Kraken Portfolio Trackers: A Guide for Crypto Investors

Kraken’s built-in tools are great for trading, but fall short for serious portfolio tracking. This guide shows how to connect Kraken to PinkLion for smarter analytics, diversification checks, risk simulations, and full multi-asset visibility.

Overview of Kraken’s Portfolio Tracking Capabilities

Kraken is primarily a cryptocurrency exchange, but it does give you some built-in portfolio tracking in its apps (especially Kraken Pro). Real-time pricing and balances: The interface updates your holdings and account balance as prices move. You can log in anytime to see how much of each coin you own and what it’s worth right now in your chosen currency.

Current performance metrics: Kraken Pro added a Portfolio page/widget that surfaces quick stats like total portfolio value and profit/loss at a glance. For each asset, Kraken Pro shows your average entry price, cost basis, and unrealized P&L (profit or loss), so you can tell how each position is doing. That makes it easy to check things like your average buy price for Bitcoin, or whether you’re up or down on an Ethereum holding.

Basic account history: Kraken provides a ledger of your transactions (trades, deposits, withdrawals) plus an exportable account history. It’s not visual, but it does let you review past activity and do your own performance analysis over time if you need to. Mobile and web access: you can view your portfolio in Kraken’s mobile app or on the web, and it stays in sync across devices so the numbers match wherever you log in.

✅ What Kraken Gets Right

- Accurate Real-Time Data: Kraken updates prices and balances live, so you see your portfolio value change as the market moves. You don’t have to manually refresh or guess. Your holdings’ valuation is recalculated continuously in real time.

- Integrated P&L Metrics: The Kraken Pro interface now shows practical portfolio stats like average buy price, cost basis, and unrealized profit/loss for each asset. That’s a big step up from earlier versions that didn’t surface these insights. With cost basis and P&L built in, you can quickly see what’s up, what’s down, and by how much, without exporting anything to a spreadsheet.

- Simple Balance Tracking: Kraken’s native dashboard gives you a clear view of what you own and the quantities. It’s an easy way to check your crypto balances and total account value in one place. If you’re primarily a crypto investor, that quick clarity on holdings and 24-hour changes is genuinely convenient.

- Secure and Reliable Platform: Kraken has a reputation for strong security practices and a long track record as a dependable exchange. Sticking with Kraken’s own tools keeps your data inside a secure environment. If you’re only using Kraken’s internal tracking, you don’t need to grant external apps access. (We’ll get into API security later for cases where you do connect external tools.)

- Built-In Staking and Earning Display: If you stake assets on Kraken or earn rewards, those are reflected directly in your account balances. Kraken automatically adds staking rewards to your balance (treating them as deposits at the time of reward). That means your on-exchange portfolio value includes earned crypto, which helps when you’re tracking staking-driven growth within Kraken.

Kraken’s native portfolio features are solid for basic crypto tracking. You get real-time updates, a clean view of holdings, and now some useful performance stats. That covers the essentials, especially if all your crypto activity stays on Kraken. However, as your investments grow, you’ll likely run into some limitations with Kraken’s built-in tools.

Limitations of Kraken’s Native Portfolio Tools

❌ Lack of Diversification Insights: Kraken lists your coins, but it doesn’t show your allocation visually or break things down by sector/category. You can’t see what percentage each asset makes up, or how correlated your holdings are. That makes it easy to get over-concentrated without realizing it.

❌ No Forward-Looking or Planning Tools: Kraken doesn’t offer simulations, forecasts, or goal tracking. You can’t run “what if” scenarios or project future value. There’s also no way to tie your holdings to goals like early retirement or monthly income, which limits real planning.

❌ Limited View of Total Wealth: Kraken only shows what you hold on its platform. It doesn’t pull in other exchanges, wallets, stocks, or cash, so you can’t see your full net worth or total portfolio allocation. That makes it harder to run a genuinely diversified strategy.

❌ No Benchmarks or Context: Kraken doesn’t compare your performance to benchmarks like Bitcoin, the S&P 500, or crypto indices. You also don’t get metrics like Sharpe ratio or portfolio volatility, so it’s tough to tell if your risk-adjusted returns actually make sense.

❌ No Advanced Analytics: Beyond basic P&L, Kraken doesn’t go much deeper: no correlation tracking, stress tests, drawdown analysis, or allocation optimization. You can’t estimate how your portfolio might behave in a crash or calculate more advanced risk metrics.

