7 Best Platforms for High Dividend Yield ETFs in 2025

Discover the top platforms to research and invest in high dividend yield ETFs. Our 2025 guide covers brokerages, research tools, and issuer sites.

In the quest for steady investment income, high dividend yield ETFs stand out as a powerful tool for building wealth and generating cash flow. These funds offer diversified exposure to companies that regularly distribute a portion of their earnings to shareholders, providing a more stable income stream compared to individual stocks. But finding the right ETFs and the best platforms to buy and analyze them can be overwhelming.

This guide cuts through the noise. We will explore the top 7 platforms of 2025, from commission-free brokerages like Schwab and Fidelity to sophisticated research tools such as Morningstar. Each entry provides a detailed look at what makes the platform unique, complete with screenshots and direct links to help you get started immediately. We focus on the specific features that matter most to income-focused investors, including advanced screening tools, transparent fee structures, and the quality of available data.

To truly leverage this income, consider how high dividend yield ETFs fit into your overall financial architecture. Integrating them effectively requires understanding all the essential financial planning steps to ensure they align with your long-term goals. This list is your starting point for identifying, purchasing, and managing the best high dividend yield ETFs for your portfolio.

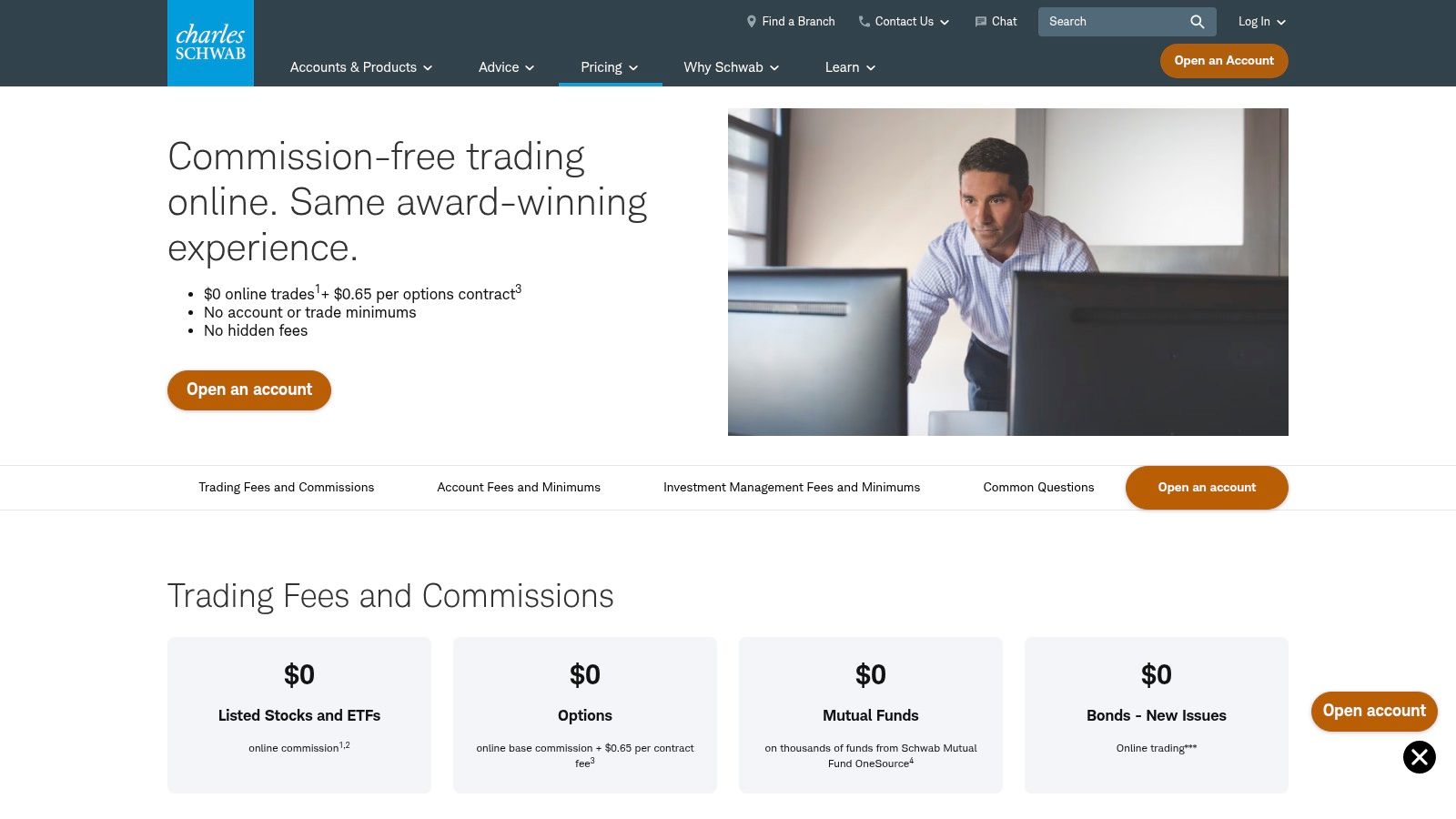

1. Charles Schwab: Best for Low-Cost, All-in-One Access

Charles Schwab stands out as an exceptional platform for investors seeking high dividend yield ETFs due to its powerful combination of zero-cost trading, extensive fund selection, and robust research tools. As a full-service brokerage, it provides an all-in-one solution where you can not only purchase ETFs but also manage your entire financial portfolio, from retirement accounts to individual brokerage accounts, with no minimum deposit required to get started.

