AJ Bell Portfolio Tracker (2025 Guide)

AJ Bell is a great low-cost broker, but its tracking features are limited. This guide shows how to visualize diversification, forecast income, and benchmark performance using smarter portfolio trackers.

AJ Bell Youinvest is a popular UK platform for Stocks & Shares ISAs and SIPPs, known for its low fees and wide investment selection. But how does it hold up when it comes to portfolio tracking? In this guide, we break down what AJ Bell offers, where it falls short, and how you can enhance your experience with a modern tracker like PinkLion.

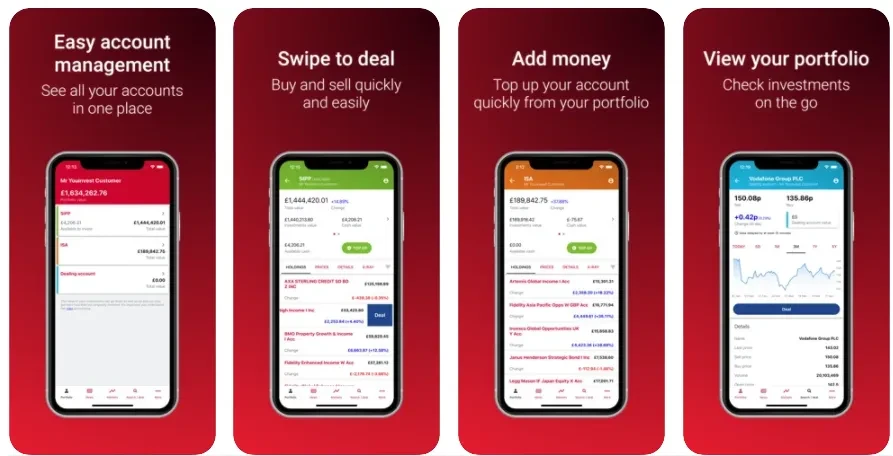

✅ What AJ Bell Offers for Portfolio Tracking

1. Account Overview & Holdings

- Real-time values, gain/loss per holding

- Easy to check daily P/L

2. Individual Investment Performance

- Daily, 1Y, 5Y and since-purchase performance charts

- No chart of total portfolio value over time

3. Dividend Tracking (Historical)

- View past dividends in activity feed

- Optional auto reinvestment (fee applies)

- No forward dividend forecast or monthly income schedule

4. Morningstar Portfolio X-Ray

- Snapshot of asset class, geographic, and sector allocation

- Can look through funds to identify top holdings

- Categorizes equities (Cyclical, Sensitive, Defensive)

5. Statements & Exports

- CSV/PDF exports of transactions and valuation statements

- Useful for manual tracking or spreadsheets

Where AJ Bell Falls Short

❌ No Portfolio-Level Performance Graph

You can see how each asset has performed, but not your full portfolio growth over time.

❌ No Forward Income Forecasting

You won’t find a total projected dividend yield or future monthly cash flow. Great if you're income-focused? Not here.

❌ No Benchmarking Tools

You can't compare your performance to FTSE 100, All-Share, or even a simple 60/40 mix. Everything is shown in isolation.

❌ Limited Risk Analytics

No Sharpe ratio, volatility, beta, or value-at-risk calculations. You can't simulate market crashes.

❌ No Scenario Planning or Goal Forecasting

Want to model retirement, test allocations, or optimize for risk-adjusted return? You’ll need a different tool.

❌ Single-Platform Focus

AJ Bell shows only what’s in AJ Bell. If you have investments elsewhere (e.g. Vanguard, Trading212), you’re on your own.

