Crypto Portfolio Tracker: Complete 2025 Guide

Why Crypto Investors Need Real-Time Portfolio Tracking

Crypto markets are notoriously volatile, so prices can swing wildly within minutes. Manually updating spreadsheets after every trade or price change is nearly impossible in such a fast-moving environment. Moreover, most investors now hold assets on multiple wallets and exchanges (e.g. DeFi wallets, hardware wallets, CEX accounts), so consolidating all of that data is challenging.

A real-time tracker automatically pulls in balances and prices across chains, accounting for gas fees and DeFi yields, so you always see your true net worth. And with regulators demanding exact transaction histories for taxes, “clear transaction histories and accurate valuations” become essential.

In short, a live crypto tracker saves time, avoids errors, and helps ensure you don’t miss fees or trades when reporting gains.

Quick Look: ✅ Must-Have Features in a Crypto Portfolio Tracker

Key Features:

📈 Live Price Feeds: Real-time market data for thousands of tokens is crucial. For example, CoinMarketCap’s free tracker provides live prices for 20,000+ cryptos. (We’ll use CoinGecko’s API below, which similarly covers 16,000+ coins.)

💰 Profit/Loss (P/L) Tracking: Track both unrealized and realized gains. The Google Sheets example adds columns for current value, cost basis, unrealized P&L and realized P&L, plus ROI percentage. This lets you see your returns at a glance.

🔗 Wallet & Exchange Sync: Automatic syncing is vital. Top apps like CoinStats can connect 300+ exchanges and wallets across 70+ blockchains. This means your sheet or app pulls balances directly (via APIs), rather than needing manual entry.

🪙 DeFi & NFT Support: Modern portfolios often include staking yields and NFTs. Some trackers now support DeFi staking balances and NFT floor prices in one place. (We’ll show a Pro Tip on fetching NFT floors via OpenSea’s API below.)

⚠️ Gaps in Generic Trackers

📝 Manual Setup Required: Many free trackers (like CoinMarketCap’s) still rely on you to manually input or import each trade, which is time-consuming and error-prone.

🖼️ Lack of NFT Insights: Generic crypto apps often ignore NFT collections or their floor prices, so you may need a separate NFT tracker.

🔄 No Automated DeFi Yields: Most standard trackers don’t auto-calc staking/liquidity APYs – you’d have to add those manually.

🐢 Slower Feeds: Some spreadsheets or basic apps may only refresh hourly or on demand, so price data can lag real-time.

Build Your Own Crypto Portfolio Tracker (Google Sheets + API)

1️⃣ Copy the Crypto Template — We’ve provided a free Google Sheets template (link to copy). This comes pre-formatted with holdings, price lookup formulas, and P/L columns. Make your own copy before editing so you always have a backup.

2️⃣ Pull Prices via CoinGecko API — Use an Apps Script like ImportJSON (Brad Jasper’s script) to fetch coin prices from CoinGecko. In Apps Script (Extensions ▶ Apps Script), add the ImportJSON code and save. Then use a formula like: =ImportJSON("https://api.coingecko.com/api/v3/coins/markets?vs_currency=usd&ids=bitcoin,ethereum", "/name,/current_price,/price_change_percentage_24h", "noHeaders", AutoRefresh!$A$1) to get live prices. CoinGecko’s free tier allows up to 30 calls/minute, which is ample for a single-sheet portfolio (you can stagger calls with a dummy refresh parameter).

3️⃣ Add Wallet Balances via Etherscan API — For on-chain token balances, call Etherscan (or other block explorer) via ImportJSON. For example, to get an Ethereum token balance:

swiftCopyEdit=ImportJSON("https://api.etherscan.io/api?module=account&action=tokenbalance&contractaddress=YOUR_TOKEN_ADDR&address=YOUR_WALLET_ADDR&tag=latest&apikey=YOUR_KEY", "/result", "noHeaders", AutoRefresh!$A$1)

This returns your token amount, which you then multiply by price. Etherscan’s documentation shows a similar pattern for a gas price lookup, and you can adapt it to the account&action=tokenbalance endpoint. (Grab free API keys from etherscan.io.)