❌ Limited Income Tracking: Kraken shows staking rewards only after they land, but it doesn’t project yields or forecast future income. There’s no clear view of annual portfolio yield or an upcoming payout calendar, which makes passive-income planning harder.

In summary, Kraken’s built-in tools focus on the here-and-now of your crypto holdings, but they miss the analytical depth, big-picture view, and planning features that more sophisticated investors eventually need. Once you build a sizable portfolio or spread across multiple asset classes, these gaps become more painful. That’s where dedicated portfolio trackers come in.

Explore features and limitations here

Why Use a Dedicated Portfolio Tracker (Integrating Kraken)

Kraken is great for trading and holding crypto, but managing a broader, diversified portfolio takes more. That’s where a dedicated tracker like PinkLion fits.

- Unified Multi-Asset View: Trackers pull all your accounts (Kraken, Coinbase, stock brokers, banks) into one dashboard. You get the full picture of your portfolio, including allocation across crypto, stocks, cash, and more. No more jumping between apps or keeping everything in spreadsheets.

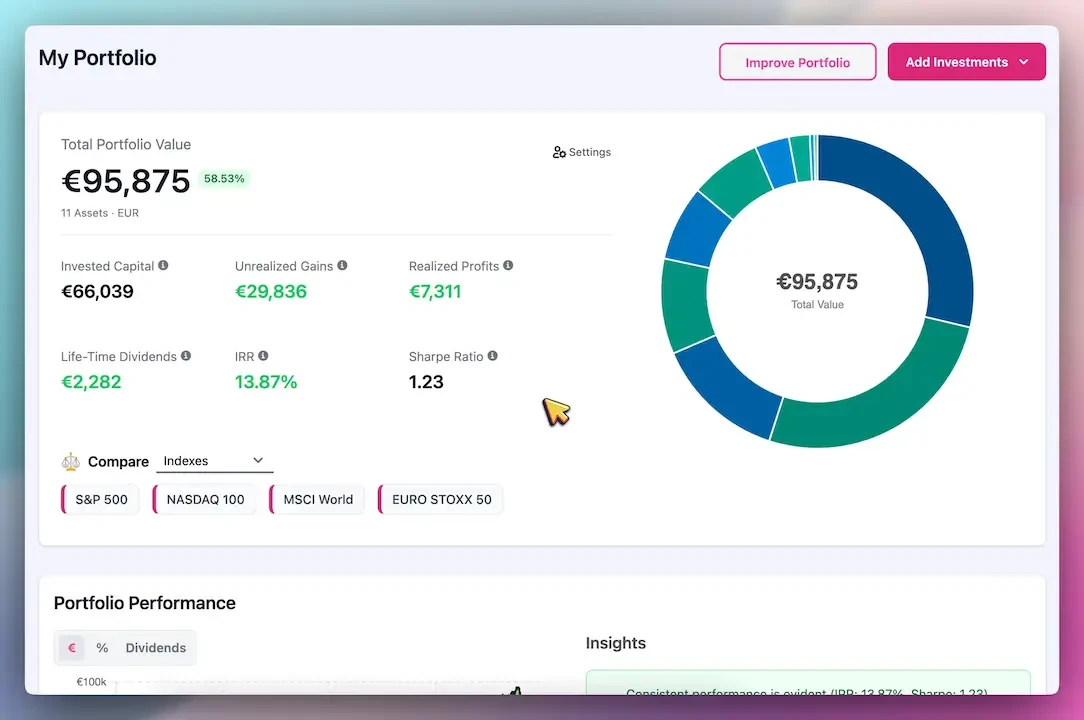

- Advanced Analytics: While Kraken shows your current balances, a tracker gives you the why behind the numbers, diversification scores, Sharpe ratio, beta, and sector breakdowns. It makes it easier to see how your portfolio actually behaves and where hidden risks or imbalances are creeping in.

- Forward Planning & Scenario Testing: Trackers let you run “what-if” simulations, stress tests, and growth forecasts that matter for managing risk and setting goals. You can track progress toward targets like early retirement or monthly income, something Kraken doesn’t support.

- AI Optimization: Platforms like PinkLion can offer AI-driven recommendations to improve allocation, reduce overlap, and boost returns. They surface inefficiencies Kraken won’t catch and act like a lightweight advisor for smarter decision-making.

