E*TRADE Portfolio Tracker (2025 Guide )

E*TRADE shows today’s gains, but a dedicated tracker reveals risk, future income, and AI-powered optimizations, giving long-term investors a clearer path to their goals.

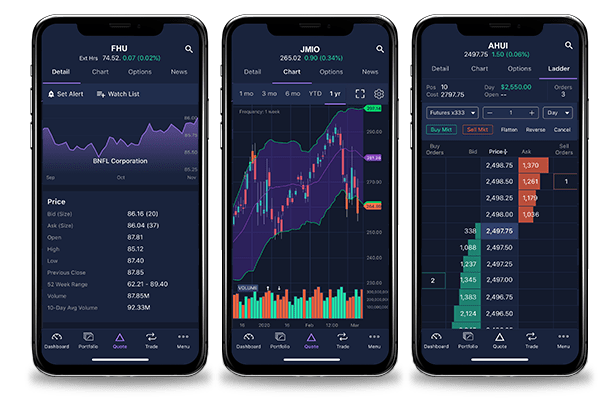

E*TRADE is a household name for self‑directed investors. Its trading platform is packed with research and real‑time quotes, and the core dashboard gives a decent snapshot of your holdings.

But long‑term wealth building needs more than daily P/L. You also need to know:

- Am I on track for my goals?

- Is my risk balanced?

- What income can I expect next month?

Below you’ll see what E*TRADE covers natively, where it stops short, and how an advanced tracker like PinkLion fills the gaps with multi‑broker sync, dividend forecasting, stress tests, and AI optimisation.

🟢 What E*TRADE Does Well

| ✅ Built-In Feature | Why It Helps |

|---|---|

| Unified Account View | Shows every position in one click, across taxable and IRA accounts. |

| Streaming Quotes | Real-time prices keep performance current during market hours. |

| Basic Performance Charts | Plot total return and compare to the S&P 500 or Nasdaq. |

| Sector Allocation Pie | Quick glance at how much is in Tech, Healthcare, etc. |

| Order & Dividend History | Full log of trades, interest and dividend payments. |

For beginners, this is a solid starting point. You always know what you own and today’s gain/loss.

🔺 Where E*TRADE Falls Short

❌ No External Account Sync – Holdings in a 401(k), Coinbase wallet, or spouse’s account stay invisible.

❌ Limited Risk Metrics – No volatility, Sharpe ratio, or stress‑test views for the full portfolio.

❌ No Forward Income Forecast – Past dividends show, but future payouts and portfolio yield don’t.

❌ No Goal Tracking – The dashboard won’t say if you’re 70 % of the way to retirement funding.

❌ Zero AI Guidance – Research is DIY; there’s no engine suggesting overlap cuts or risk tweaks.

Result: you still juggle spreadsheets or multiple logins to see the bigger picture.