The platform’s commitment to low costs is a major advantage for dividend investors. By offering $0 online commissions for all US-listed ETFs, Schwab ensures that trading fees do not erode your dividend income over time. This structure is particularly beneficial for investors who use strategies like dollar-cost averaging, as they can make regular, small investments without incurring a per-trade fee.

Key Features and User Experience

Schwab's user interface is clean and intuitive, making it accessible for beginners while still offering the depth needed by experienced investors. The platform's ETF screener is a highlight, allowing users to filter thousands of funds based on specific criteria like dividend yield, expense ratio, asset class, and performance history. This tool is invaluable for pinpointing the best high dividend yield ETFs that align with your specific investment goals.

- Fund Selection: Access a vast marketplace of ETFs from various issuers, plus Schwab’s own highly-regarded, low-cost dividend funds like the Schwab U.S. Dividend Equity ETF™ (SCHD) and the Schwab International Dividend Equity ETF™ (SCHY).

- Account Access: Open an individual brokerage, IRA, or custodial account with a $0 minimum, removing a common barrier to entry for new investors.

- Research Tools: Beyond the screener, Schwab provides in-depth reports, third-party analysis, and educational resources to help you make informed decisions.

Practical Tip: Use Schwab’s "ETF Compare" tool to line up several high dividend yield ETFs side-by-side. This allows you to directly compare key metrics like 30-day SEC yield, expense ratios, and historical total returns on a single screen, simplifying your final selection process.

While online trades are free, be aware that broker-assisted trades incur a $25 service charge. However, for the typical investor buying and holding ETFs, this is rarely a concern. Overall, Charles Schwab provides a comprehensive, cost-effective, and user-friendly ecosystem perfect for building and managing a dividend-focused portfolio.