4️⃣ Track Trades & Fees — Add columns in the sheet for total invested (sum of buy-costs), plus transaction fees if desired. Then use formulas to compute Unrealized P/L = Current Value – Total Invested, and Realized P/L for any sells. The template suggests headings like Current Holdings, Holding Value, Total Invested, Unrealized P&L, Realized P&L and ROI%. This way you can capture profits per coin.

5️⃣ Visualize Allocation & Performance — Use Google Sheets charts to display your data. For example, insert a donut/pie chart to show allocation by asset class (coins vs NFTs vs DeFi tokens), and a line graph for portfolio value or ROI over time. CoinGecko’s tutorial even recommends adding charts for an “easily digestible” portfolio overview. A simple dashboard (like a summary donut chart or gauge) makes the data more engaging.

6️⃣ Automate Refresh — Set up a time-driven trigger in Apps Script to refresh your data every minute. For instance, create a small AutoRefresh() function that writes a random value to a hidden sheet (breaking Google’s caching), then schedule it (Triggers ▶ Add Trigger) to run every minute. Alternatively, services like Zapier or Make.com can call the sheet periodically. This keeps prices and balances up to date automatically.

Pro Tip: Track NFT floors using OpenSea’s API. For each collection slug, call the stats endpoint (e.g.https://api.opensea.io/api/v1/collection/YOUR_COLLECTION/stats) and parse thestats.floor_pricefield. You can do this with ImportJSON as well. This way your sheet can even display the latest NFT floor prices alongside your crypto holdings.

🦁 Meet PinkLion—Unified Crypto & Multi-Asset Tracking

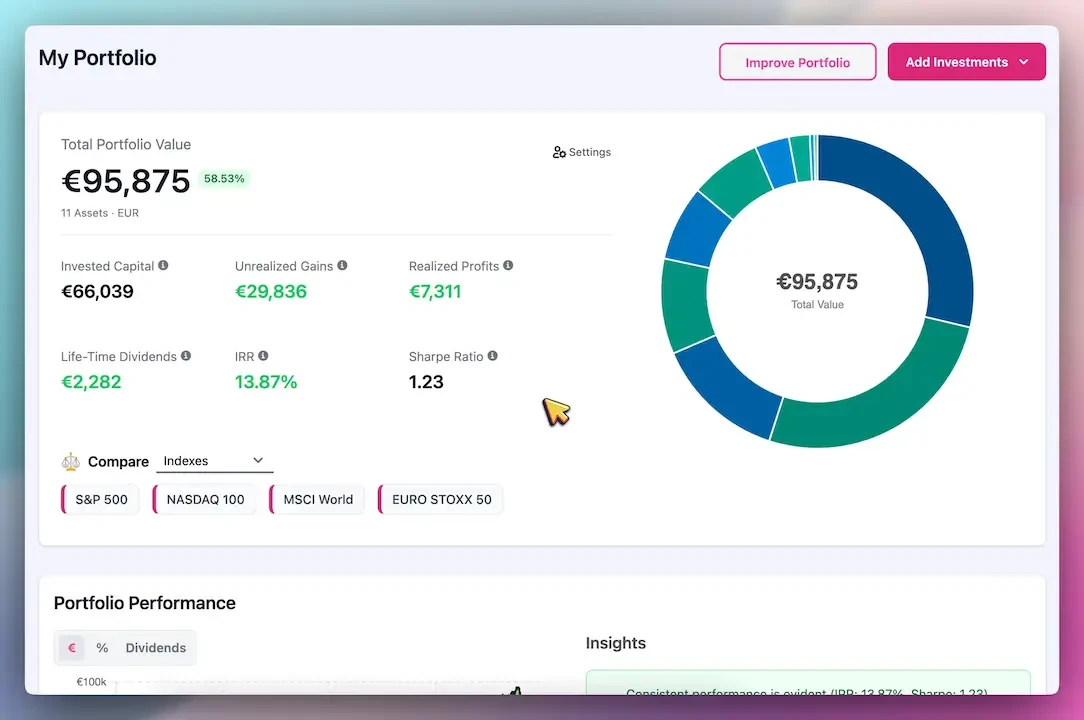

PinkLion is a next-generation portfolio manager that brings all your assets (crypto, stocks, ETFs, and more) into one dashboard. According to its site, PinkLion already supports 5,000+ crypto coins and lets you “keep tabs on your token holdings, performance, and allocations across exchanges”. You can link multiple wallet and exchange accounts so your balances sync automatically (no manual entry required). Plus PinkLion goes beyond simple tracking. It’s AI-powered – the “AI Portfolio Optimization” features use intelligent algorithms to fine-tune your mix of assets. In other words, it can suggest rebalancing to meet your goals or highlight hidden risks.

