Binance Portfolio Tracker (2025 Guide)

Binance shows you your crypto balance, but not your full financial picture. This guide reveals how to track your entire portfolio, uncover hidden risks, and use AI to optimize your crypto strategy across market cycles.

Binance.US is a popular crypto exchange for American investors. But long-term investing is about more than just trading coins — it’s about tracking your whole portfolio, planning ahead, and managing risk smartly.

Binance.US is great at execution, but lacks the insights needed to manage mixed portfolios of crypto, stocks, and ETFs. Here’s what Binance.US offers, where it falls short, and how tools like PinkLion can fill the gap.

📊 What Binance.US Offers for Portfolio Tracking

- 📈 Real-Time Balances – Instantly see how much your crypto is worth in USD.

- 📜 Order History – Clear view of past trades, deposits, and withdrawals.

- 🔐 Staking Integration – Earn and track staking rewards directly on the platform.

For basic crypto tracking, Binance.US gets the job done. But deeper planning? That’s where it struggles.

⚠️ Limitations of Binance.US Portfolio Tools

❌ Crypto-Only Tracking – No way to add stocks, ETFs, or cash from other platforms.

❌ No Asset Allocation Breakdown – You can’t see diversification by sector or asset class.

❌ No Historical ROI – No charts of portfolio performance over time.

❌ No Benchmarking – Can’t compare returns to BTC, ETH, or S&P 500.

❌ No Risk Metrics – Missing Sharpe ratio, volatility, and drawdown analysis.

❌ No Forward Planning – No simulations, projections, or goal tracking.

Binance.US is fine for real-time balances, but lacks almost everything for broader portfolio management.

🎯 Why You Need a Dedicated Portfolio Tracker

Platforms like PinkLion connect to Binance.US and add everything Binance lacks:

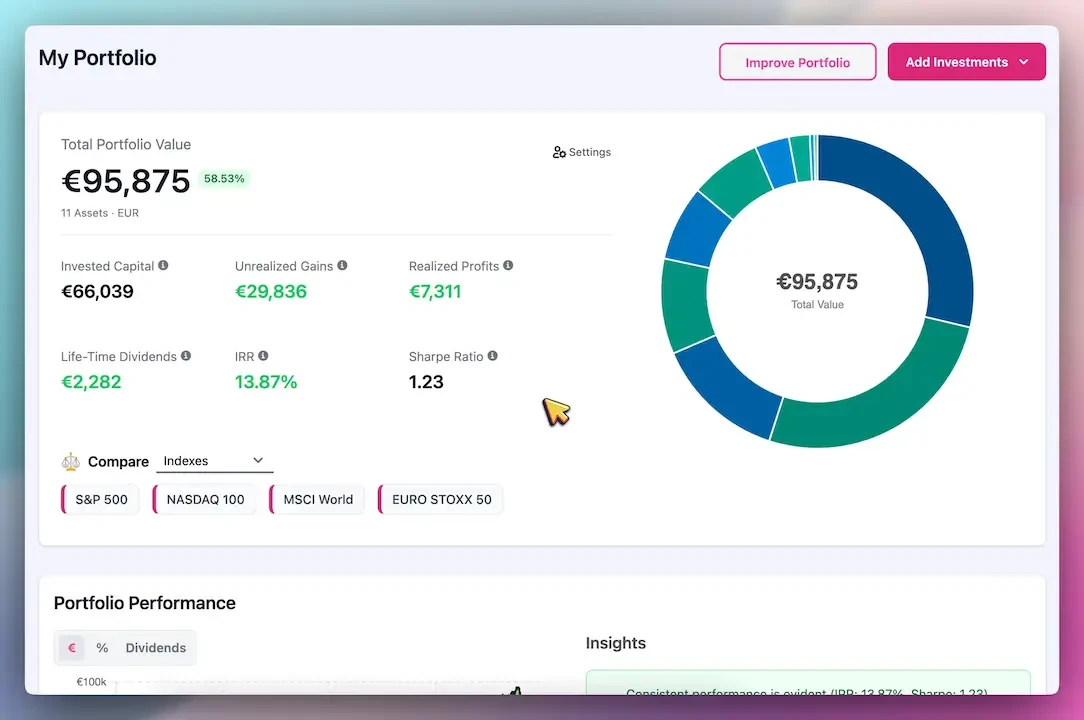

- 🔄 Unified Dashboard – See crypto, stocks, ETFs, and more in one view.

- 🔍 Diversification Analysis – Spot concentration risks and correlation overlap.

- 📈 Performance Tracking – ROI, unrealized/realized gains, time-weighted returns.

- 🧪 Stress Testing – Simulate crashes or volatility spikes.

- 📅 Income Forecasting – See upcoming staking/dividend payments.

- 🤖 AI Rebalancing – Get smart suggestions based on your goals.

Think of Binance.US as your exchange — and your portfolio tracker as your control center.