Website: https://www.schwab.com/pricing

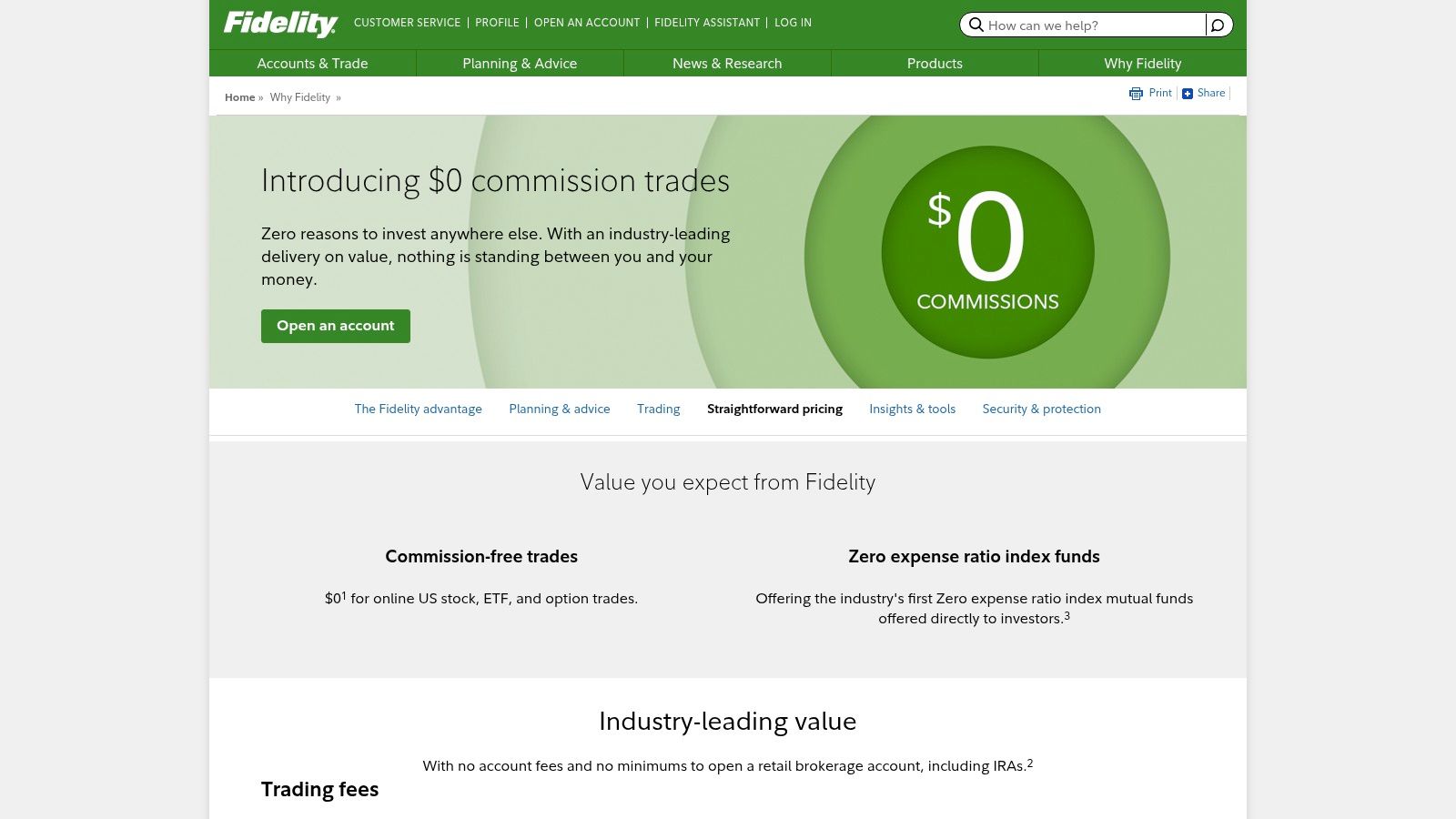

2. Fidelity: Best for In-Depth Research and Education

Fidelity is a powerhouse for investors hunting for high dividend yield ETFs, offering a compelling mix of zero-commission trading, a massive fund selection, and arguably some of the most comprehensive research and educational tools in the industry. As a leading full-service brokerage, it allows investors to manage their entire financial picture under one roof, from brokerage and retirement accounts to cash management, all with no account minimums or maintenance fees, making it highly accessible.