- Performance & Tax Reporting: Trackers calculate true portfolio returns across platforms and make tax season easier with clean cost basis tracking, gain/loss logs, and optional reports. They can even help flag tax-loss harvesting opportunities Kraken doesn’t show.

- Time-Saving & Reliable Oversight: Automated syncs mean no manual input or messy spreadsheets. You get accurate, real-time insights, alerts for outliers, and a complete view of your financial health, while Kraken stays focused on secure execution.

Kraken is your trading engine. A tracker is your investment command center. Combining both gives you the tools to grow, analyze, and manage your wealth intelligently.

Kraken vs PinkLion Feature Comparison

How does Kraken’s native portfolio tracking stack up against a third-party platform like PinkLion? The table below highlights key features and which platform offers them:

| Feature | Kraken Native Tools | PinkLion |

|---|---|---|

| Real-Time Pricing & Balances | Yes. Live prices and balances update instantly as markets move. | Yes. Syncs real-time data from Kraken and other sources in one dashboard. |

| Portfolio Value History | No. No historical charts or ROI tracking over time. | Yes. Tracks portfolio growth, ROI, and performance trends over time. |

| Multi-Asset Support | No. Only shows Kraken crypto and fiat balances. | Yes. Combines crypto, stocks, ETFs, and more in one view. |

| Diversification Analysis | No. No allocation or correlation insights provided. | Yes. Visualizes portfolio allocation and highlights concentration risks. |

| Performance Metrics | Partial. Shows cost basis and unrealized P&L per coin. | Yes. Calculates overall return, realized/unrealized P&L, and risk-adjusted returns. |

| Benchmarking & Analytics | No. Lacks benchmarks and advanced metrics like Sharpe ratio or beta. | Yes. Compares to indices and computes risk metrics like drawdown and volatility. |

| Forward-Looking Tools | No. No forecasts, simulations, or goal tracking. | Yes. Simulates scenarios, projects returns, and tracks investment goals. |

| AI-Powered Insights | No. Doesn’t suggest changes or analyze allocations. | Yes. Offers tailored recommendations to improve diversification and performance. |

| Income & Yield Tracking | Limited. Shows rewards only after they’re paid. | Yes. Forecasts income, tracks yield, and displays a payout calendar. |

💡 Summary

Kraken’s native tools cover the basics (real-time data, simple P&L on Kraken-held assets), but third-party trackers like PinkLion deliver a much richer feature set.

PinkLion provides a comprehensive, multi-asset view with advanced analytics (diversification, risk metrics), forward-looking simulations, AI guidance, and convenient extras like performance tracking over time and income planning. This breadth of features helps intermediate investors manage and optimize their portfolios more effectively than using Kraken alone.