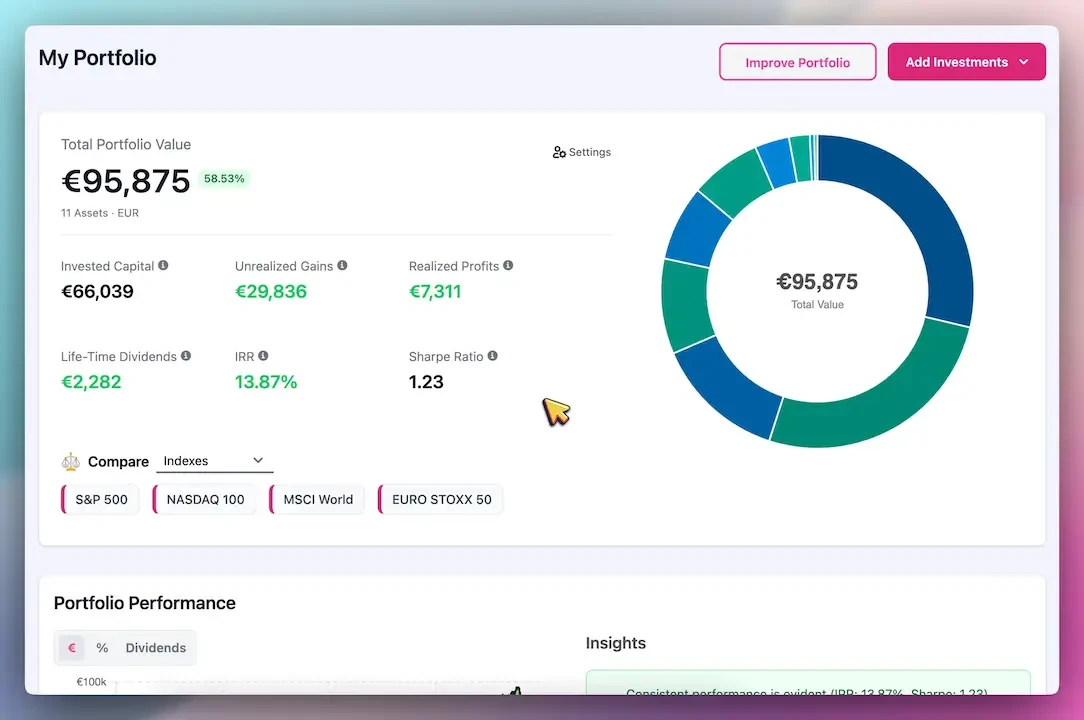

🎯 What a Modern Tracker Adds

🔗 Multi‑Broker Sync – One click pulls E*TRADE and every other account into a single view.

📊 Deep Analytics – Automatic volatility, drawdown, beta, and diversification heatmaps.

💰 Dividend Calendar – See next month’s payouts and 12‑month projected income.

🤖 AI Optimisation – Personalised suggestions to boost risk‑adjusted return or yield.

🛡️ Stress Tests – Replay 2008 or COVID‑19 crashes on your exact holdings.

🔒 Read‑Only Security – Bank‑grade encryption; tracker can’t trade or withdraw.