The platform's cost structure is a significant benefit for dividend-focused investors. With $0 online commissions on all U.S.-listed stock and ETF trades, Fidelity ensures that your returns are not diminished by transaction fees. This is especially advantageous for those who make frequent, smaller investments to build their positions over time, as every dollar saved on fees can be reinvested to compound growth and dividend income.

Key Features and User Experience

Fidelity’s platform strikes an excellent balance between a user-friendly design for newcomers and the sophisticated tools required by seasoned investors. Its ETF screener is exceptionally powerful, allowing users to filter by dozens of criteria, including dividend yield, distribution frequency, and fund-specific metrics from providers like Morningstar and Lipper. This makes it easy to find high dividend yield ETFs that meet precise portfolio needs.

- Fund Selection: Gain access to thousands of ETFs from top issuers, alongside Fidelity’s own lineup of funds, providing an extensive marketplace to choose from.

- Account Access: Open a brokerage account, Roth or Traditional IRA, or other account types with a $0 minimum deposit, eliminating a key barrier for those just starting.

- Research and Education: Fidelity's "Learning Center" is a vast library of articles, webinars, and courses designed to improve investor knowledge at all skill levels.

Practical Tip: Use Fidelity's "Thematic Investing" tool to discover high dividend yield ETFs grouped by specific economic trends or sectors, like "Asset Rich Companies" or "Global Infrastructure." This can help you uncover funds that align with both your income goals and your long-term market outlook.

While online trading is free, investors who utilize advanced strategies like covered calls should note that standard options contract fees apply. However, for the typical buy-and-hold dividend investor, Fidelity’s platform is a top-tier, low-cost choice that empowers users with market-leading research to build a robust income-generating portfolio.

Website: https://www.fidelity.com/why-fidelity/pricing-fees/

3. Vanguard: Best for Low-Cost Investing and Investor Education

Vanguard is a titan in the investment world, renowned for its investor-first philosophy and a powerful platform for accessing high dividend yield ETFs at an exceptionally low cost. As both a brokerage and one of the world's largest ETF issuers, it offers a seamless experience for those looking to build a dividend portfolio directly from the source. Its commitment to minimizing fees means more of your dividend income stays in your pocket, compounding over time.

The platform champions accessibility with $0 online commissions for Vanguard and most non-Vanguard ETFs, coupled with no account minimums. A standout feature is the ability to purchase fractional shares for as little as $1, which is perfect for investors who want to consistently deploy capital, regardless of an ETF's share price. This empowers users to build a well-rounded portfolio without needing significant upfront investment. Learn more about how to diversify your investment portfolio to maximize this feature.

Key Features and User Experience

Vanguard's platform is straightforward and educational, designed to help investors understand exactly what they are buying. It provides transparent disclosures on crucial costs like expense ratios and bid-ask spreads, empowering you to make cost-conscious decisions. This focus on education is a core part of the Vanguard experience, making it an excellent choice for both new and seasoned dividend investors who value clarity and long-term value.

- Industry-Leading Costs: Vanguard ETFs are famous for their rock-bottom expense ratios, a key advantage for maximizing long-term returns from high dividend yield ETFs.

- Direct Access: Easily invest in hallmark dividend funds like the Vanguard High Dividend Yield ETF (VYM) alongside thousands of other options from various issuers.

- Fractional Shares: Start investing with just $1, allowing for precise dollar-cost averaging and making every dollar work for you immediately.

- Educational Resources: The platform offers a wealth of high-quality, jargon-free articles and tools explaining the nuances of ETF investing and portfolio construction.

Practical Tip: When evaluating ETFs on Vanguard's platform, pay close attention to the "Trading Information" tab on any fund's profile page. This section clearly displays the bid-ask spread, a hidden cost of trading that Vanguard helps you understand and minimize.