How to Connect Kraken to PinkLion

Step-by-step guide:1

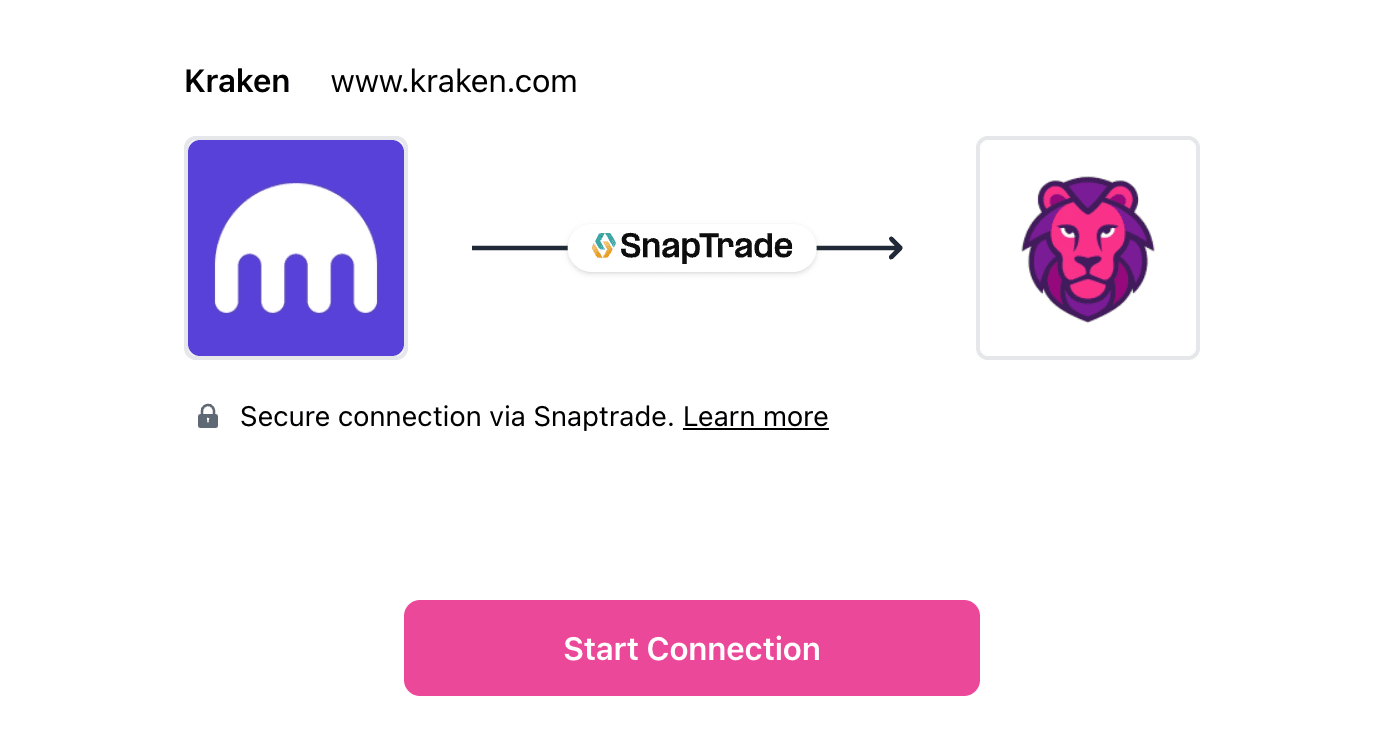

- Sign up for a free PinkLion account (web or mobile).

- Go to Broker → Connect Broker in your dashboard.

- Select Kraken and follow the instructions to paste your API key and secret.

- PinkLion will sync your Kraken portfolio. You can immediately run an AI optimization or stress test for personalized insights.

Best Practices for Tracking Your Kraken Portfolio

📈 1. Rebalance with Purpose

When prices move, your portfolio can drift away from your target allocation. Rebalancing (selling what’s overweight and adding to what’s underweight) helps keep risk where you intended it. Most investors rebalance quarterly, or when weights move a lot. A tracker like PinkLion can flag when you’re off target.

🧺 2. Stay Diversified

Try not to lean too hard on one coin or one theme. Use your tracker’s allocation and correlation views to catch concentration risk early. Mix majors (like BTC and ETH) with altcoins, and consider adding non-crypto assets if you want to reduce overall volatility.

🧪 3. Run Scenario Simulations

A good tracker lets you stress-test your portfolio. Check how it might behave in a crash or a strong bull run. The point is to adjust risk ahead of time, not after a drawdown.

🧠 4. Stay Proactive, Not Reactive

Review your dashboard regularly, but don’t let price swings push you into snap decisions. Use the data to ask better questions: Is my risk profile drifting? Is it time to rebalance? Pair the numbers with common sense.

Kraken Portfolio Tracker FAQ

Q: Is it safe to connect Kraken to a tracker like PinkLion?

Yes. PinkLion uses bank-level encryption and has read-only access to your transactions. You can revoke access anytime.

Q: Can I connect more than just Kraken?

Yes. PinkLion integrates with other exchanges (Coinbase, Binance), and stock brokers (Vanguard, Fidelity). You can track all assets in one dashboard.

Q: Can I trust the AI suggestions?

AI tools help you find risks, optimize allocation, or compare scenarios. But they don’t replace your judgment. Think of it as a smart second opinion.

Q: What if I stop using the tracker?

Just delete the read-only connection to Kraken to instantly cut off access. If switching tools, export your data or reconnect with a new service. Your core data stays safe with Kraken.

Conclusion: Smarter Crypto Investing

Kraken is a great platform to trade and hold crypto, but it’s just one piece of the puzzle. Pairing it with a smart tracker like PinkLion gives you deeper insights, risk control, and goal-based planning.

While Kraken executes your trades, PinkLion helps you analyze your portfolio, run simulations, and make data-driven decisions. You’ll spend less time guessing and more time optimizing.

Whether you want to rebalance, plan for retirement, or simply track everything in one view, using a dedicated tracker turns crypto investing from reactive to strategic.

Combine Kraken’s strength with PinkLion’s intelligence, and take control of your portfolio like a pro.