🦁 Why PinkLion Complements E*TRADE

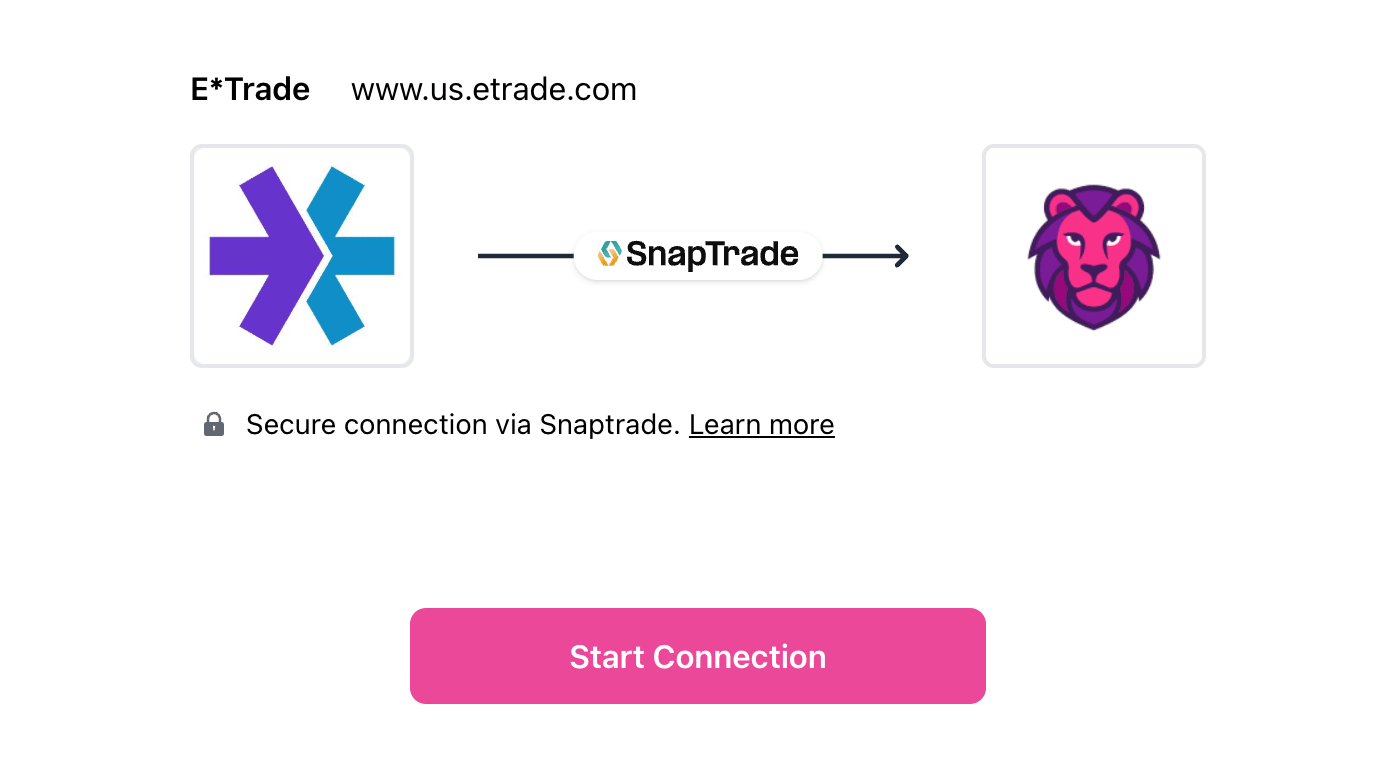

1. 60‑Second Secure Sync

Authorize through E*TRADE’s OAuth portal → data imports automatically every day.

2. AI Portfolio Health Check

PinkLion scans for concentration, overlap, or under‑diversification and serves clear fixes.

3. Forecastable Income

Forward dividend yield, payout calendar, and optional DRIP impact — all computed for you.

4. Crash‑Proofing Tools

Simulate historic downturns; adjust and re‑test until drawdown fits your comfort zone.

5. One Dashboard, All Assets

Add Vanguard funds, Coinbase crypto, or a partner’s brokerage. PinkLion unifies them without double‑counting.

📊 E*TRADE vs PinkLion – Feature Snapshot

| 📊 Feature | E*TRADE (native) | 🦁 PinkLion (add-on) |

|---|---|---|

| Account Coverage | E*TRADE only | All brokers & wallets |

| Real-Time Quotes | ✅ Live prices | 🔄 Daily & on-demand refresh |

| Performance Metrics | Basic return % | IRR, TWR, Sharpe, drawdown |

| Diversification View | Sector pie | Sector, region, correlation matrix |

| Risk Alerts | ❌ None | Volatility & concentration warnings |

| Income Forecast | ❌ Past only | Future dividend calendar + yield |

| AI Optimiser | ❌ | Yes – personalised tweaks |

| Stress Testing | ❌ | Yes – 2008, 2020, custom |

| Trading Capability | ✅ Place orders | ❌ Read-only analytics |

| Cost | Included | Free tier + £5/mo Pro |

🔗 How to Link E*TRADE to PinkLion

- Create a PinkLion account (free start).

- Connect Broker → E*TRADE. Authorise via secure OAuth.

- Initial Sync – positions & history import.

- Review Dashboard – allocation charts and AI tips appear.

- (Optional) Upload CSVs or add other accounts for a full picture.

Disconnect anytime: revoke in ETRADE or PinkLion settings.

💡 Pro Tips for E*TRADE Investors

- 📆 Quarterly Rebalance – Use PinkLion’s AI report to keep risk on target.

- 🤑 Track Dividend Snowball – Reinvest payouts; watch compound growth in the income tab.

- 🧪 Run What‑Ifs First – Simulate big moves before clicking “Sell” in E*TRADE.

- 🌐 Consolidate Everything – Link all accounts so sector exposure is measured portfolio‑wide.

FAQ

Is PinkLion safe to connect?

Yes. It uses bank‑grade, read‑only connections; can’t trade or transfer funds.

Does PinkLion handle fractional shares?

Absolutely – imports to the exact decimal.

How often does data update?

Automatic daily sync, plus manual “Refresh” whenever you want.

Can I track other brokers too?

Yes. Add as many as you like for a true 360° view.

🚀 Conclusion – Trade on E*TRADE, Track Like a Pro

E*TRADE gives you speed and reliability for placing trades. PinkLion gives you clarity, foresight, and optimisation. Combine the two, and you’ll:

- See every asset in one dashboard

- Plan income and goals with confidence

- Stress‑test against worst‑case markets

- Let AI surface smarter allocation ideas

No more spreadsheets. No blind spots. Just smarter, calmer investing.

Start tracking smarter → Try PinkLion