✅ Binance vs PinkLion: Quick Feature Comparison

| Feature | Binance.US | PinkLion |

|---|---|---|

| Real-time balances | ✅ | ✅ |

| Multi-asset view (stocks + crypto) | ❌ | ✅ |

| Diversification analysis | ❌ | ✅ |

| ROI and performance tracking | ❌ | ✅ |

| Benchmarking | ❌ | ✅ |

| Risk metrics (Sharpe, volatility) | ❌ | ✅ |

| Forward simulations | ❌ | ✅ |

| Income calendar | ❌ | ✅ |

| AI rebalancing tips | ❌ | ✅ |

| Secure API (read-only) | N/A | ✅ |

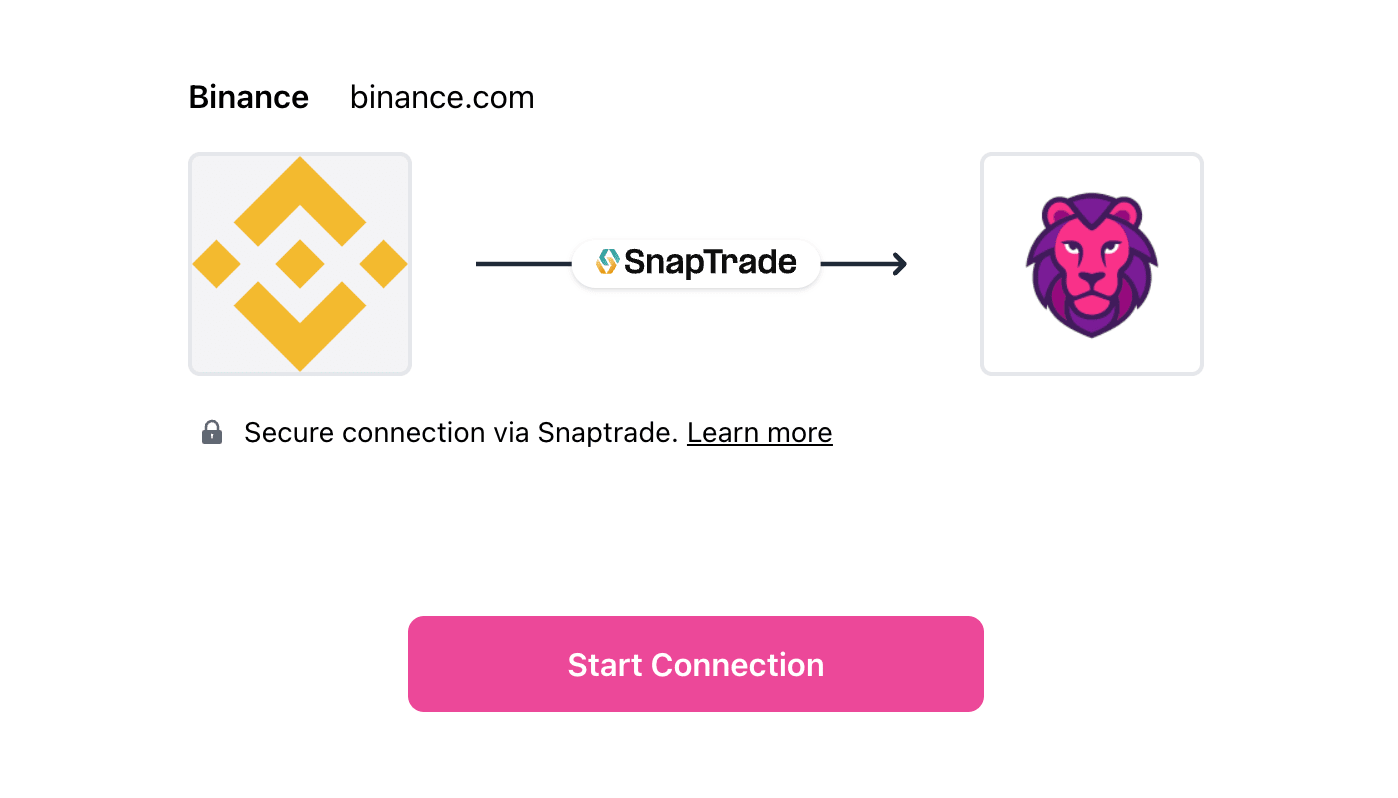

How to Connect Binance to PinkLion

Step-by-step guide:

- Sign up for a free PinkLion account (web or mobile).

- Go to Broker → Connect Broker in PinkLion.

- Choose Binance and follow the secure login prompts to authorize the connection.

- After linking, PinkLion will sync your Binance portfolio. You can immediately run an AI optimization or stress test to gain new insights on your holdings.

🧠 Pro Tips for Binance.US Investors

- ⚖️ Rebalance Proactively – Crypto rallies can distort your allocation fast.

- 🤝 Mind Correlations – Crypto and tech stocks may move together.

- 📆 Plan Income Timing – Match staking rewards to your spending needs.

- 🔮 Use Simulations – Model outcomes before reallocating funds.

- 🧠 Stay Strategic – Let data guide you, not market noise.

✅ Final Take

Binance.US is a powerful trading platform — but it’s not built for long-term portfolio strategy.

Pair it with a smart portfolio tracker like PinkLion to:

- 📊 See your whole portfolio, not just crypto

- 🤖 Get optimization tips and risk alerts

- 📅 Plan your income, rebalancing, and goals

With Binance.US + PinkLion, you can trade fast and invest smart.