Vanguard Portfolio Tracker (2025 Guide)

Stop juggling spreadsheets. Vanguard investors are turning to smarter tools for real-time tracking, portfolio optimization, and tax-efficient planning.

Vanguard is synonymous with long-term investing and low-cost index funds. Its U.S. brokerage platform gives millions of retail investors an easy way to build wealth steadily. However, building wealth isn’t just about buying funds – it’s about tracking and optimizing your portfolio over time. Vanguard’s own tools provide a basic foundation, but they lack some real-time analytics and advanced planning features that modern investors crave.

For those managing taxable brokerage accounts, the stakes are even higher. Without detailed insights into risk, income, and tax impact, you could be leaving money on the table. This guide evaluates Vanguard’s native portfolio tracking capabilities, highlights its limitations (especially around forward-looking analysis, AI optimization, and benchmarking), and shows how a dedicated tracker like PinkLion can give Vanguard investors an edge.

For those managing taxable brokerage accounts, the stakes are even higher. Without detailed insights into risk, income, and tax impact, you could be leaving money on the table. This guide evaluates Vanguard’s native portfolio tracking capabilities, highlights its limitations (especially around forward-looking analysis, AI optimization, and benchmarking), and shows how a dedicated tracker like PinkLion can give Vanguard investors an edge.

What Vanguard Offers for Portfolio Tracking

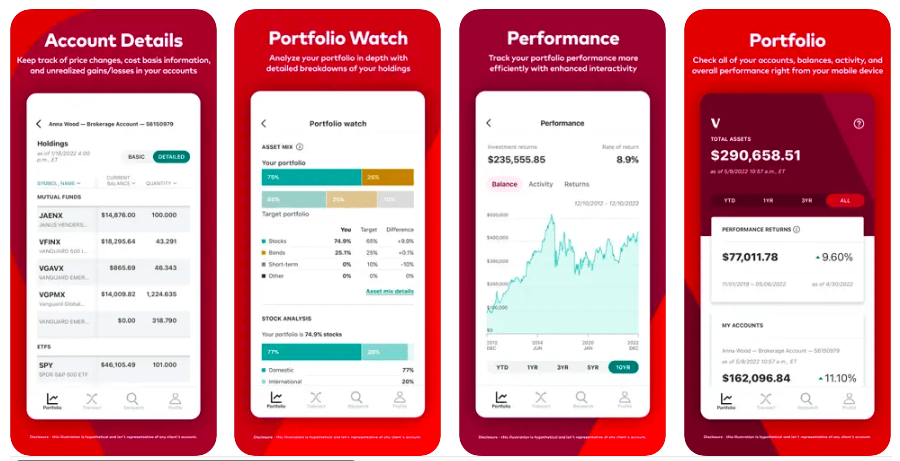

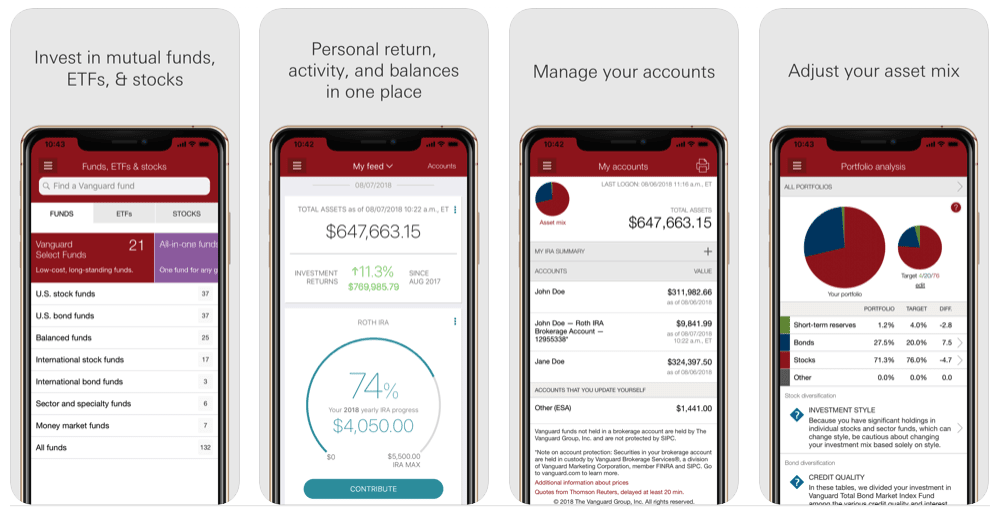

Vanguard’s platform focuses on simplicity and long-term investing fundamentals, offering basic tools for tracking your portfolio’s performance.

