Coinbase Portfolio Tracker (2025 Guide)

Coinbase makes it easy to invest in crypto. But tracking risk, diversification, and income takes more. Discover smarter ways to manage your portfolio and plan beyond Bitcoin.

Coinbase made crypto investing easy. But growing long-term wealth requires more than just holding a few coins. Once you buy, the real work begins — tracking performance, managing risk, and adjusting your strategy.

Coinbase’s built-in tools are a solid start. But if you also hold stocks or ETFs, or want to plan and optimize your portfolio like a pro, you’ll need a more complete solution. Here’s why — and how tools like PinkLion give Coinbase users an edge.

What Coinbase Offers for Portfolio Tracking

Standard Coinbase and Advanced Trade offer clean, beginner-friendly dashboards:

- 📈 Real-Time Portfolio Value – Instantly see how your coins are performing in dollars and percentages.

- 💹 Performance Metrics (Beta) – View total return, average cost, and unrealized gains/losses per asset.

- 📜 Transaction History – Track buys, sells, transfers, and staking rewards.

- 📊 Mobile + Web Access – Synced across devices for convenient tracking.

- 🔐 Secure Environment – Cold storage, 2FA, and insured hot wallets.

🟢 Staking rewards and cashback are also integrated into your portfolio value. Everything stays in one place. These features are great for getting started — but they aren’t enough for long-term planning.

Limitations of Coinbase’s Portfolio Tools

Despite improvements, Coinbase’s tracking still has big gaps:

❌ No Diversification Analysis – You can’t view allocation by sector, market cap, or correlation.

❌ No Forward Planning – No way to simulate different scenarios or plan for future rebalancing.

❌ Crypto Only – Doesn’t account for your ETFs, mutual funds, stocks, or savings.

❌ No Benchmarking – Can’t compare performance to BTC, ETH, S&P 500, or 60/40 portfolios.

❌ Limited Risk Insights – Missing tools like beta, volatility, Sharpe ratio, and max drawdown.

❌ No Income Projections – Rewards and yields are shown only after they arrive; no planning tools.

If you’re managing more than just crypto, or want to optimize your holdings Coinbase alone won’t cut it.

