fat FIRE seekers may work into their 40s or 50s, build side hustles, or invest in real estate to accelerate wealth.

- Security-minded individuals: A larger portfolio provides peace of mind against market dips, medical bills, or emergencies.

In short: Fat FIRE is perfect for high earners who value comfort, flexibility, and financial security, even if it means working longer. If your priority is fast, minimalist retirement, Lean FIRE may be a better fit.

How Much Money Do You Need for Fat FIRE?

Fat FIRE requires a larger budget and portfolio compared to regular FIRE, as it’s designed for a comfortable, six-figure lifestyle.

- Annual Spending: Many Fat FIRE plans aim for $100k+ per year, with some targeting $150k–$200k or more depending on travel, housing, or family needs. Lean FIRE, by contrast, often requires under $40k annually.

- Target Nest Egg: Using the 4% rule, $100k/year spending requires about $2.5M invested. For added security (3% rule), this could mean $3.3M or more. Many Fat FIRE enthusiasts set goals of $3–5M+, especially in high-cost areas or with children.

- Example: A couple aiming for $120k/year would need ~$3M saved. With high incomes and saving $100k annually, they could hit this goal in 15–18 years at 5% annual returns.

Lifestyle Planning: Beyond hitting the number, consider healthcare, travel, housing, and other long-term needs. Many aim higher (e.g., $5M) for extra security and peace of mind.

In summary: Fat FIRE often means $2.5–5M in savings to sustain a high-end retirement, achievable through high income, aggressive saving, and smart investing.

Example: Living the Fat FIRE Lifestyle

Imagine Jack and Diane, a couple who saved aggressively in their 20s and 30s. By their mid-40s, they built a $4 million portfolio, allowing them to withdraw $120,000 per year (using a 3% rule) while enjoying early retirement.

Their lifestyle includes:

- A comfortable home in a high-cost area, fully paid off.

- International travel, often in business class, and stays in upscale hotels.

- Private schooling and college funds for their two children, plus family vacations.

- Enjoying hobbies like golf and sailing without worrying about every expense.

- Financial security to handle emergencies, invest in charities, and help relatives.

They occasionally do part-time consulting, but only by choice. Fat FIRE gives them freedom, peace of mind, and a lifestyle upgrade without the need for frugality.

Key takeaway: Fat FIRE means early retirement with financial abundance, allowing you to live comfortably and spend on what you love, supported by years of disciplined saving and investing.

Pros and Cons of Fat FIRE

Fat FIRE offers a luxurious early retirement but comes with challenges. Here’s a quick breakdown:

Pros

- Comfortable Lifestyle: Enjoy travel, dining, hobbies, and conveniences without a tight budget.

- True Financial Freedom: Your investments fully cover expenses, making work optional.

- Bigger Safety Net: A multi-million portfolio handles emergencies, downturns, and family support.

- Family & Legacy Benefits: Easier to fund education, leave inheritances, or support causes.

- Less Frugality: You can enjoy life’s comforts while saving and after retiring.

Cons

- Harder to Achieve: Requires high income, aggressive saving, and years of effort.

- Later Retirement: You may work into your 40s or 50s to hit the higher savings target.

- High Income Requirement: Average salaries often can’t sustain Fat FIRE without major sacrifices.

- Lifestyle Creep Risk: Bigger budgets can lead to overspending or shifting “enough” goals.

- Market & Planning Risks: Large downturns or underestimating expenses can impact security.

- Non-Financial Downsides: Potential burnout, delayed enjoyment of life, or lack of purpose post-retirement.

Bottom line: Fat FIRE delivers comfort and peace of mind but demands discipline, high earnings, and a longer timeline. It’s best for those who value a richer retirement over retiring as early as possible.

Fat FIRE vs. Other FIRE Strategies (Quick‑View)

FIRE isn’t one‑size‑fits‑all. Below is a concise comparison of the four most popular approaches Lean, Fat, Barista, and Coast FIRE highlighting lifestyle, money targets, and work expectations.

| FIRE Strategy | Lifestyle in Retirement | Typical Nest Egg | Work Approach |

|---|---|---|---|

| Lean FIRE | Ultra‑frugal minimalist budget <$40k/yr. | ≈ $1 M (25 × expenses) | Quit full‑time work ASAP, often by 30s‒40s. |

| Fat FIRE | Comfort / luxury $100k + spending. | $2.5 – 5 M + | Retire in 40s‒50s no work needed. |

| Barista FIRE | Moderate part‑time income fills the gap. | ≈ 50–70 % of full FIRE number | Semi‑retired low‑stress, part‑time job (e.g. cafe, gig work). |

| Coast FIRE | Normal lifestyle now traditional retirement fully funded. | “Coast” number hit early portfolio compounds to full FI by 65. | Keep working to pay current bills, no further saving required. |

Key takeaways

- Lean FIRE: Fastest exit, lowest spending.