While online trades are free, be mindful that phone-assisted trades may incur a commission, making the online platform the most cost-effective choice. For investors focused on a buy-and-hold strategy centered on low-cost, high-quality dividend funds, Vanguard provides an unparalleled, investor-friendly environment.

Website: https://investor.vanguard.com/investment-products/etfs/etf-fees

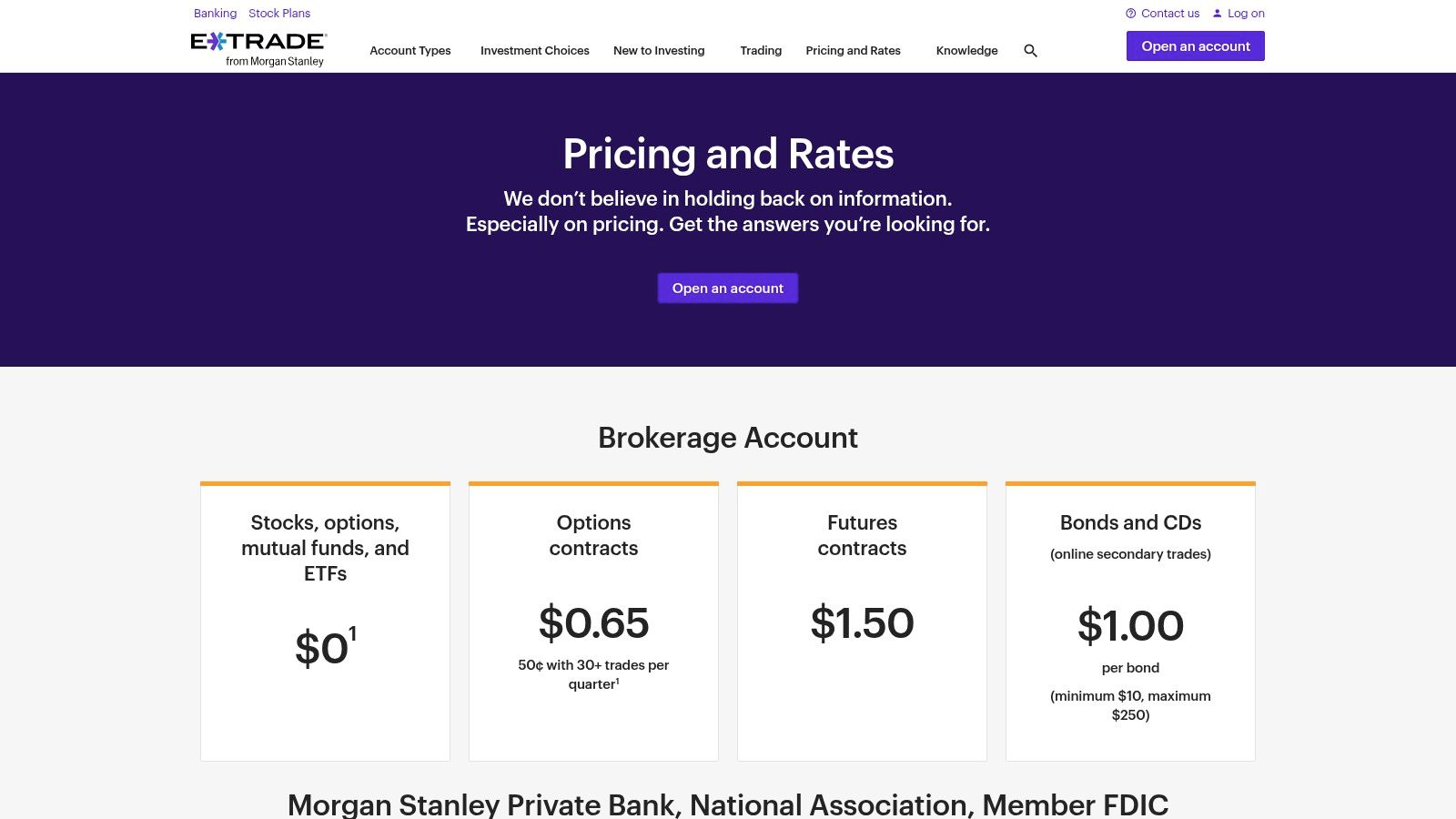

4. E*TRADE from Morgan Stanley: Best for Advanced Screeners and Research Integration

ETRADE from Morgan Stanley is an exceptional choice for investors targeting high dividend yield ETFs thanks to its combination of $0 online commissions, industry-leading ETF screeners, and seamless third-party research integration. Whether you’re a long-term dividend investor or an active trader, ETRADE’s multi-platform approach lets you analyze, compare, and purchase dividend payers with precision.

Beyond zero commissions on all US-listed ETFs, E*TRADE gives you access to Morgan Stanley’s research ecosystem. You can link your brokerage account to Morgan Stanley wealth management services and view proprietary market commentary alongside popular third-party data. This integration is ideal for dividend-focused investors who want both breadth and depth in their analysis.

Key Features and User Experience

- $0 ETF Commissions – Trade all US-listed ETFs online with no per-trade fee. Tiered OTC pricing applies only to over-the-counter securities, not ETFs.

- Advanced ETF Screener – Filter thousands of funds by dividend yield, expense ratio, asset class, market cap, and historical performance.

- Multi-Platform Access – Use ETRADE web, mobile app, or the advanced ETRADE Pro platform for real-time streaming quotes and customizable workspaces.

- Third-Party Research – Tap into Morningstar ratings, Thomson Reuters reports, and in-house Morgan Stanley analysis directly from each ETF’s detail page.

- Account Types – Open individual, joint, IRA, or custodial accounts with no minimum investment, making it easy to build a dividend ETF portfolio.

Investors can also set up automated screen alerts to notify them when a target dividend yield threshold is met or when an ETF’s expense ratio drops below a set level. This ensures you never miss new opportunities in the high dividend yield ETF universe.