Another standout is 1-click Stress Testing. PinkLion lets you pick historical crash scenarios (2008 crash, 2020 COVID dip, etc.) and instantly see how your portfolio would have behaved. The results (drawdowns, recovery times, asset impact) are shown side-by-side for each event. This visual, data-driven risk analysis is impossible in a static sheet. And everything is designed for ease of use – “no spreadsheets, no guesswork,” as PinkLion puts it. In short, with PinkLion you get a unified, no-code platform that auto-syncs your wallets, tracks crypto & stocks together, and even offers smart forecasts – solving the gaps of DIY trackers.

Feature-by-Feature Comparison

| 📋 Feature | 📝 DIY (Google Sheets) | 📱 CoinMarketCap / Delta | 🦁 PinkLion |

|---|---|---|---|

| Live Price Data | ✅ via API scripts | ✅ In-app live feeds | ✅ Real-time quotes |

| Asset Coverage | Crypto (manual add for others) | Crypto / Crypto + Stocks | Crypto + Stocks/ETFs (100 K+ assets) |

| Multi-Account Sync | ⚠️ Manual API setup | 🔄 Some wallet/exchange sync | ✅ Auto-sync wallets & brokers |

| DeFi & NFT Support | ⚠️ Custom add-ons | Limited NFT, no APY | Roadmap (crypto focus today) |

| Profit / Loss Tracking | ✅ Formulas in sheet | ✅ Built-in dashboards | ✅ Advanced P/L analytics |

| Tax Reporting | ⚠️ CSV export only | ❌ Few tax tools | ✅ Transaction export & integrations |

| Stress Testing | ❌ Not available | ❌ Not available | ✅ Historical crash scenarios |

| AI Insights & Forecasts | ❌ None | ❌ None | ✅ AI rebalancing & 1-yr forecasts |

| User-Friendliness | ⚠️ Spreadsheet skills required | ✅ Mobile-friendly apps | ✅ Intuitive UI, no coding |