✅ What Vanguard Gets Right

Low-Cost Funds & Long-Term Focus: Vanguard pioneered low-cost index investing and continues to champion a buy-and-hold philosophy. You get access to Vanguard’s ultra-low expense ratio funds and a platform that encourages steady, goal-oriented investing over short-term trading.

Diversification & Portfolio Watch: Vanguard’s Portfolio Watch tool analyzes your asset mix across stocks vs. bonds, U.S. vs. international, market caps, styles, and more. It even lets you aggregate outside accounts to get a consolidated view of all your investments in one analysis – helping identify imbalances in your overall allocation.

Built-In Tax and Performance Tracking: The Vanguard dashboard separates your unrealized short-term vs. long-term capital gains, which is handy for tax planning in taxable accounts. It also provides personal performance metrics like internal rate of return (IRR) and time-weighted return, giving you a clearer picture of how your portfolio is actually doing over time (beyond just fund NAV changes).

Investor Education & Planning Tools: Vanguard offers robust educational resources and planning calculators to keep investors focused on their goals. The platform’s minimalist, no-frills design is intentional – Vanguard avoids flashy trading features to help you stay disciplined. This long-term, principled approach is a major draw for its user base.

These strengths give Vanguard investors a solid foundation. But as your portfolio grows, the native tools’ limitations – especially in analysis and planning – become apparent.

Why Vanguard Investors Need a Dedicated Tracker

Once you’ve built up a substantial portfolio (and especially if you hold multiple funds or accounts), relying on Vanguard’s basic dashboard can feel like driving with blind spots. Here’s why adding a dedicated tracker is essential:

1. Hidden Overlap and Concentration Risk

You might think you’re diversified because you own several Vanguard funds, but often those funds hold many of the same stocks. For example, an S&P 500 index fund and a total market fund both allocate heavily to Apple, Microsoft, etc. Vanguard’s dashboard doesn’t clearly alert you to these overlapping exposures or correlation risks. Without an external tracker, you may be blind to concentration in your portfolio.

2. No Real-Time Analytics or Alerts

Vanguard’s platform is not built for real-time monitoring. Quotes and portfolio values update with delays, and there are no customizable price/risk alerts. If you want intraday insight into your portfolio’s performance or instant notifications (say, when a stock drops 5% or your allocation drifts), the basic Vanguard site leaves you wanting.

3. Limited Forward-Looking Tools

Vanguard shows what has happened (historical performance), but not what could happen. There’s no way to model how your portfolio might perform in a market downturn, or to simulate different allocation scenarios on the platform. You also won’t find a forward-looking dividend calendar or income forecast; dividend info only appears after payouts hit your account. In short, planning for the future – be it projecting income or stress-testing a crash – isn’t possible with Vanguard’s native tools.

4. No AI Guidance or Optimization

Vanguard’s ethos of simplicity means it doesn’t offer any AI-driven recommendations or portfolio optimization. You won’t get suggestions on better asset allocations or alerts if you’re taking too much risk for too little return. Any rebalancing or improvements are up to you to figure out. Modern tools can use machine learning to analyze your holdings and recommend adjustments (e.g. improve risk-adjusted returns or reduce redundant holdings), but Vanguard provides no such intelligence by itself.

5. Lack of Benchmarking & Goal Tracking

Are you beating the market or lagging? Vanguard’s platform won’t readily tell you. There’s no easy way to compare your personal portfolio performance against common benchmarks like the S&P 500 or a 60/40 portfolio. Any benchmarking requires exporting data and crunching numbers in external tools. Likewise, while Vanguard offers general goal planners, it doesn’t tie your portfolio tracking to specific targets (e.g. “on track for retirement at 50” or “earning $X in annual dividends”) in real-time. Without that context, it’s hard to gauge success or adjust your strategy against a clear yardstick.

Limitations of Vanguard’s Built-In Dashboard

❌ Delayed Data Updates – No live pricing or alerting. Account balances and quotes on Vanguard update on a delay, not real-time, and the platform lacks push notifications or custom alerts. Active investors can miss timely insights and opportunities.

❌ No Advanced Risk Metrics – Vanguard provides basic allocation visuals, but no calculations of portfolio volatility, beta, Sharpe ratio, or max drawdown. You don’t have a clear view of how risky your portfolio is under the hood.