Practical Tip: Use E*TRADE Pro’s customizable watchlists alongside the “Compare ETFs” feature to track up to six funds side-by-side, highlighting key metrics like 30-day SEC yield and trailing-12-month distribution rate.

While advanced order routing may incur per-share fees for certain professional trading workflows, this seldom impacts buy-and-hold ETF investors. Overall, E*TRADE from Morgan Stanley delivers a powerful, research-driven environment for building and managing a dividend-heavy portfolio.

Website: https://us.etrade.com/what-we-offer/pricing-and-rates

5. iShares by BlackRock: Best for Authoritative Fund Research

While you can't trade directly on the iShares website, it serves as an indispensable primary source for researching high dividend yield ETFs. As the official issuer site for BlackRock, it provides the most accurate and up-to-date data directly from the fund manager. This makes it a crucial first stop for due diligence before you purchase funds like the iShares High Dividend ETF (HDV) or the iShares Select Dividend ETF (DVY) through your brokerage account.

The platform excels at transparency, offering detailed product pages for every ETF. Investors can find definitive information on key dividend metrics like the 30-day SEC yield and trailing 12-month yield, which is essential for comparing the income potential of different funds. This direct-from-source data ensures you are basing decisions on official numbers rather than potentially outdated third-party information.

Key Features and User Experience

The iShares website is designed as a comprehensive research hub with a clean, data-centric layout. Its primary value lies in the depth of information available for each fund, allowing investors to look "under the hood" of any high dividend yield ETF in its lineup. Beyond the data, understanding an issuer's broader operational context, such as recent news regarding BlackRock's ESG practices, can also inform investment decisions.

- Comprehensive ETF Data: Access precise details on performance history, expense ratios, portfolio characteristics, and specific fund holdings, updated regularly.