Why You Need a Dedicated Tracker

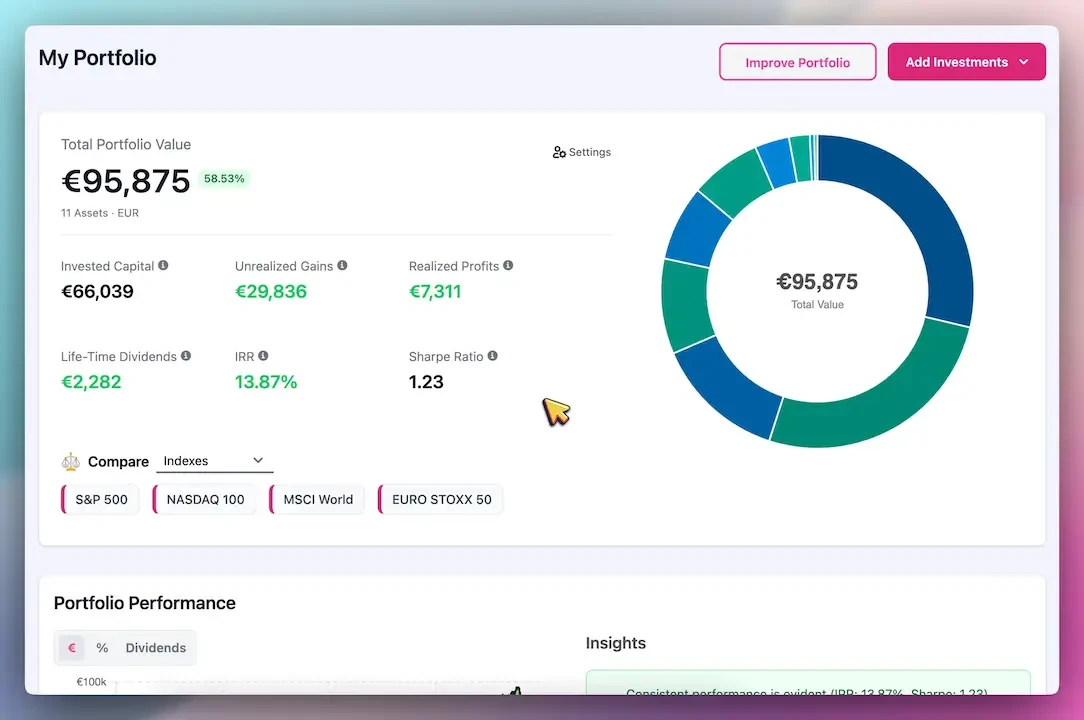

A smart portfolio tracker like PinkLion fills the gaps Coinbase leaves behind:

🔄 Unified Portfolio View – Combine your crypto, stocks, ETFs, and even cash positions.

📊 Advanced Analytics – See sector weight, geographic split, correlation heatmaps, and exposure.

🔮 What-If Tools – Simulate allocation changes and market events before acting.

🤖 AI Optimization – Smart reallocation suggestions based on your goals and risk tolerance.

📅 Income Forecasting – View future dividend and staking flows on a calendar.

Think of Coinbase as your execution layer, and your tracker as the insight engine.

✅ Must-Have Tracker Features (Like PinkLion)

To move from passive holding to active investing, look for tools with:

- Automatic Syncing – Securely connect Coinbase and brokers for up-to-date data.

- Diversification Monitoring – See where you're overexposed or under-diversified.

- Detailed Performance Metrics – Realized/unrealized gains, IRR, Sharpe ratio, and drawdowns.

- Income Visibility – Forecast yield by month or by asset class.

- Stress Testing – See how your portfolio would perform in 2008, 2020, or a Bitcoin crash.

- AI-Driven Suggestions – Get personalized ideas to rebalance or enhance return.

- Secure, Read-Only Connections – Bank-grade encryption with no trading access.

Why Coinbase Users Choose PinkLion

PinkLion works seamlessly with Coinbase and enhances your experience:

- 🔐 Secure Coinbase Sync – your Coinbase transactions can be easily connected to PinkLion. Read-only access.

- 🔁 Daily Auto-Refresh – Portfolio data updates automatically.

- 📈 Smart Recommendations – Adjust portfolio based on your preferences (growth vs income).

- ⚠️ Real Risk Monitoring – Get alerts for overconcentration, drift, or increased volatility.

- 📊 Total Asset Coverage – See stocks, ETFs, crypto, and more in one simple view.

It’s the clarity and control Coinbase doesn’t provide, especially for investors beyond just crypto.

Coinbase Sync in 60 Seconds

- Connect your account securely: Link your Coinbase via PinkLion’s encrypted portal (read-only access).

- Or upload a CSV: If you prefer, you can import your Coinbase transactions manually in seconds.

- Automatic import: PinkLion pulls in your holdings, trade history, and cost basis.

- Always up-to-date: Your Coinbase portfolio data refreshes daily (or whenever you hit “Refresh”) for the latest balances.

Pro Tips for Coinbase Investors

🧠 1. Rebalance Intentionally – Use rebalancing signals to realign with your strategy, especially after rallies or dips.

📉 2. Spot Hidden Correlations – BTC and tech stocks often move together. Use tools to reduce overlap.

🔮 3. Simulate Before Acting – Don’t just buy or sell — model the effect on performance, diversification, and risk first.

📆 4. Time Your Yield – Plan staking payouts and dividend income for reinvestment or cash flow needs.

🚨 5. Track Behavior Patterns – Identify costly habits like panic-selling or overtrading with analytics.

Conclusion

Coinbase is a great on-ramp to crypto. But it’s not built for holistic wealth tracking.

To see your full picture, prepare for volatility, and grow your investments across asset classes, you need something more.

PinkLion gives you:

- 🔍 Real-time portfolio visibility

- 🧠 AI-powered insights and optimizations

- 📆 Income forecasting for staking and dividends

- 🧪 Stress tests and diversification analytics

All in one secure, easy-to-use dashboard.