Migrate from DIY Sheet to PinkLion in 3 Minutes

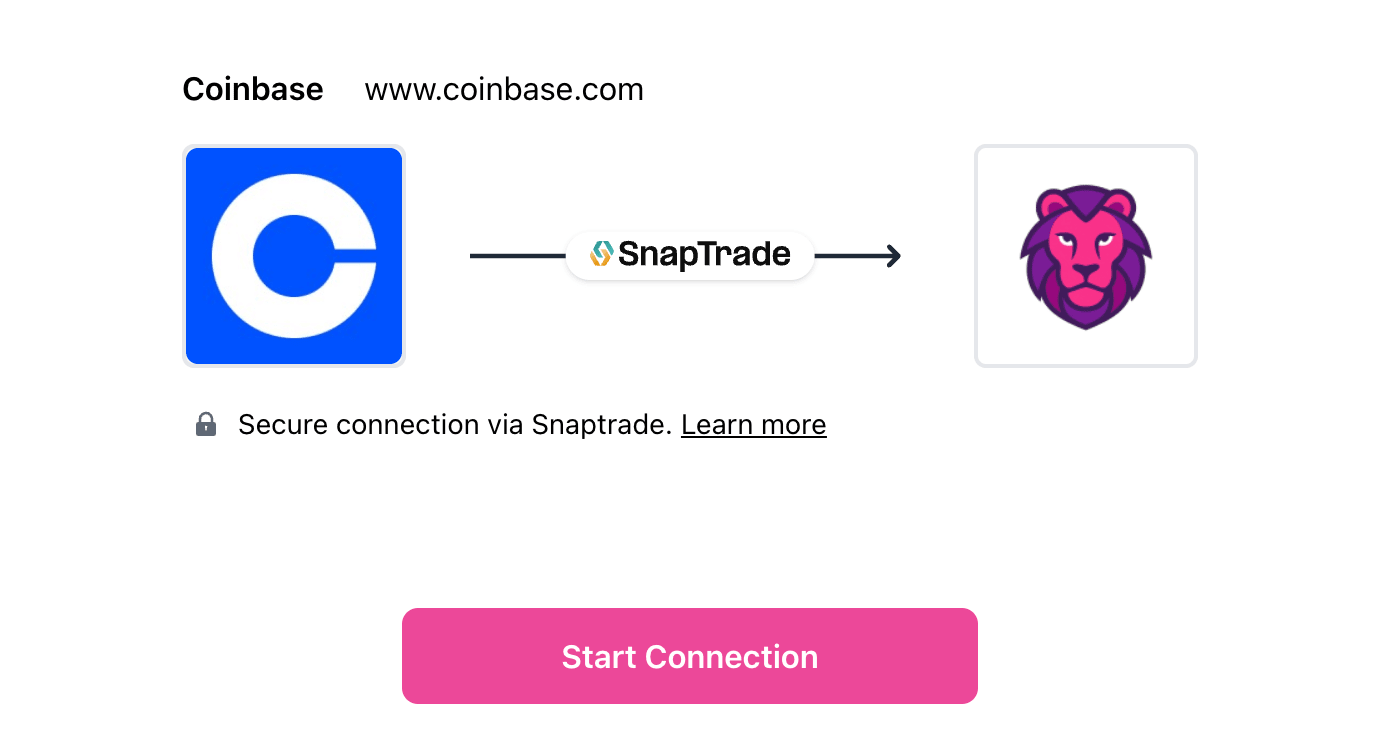

Ready to upgrade? PinkLion makes it easy. Its Seedling (Free) Plan supports CSV or manual import of your holdings. Just export your transactions or balances from your spreadsheet (as CSV) and upload them into PinkLion. For a seamless live sync, you can connect your exchange accounts or wallets, even the Seedling plan allows manual import, and the paid plans unlock one-click broker linking. Once connected, PinkLion auto-fetches your holdings and keeps them updated.

Keep using Sheets as a sandbox. Even after switching, you can continue experimenting in a Google Sheet: try out new investment ideas, build on-chain models, or track test-net assets. Meanwhile, PinkLion becomes your official “source of truth” for all real holdings.

FAQs

Q: How do I track a cold (hardware) wallet?

A: You can include any address by using a public API. For example, add the wallet’s address and call Etherscan’s API for its balances (as in Step 3 above). PinkLion also lets you import wallet addresses into your account, pulling balances from the chain. Just ensure you use a read-only wallet or API key (no private keys needed) for safety.

Q: Can I include NFTs in my tracker?

A: Right now, many crypto trackers still lack built-in NFT tracking. If you have NFTs, you could add their floor prices manually (via OpenSea API as noted above) or use a separate NFT tracker. Some portfolio apps (like Delta) have started integrating NFTs, but PinkLion today focuses on fungible assets. It’s worth watching PinkLion’s roadmap for future NFT support.

Q: How often does the data refresh?

A: It depends on your setup. Google Sheets with free APIs may refresh every few minutes at best (and can even hit rate limits). Dedicated apps like PinkLion, however, fetch updates continuously. PinkLion updates your portfolio performance daily across accounts, so you always see current prices and balances.

Q: Is my data secure?

A: Yes – trust is key. PinkLion uses bank-grade encryption and explicitly states it does not store your sensitive login credentials. When you connect an exchange or wallet, you use read-only API keys (or OAuth). This means PinkLion can see your balances but cannot execute trades or withdrawals. In general, always use read-only connections and enable any extra security (like 2FA) on your accounts.

Q: What about privacy?

A: As with any online service, review the privacy policy. PinkLion’s policy emphasizes that your data is yours and encrypted. Unlike public trackers, your portfolio isn’t shared. In your own Google Sheet version, your data is as private as your Google account security. If ultimate privacy is needed, you can keep using a local sheet (offline) – just you’ll miss live price updates.

Conclusion

Managing a crypto portfolio across wallets, exchanges, DeFi pools and NFTs can be a nightmare without the right tools. A tracker ensures you never miss a price move or a transaction fee, and it lays the groundwork for clean tax reporting.

Start with our free Google Sheets crypto tracker template to take control of your data. When you’re ready for the next level, PinkLion offers an AI-enhanced, multi-asset dashboard that automates everything for you.