- Fund Documentation: Easily find and download critical documents such as the prospectus, fact sheets, and tax information for any ETF.

- ETF Screener: Filter the entire iShares lineup by asset class, investment strategy (like dividend growth or high yield), and other key metrics to find funds that match your criteria.

- Broad Dividend Selection: Explore a wide range of dividend-focused ETFs, from U.S. high-yield strategies to international dividend growth funds.

Practical Tip: When analyzing an ETF on iShares, navigate to the "Distributions" tab on the fund's page. This section provides a detailed history of every dividend payment, allowing you to see the consistency and growth of payouts over time, a critical factor for income-focused investors.

The main limitation is that iShares is not a brokerage; it's a research tool. You must use a separate platform like Schwab or Fidelity to execute trades. However, for investors who prioritize making informed decisions based on official data, the iShares website is an essential resource for building a portfolio of the best high dividend yield ETFs. If you're looking to understand the fundamentals of this strategy, you can explore more about how to select dividend-paying investments.

Website: https://www.ishares.com

6. Morningstar Investor: Best for In-Depth, Independent Research

Morningstar Investor is the premier platform for investors who prioritize deep, unbiased research when selecting high dividend yield ETFs. Rather than just a trading platform, Morningstar is a subscription-based research service that equips you with institutional-grade tools to look beyond a fund's surface-level yield. It helps you assess the underlying quality of an ETF’s holdings, its strategy, and its management, which is crucial for avoiding "yield traps" and building a resilient dividend portfolio.

The platform’s strength lies in its trusted, issuer-agnostic methodology. While a brokerage might promote its own funds, Morningstar provides independent analyst reports and its proprietary Morningstar Medalist Ratings. These forward-looking assessments evaluate ETFs on a five-tier scale from Gold to Negative, giving you a clear indicator of which funds their analysts believe will outperform over a full market cycle. This is invaluable when comparing various high dividend yield ETFs that may appear similar at first glance.

Key Features and User Experience

Morningstar’s interface is data-rich and geared toward serious analysis. The ETF screener is exceptionally powerful, with over 200 data points that allow you to filter funds by dividend yield, dividend growth rate, expense ratio, and Morningstar-specific quality metrics. Full access requires a paid subscription, which costs $34.95 per month or approximately $249 per year, though a free 7-day trial is available.

- ETF Screener: Utilize highly specific filters to pinpoint ETFs that match your exact dividend and quality criteria.

- Analyst Research: Gain access to detailed reports and the Medalist Rating for thousands of ETFs, offering insights you won't find on a standard brokerage platform.

- Portfolio X-Ray Tool: Analyze your existing or potential portfolio to identify sector concentration, style drift, and holding overlaps between different ETFs.

- Independent Methodology: Rely on objective, third-party analysis to make more confident and informed investment decisions.

Practical Tip: When using the ETF screener, don't just filter for the highest yield. Combine a minimum yield filter (e.g., >3%) with a quality filter, such as a Medalist Rating of "Bronze" or higher. This simple two-step process helps you immediately weed out lower-quality funds and focus on sustainable income sources.

While it is a research tool and not a brokerage for trading, its analytical power is unmatched for investors dedicated to building a high-quality dividend portfolio. The cost is a key consideration, but for those managing a significant portfolio, the insights can easily justify the subscription fee by helping to avoid costly investment mistakes.

Website: https://www.morningstar.com/mm

7. ETF Database (ETFdb): Best for Focused ETF Research and Comparison

ETF Database (ETFdb) is an indispensable research tool for investors who want to discover and analyze high dividend yield ETFs before making a purchase. Unlike a brokerage where you transact, ETFdb is a specialized data and educational platform designed to help you build a shortlist of the best funds across the entire market. It excels at cutting through the noise and presenting clear, sortable data for easy comparison.