❌ No Forward-Looking Forecasts – There’s no built-in way to see projected income or run “what-if” scenarios on your portfolio. Future dividend payouts, worst-case scenario simulations, or rebalancing impact analyses are absent.

❌ No AI-Powered Optimization – The platform won’t coach you on how to optimize your asset mix. There’s no algorithm scanning for inefficiencies or suggesting improvements – all strategy decisions are on your shoulders.

❌ No Easy Benchmarking – You can’t easily compare your overall performance to the broader market within Vanguard’s interface. Without benchmarks or goal-tracking built in, you may not realize if you’re underperforming (or taking on too much risk) relative to your targets.

Must-Have Features in a Modern Portfolio Tracker

To move from passive holder to proactive investor, your tracking tool should include:

✅ 1. Seamless Broker Sync

Automatically connect your Vanguard account (and other brokers) to import your full transaction history, positions, and cost basis. No more manual data entry. A good tracker refreshes your portfolio data regularly so you always have an up-to-date view.

✅ 2. Real-Time Portfolio Analytics

See your portfolio through a professional lens. Advanced trackers compute risk metrics (Sharpe ratio, beta, max drawdown), show your sector and geographic exposure, and assess your diversification health. These insights turn your portfolio into a measurable strategy – not just a list of holdings – so you can spot strengths and weaknesses at a glance.

✅ 3. Forward-Looking Income Tools

Know what’s coming before it arrives. Modern trackers provide a dividend/income calendar with monthly income forecasts, yield-by-holding breakdowns, and even alerts for upcoming ex-dividend dates. This helps you plan reinvestment or cash needs, rather than simply reacting to dividends after they land in your account.

✅ 4. AI Optimization & Scenario Simulation

Leverage artificial intelligence to strengthen your portfolio. The best tools let machine learning suggest better allocation mixes that could improve your risk-adjusted returns, reduce unnecessary overlap, or maximize dividend yield. You can also simulate thousands of scenarios – from 2008-style crashes to inflationary booms – to see how your portfolio might hold up in different conditions. Such stress-testing is invaluable for understanding potential outcomes before they happen.