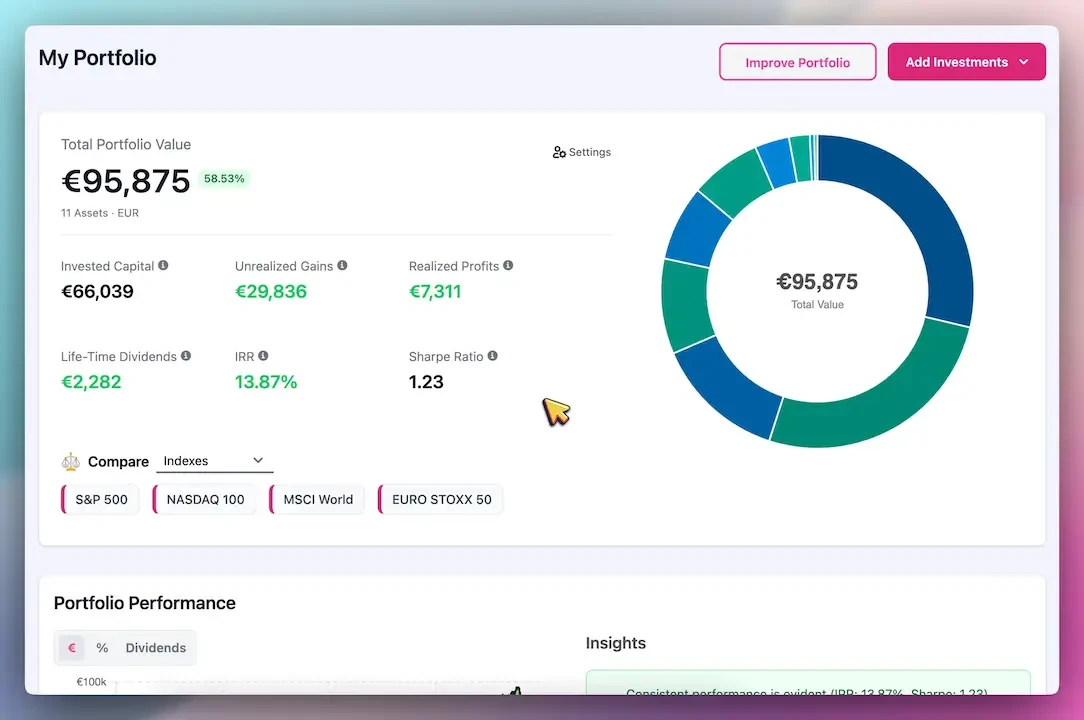

Enter PinkLion: AJ Bell’s Perfect Companion

PinkLion is a powerful portfolio tracker that syncs directly with AJ Bell or accepts CSV imports. It enhances what AJ Bell lacks:

✅ Multi-Platform Dashboard

Track AJ Bell, Vanguard, Trading212, Coinbase, and more – all in one view.

✅ Deep Diversification Breakdown

Sector, geography, asset class, industry-level breakdowns with interactive visuals.

✅ Risk Metrics & Stress Tests

Volatility, Sharpe, max drawdown, and simulations like 2008 crash or 2020 COVID dip.

✅ Forward Dividend Tracking

Monthly forecast, yield by holding, payout schedule, reinvestment analysis.

✅ AI Optimization & What-If Simulations

Suggestions to improve your portfolio based on risk tolerance and goals. Rebalance, reduce overlap, boost yield.

✅ Benchmarking Tools

Compare to FTSE 100, MSCI World, or custom portfolios. Know if you’re outperforming.

AJ Bell vs PinkLion: Side-by-Side Comparison

| Feature | AJ Bell Youinvest | PinkLion |

|---|---|---|

| Account Sync | Only tracks AJ Bell accounts | Sync AJ Bell, Vanguard, Coinbase, etc. |

| Total Portfolio Graph | Not available | Available with historical trend analysis |

| Income Forecasting | Historical only | 12-month dividend forecast & calendar |

| Diversification Charts | High-level X-Ray | Granular sector, region, asset class |

| Risk Metrics | Not available | Volatility, Sharpe, max drawdown |

| Stress Tests | Not available | Simulate 2008, COVID, interest rate shocks |

| AI Allocation Advice | Not offered | Yes: optimize for yield, risk, or growth |

| Performance Benchmarking | Not available | Compare to any index or blend |

| Multi-Broker Support | No | Yes, unified dashboard for all accounts |

How to Connect AJ Bell to PinkLion

Step-by-step guide:

- Sign up at pinklion.xyz

- Go to Broker → Connect Broker

- Choose Robinhood → Confirm Synchronization

- Immediately run an AI optimization or stress test

Pro Tips for AJ Bell Users

- 💼 Max Your ISA & SIPP – Use AJ Bell for tax-free investing. Then track your returns with PinkLion.

- 🔁 Reinvest Dividends Smartly – AJ Bell allows auto-reinvest, but check fees. PinkLion shows compounding effects clearly.

- 🌐 Track Beyond AJ Bell – Use PinkLion to combine your workplace pension, crypto, or savings in one view.

- 📊 Review Allocation Quarterly – Markets shift. Use PinkLion’s AI simulations to stay aligned with your goals.

- 💰 Know Your Yield – PinkLion tells you monthly income. Plan ahead, especially if income is your goal.

Final Thoughts

AJ Bell is great for low-fee, tax-efficient investing. But it wasn’t built for deep analysis. That’s where PinkLion shines.

Track smarter. Rebalance with AI. See your risk and income clearly. All from one clean dashboard.

Combine AJ Bell’s execution power with PinkLion’s tracking intelligence, and you’ll invest with more control and confidence.