The platform’s greatest strength for dividend investors is its powerful, free-to-use screening tools. You can quickly find lists of ETFs ranked by dividend yield, expense ratio, or assets under management, allowing you to identify top contenders in seconds. This data-first approach, combined with plain-English educational articles, makes it a perfect starting point for both novice and experienced investors looking to refine their dividend strategy.

Key Features and User Experience

ETFdb’s interface is clean and data-centric, prioritizing fast access to the information you need. The "Highest Dividend Yield ETFs" page is a popular feature, providing a real-time, sortable list that serves as an excellent launchpad for deeper research. While the core features are free, an optional Pro subscription unlocks more advanced screeners and data downloads for power users.

- Fund Discovery: Use the comparison pages to instantly sort all available high dividend yield ETFs by key metrics like yield, fees, and total assets.

- Educational Content: The site offers valuable primers that explain the difference between high-yield and dividend-growth strategies, helping you align your ETF choice with your financial goals.

- Data Access: Most essential data is available for free. A Pro membership unlocks advanced features like model portfolios and detailed fund flow data.

Practical Tip: Start with the "Highest Dividend Yield ETFs" page and sort by yield. Then, cross-reference the top funds by their expense ratio and 1-year total return to find a balance between high income, low cost, and solid performance. This process helps you filter out potential yield traps before you commit capital.

While you cannot buy or sell ETFs directly on ETFdb, its role as a pre-investment research hub is invaluable. It empowers you to build a data-backed list of target funds to purchase through your preferred brokerage. The site is a key resource for anyone serious about making informed decisions in their dividend portfolio. For more tools, you can also explore a dividend tracker to manage your picks.

Website: https://etfdb.com

Top 7 High Dividend Yield ETF Providers Comparison

Integrate and Optimize Your Dividend Strategy

Selecting the right high dividend yield ETFs is a crucial first step, but it’s not the final destination. As we've explored, platforms like Vanguard, Charles Schwab, and Fidelity offer robust tools for purchasing these assets, while research hubs such as Morningstar and ETF Database provide the deep-dive analytics necessary for informed selection. The real power, however, comes from integrating these individual holdings into a cohesive and optimized portfolio strategy. Your journey moves from asset selection to strategic wealth management.

From Individual ETFs to a Unified Portfolio

Think of each ETF as a single instrument in an orchestra. While each one can perform well on its own, their true potential is only realized when they play in harmony. The goal is to build a portfolio where your chosen high dividend yield ETFs complement your other investments, balance your risk exposure, and consistently generate the income you need to meet your financial objectives. This requires a holistic view that individual brokerage accounts or research sites can't always provide.

To achieve this, you must move beyond simply holding these assets and begin actively managing them as part of a broader strategy. This involves several key actions:

- Holistic Performance Tracking: Consolidate your holdings from various brokers (like E*TRADE and Schwab) into a single dashboard to monitor your total dividend income and overall portfolio performance.

- Risk and Correlation Analysis: Understand how your new ETFs interact with your existing assets. Are they overly concentrated in one sector? How will they perform during a market downturn?

- Future-State Scenario Planning: Don't just look at past performance. Use forward-looking tools to simulate how your portfolio might react to different economic conditions, such as rising interest rates or a recession.

Actionable Next Steps for Dividend Investors

With your research complete and potential ETFs identified, it’s time to implement and refine. The key is to be methodical and strategic in your approach.

First, finalize your selection based on your personal risk tolerance, income needs, and investment horizon. Revisit the expense ratios, dividend sustainability, and underlying holdings of the ETFs you've shortlisted. Second, determine your allocation strategy. Decide what percentage of your portfolio will be dedicated to high dividend yield ETFs and how you will distribute your investment among your chosen funds.

Ready to transform your collection of ETFs into a powerful, income-generating engine? PinkLion connects all your investment accounts into one smart dashboard, allowing you to track dividend income, forecast cash flow, and stress-test your strategy with AI-powered analytics. Take control of your financial future and start building a more resilient portfolio today at PinkLion.