- Fat FIRE: Slowest path, highest comfort and security.

- Barista FIRE: Early lifestyle change; part‑time work bridges the gap.

- Coast FIRE: Front‑load savings, then relax retirement funds grow on autopilot.

Choose the path that best fits your income, desired lifestyle, and tolerance for savings intensity.

Conclusion: Is Fat FIRE Right for You?

Fat FIRE lets you retire early without downgrading your lifestyle, but it demands a high income, a 50–70 % savings rate, and extra working years. Ask yourself:

- Can you realistically save that much for 10–15 years?

- Does a later exit (40s/50s) feel worth the upgrade to $100k + annual spending?

- Do you picture retirement filled with travel, comfort, and generosity vs. a minimalist life?

- Is your family on board with bigger sacrifices now for a richer future?

If you answer “yes,” Fat FIRE can buy you a luxurious, worry‑free retirement. If not, consider Lean, Barista, or Coast FIRE or blend approaches as your income and goals evolve. Whatever path you choose, the core aim is the same: financial freedom on your terms.

FAQ

What is Fat Fire in simple terms?

Fat FIRE is an early‑retirement strategy that targets a large portfolio typically $2.5 – $5 million+ to fund $100k + in annual spending, so you can retire early without cutting your lifestyle.

How much money do I need for Fat FIRE?

Using the 4 % rule, multiply your desired annual expenses by 25. For $120,000 of yearly spending, you’d need about $3 million. Many Fat FIRE followers aim higher (up to $5 million) for extra safety.

How long does it take to reach Fat FIRE?

With a high income and a 50–70 % savings rate, many reach Fat FIRE in 15–20 years. Timeline depends on your income, savings rate, and investment returns.

Can I achieve Fat FIRE on an average salary?

It’s challenging. Most Fat FIRE savers are high earners or dual‑income couples. If you have a modest salary, you may need aggressive side hustles, real‑estate income, or a longer timeline.

Fat FIRE vs. Lean FIRE what’s the difference?

- Fat FIRE: $100k + annual spend, $2.5–5 M portfolio, retire in 40s/50s.

- Lean FIRE: <$40k annual spend, ~$1 M portfolio, retire in 30s/40s with minimalist living.

Fat FIRE prioritizes comfort; Lean FIRE prioritizes the earliest exit.

What investments work best for a Fat FIRE portfolio?

Most pursue a diversified mix of low‑cost index funds, real estate, and sometimes dividend stocks. The key is broad diversification and low fees to compound wealth over decades.

What safe‑withdrawal rate should I use?

Many Fat FIRE retirees still follow the 4 % rule, but some prefer 3–3.5 % for extra cushion, especially if they want their portfolio to last 50+ years.

How do taxes impact Fat FIRE?

Higher withdrawals mean potentially higher tax bills. Use tax‑advantaged accounts (401(k), IRA, HSA), plus a taxable brokerage for flexibility. Consider Roth conversions and geographic tax arbitrage.

What about healthcare before Medicare?

Fat FIRE plans should budget for private insurance, ACA subsidies, or health‑share plans often $10k – $20k per year for a family. Some choose Barista FIRE jobs mainly for benefits.

How do I avoid lifestyle creep while saving for Fat FIRE?

Automate investments, set clear spending caps, and review goals annually. A rising income should boost your savings rate first, lifestyle second.

Is Fat FIRE still possible with kids?

Yes. Just raise your spending target. Many parents budget an extra $20k–$30k per child for schooling, activities, and travel, then scale their Fat FIRE number accordingly.

What if the market crashes after I retire?

Use cash buffers, bond ladders, or a 2–3 year emergency fund to avoid selling stocks in a downturn. A lower withdrawal rate (3 %) adds further protection.

Can I combine Coast FIRE and Fat FIRE?

Absolutely. You can front‑load savings in your 20s/30s (Coast FIRE), then let compounding grow your portfolio toward a Fat FIRE target while you work a less intense job.

Is Fat FIRE worth it?

If you value a luxurious, worry‑free early retirement and don’t mind working longer or saving harder, Fat FIRE can be worth the effort. Otherwise, consider Lean, Barista, or a hybrid FIRE path.