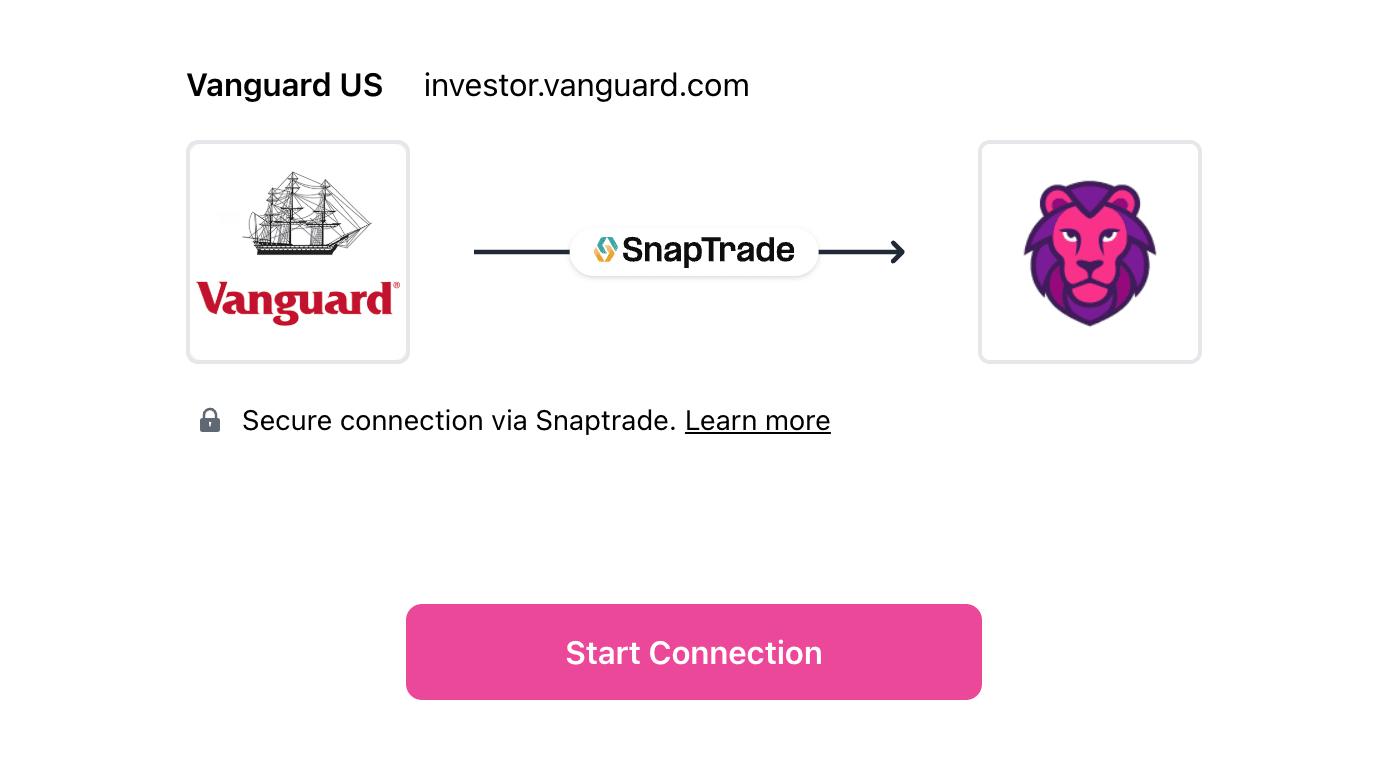

✅ 5. Secure, Read-Only Access

Security is paramount. Any tracker you use should connect to your broker in read-only mode (no trade permissions) and encrypt your data with bank-grade standards. This ensures your sensitive financial information stays safe, and that using the tool never puts your actual Vanguard account at risk.

Why PinkLion Is a Perfect Fit for Vanguard Users

PinkLion is tailor-made for Vanguard investors who want more insight without sacrificing Vanguard’s low-cost philosophy. It integrates seamlessly with your Vanguard brokerage account to deliver advanced analytics, forecasts, and AI-driven recommendations on top of what Vanguard provides. In other words, you keep the benefits of Vanguard’s platform (low fees, quality funds) while gaining a powerful “brain” to analyze and monitor your portfolio.

PinkLion consolidates all your holdings – including Vanguard – into one intuitive dashboard for holistic analysis. By seeing all your investments in one place, you can spot trends and risks you might miss using Vanguard’s site alone. For example, you can view your Vanguard ETFs alongside any stocks or crypto held elsewhere, all in a unified dashboard. Here are some highlights of what PinkLion adds for Vanguard users:

Vanguard Sync in 60 Seconds

- Connect your account securely: Link your Vanguard via PinkLion’s encrypted portal (read-only access).

- Or upload a CSV: If you prefer, you can import your Vanguard transactions manually in seconds.

- Automatic import: PinkLion pulls in your holdings, trade history, dividends, and cost basis.

- Always up-to-date: Your Vanguard portfolio data refreshes daily (or whenever you hit “Refresh”) for the latest balances.

AI That Makes You Smarter

PinkLion’s AI continuously scans your portfolio for inefficiencies and improvement opportunities based on your profile:

- Growth vs. Income focus

- Risk tolerance

- Risk/return objectives

It’s like having a personal portfolio analyst at your fingertips, for ∼$5/month

Portfolio Stress Testing

Ever wonder how your Vanguard portfolio would weather a storm? PinkLion lets you test your current mix against real-world events:

- The 2008 Global Financial Crisis

- The 2020 COVID Crash

- High-inflation bear markets

- Rising interest rate environments

This helps you identify vulnerabilities before the next crash and fix them proactively, rather than reacting after the fact.

One Dashboard for Everything

Track all your investments together:

- Stocks, ETFs, mutual funds (including Vanguard funds)

- Crypto and alternative assets (if you have them)

- Multiple broker accounts (Vanguard and beyond)

- Clean, unified analytics for your entire net worth

PinkLion handles over 150,000 assets across all major categories and brokers. Your Vanguard holdings and any outside investments are combined into a single, easy-to-use interface. No more jumping between platforms or merging spreadsheets – you get a total portfolio view instantly.

How to Connect Vanguard to PinkLion

Step-by-step guide:

- Sign up for a free PinkLion account (web or mobile).

- Go to Broker → Connect Broker in PinkLion.

- Choose Vanguard and follow the secure login prompts to authorize the connection.

- After linking, PinkLion will sync your Vanguard portfolio. You can immediately run an AI optimization or stress test to gain new insights on your holdings.

Pro Tips for Vanguard Portfolios

These smart practices will help you get more value from your Vanguard investments, especially when using PinkLion in tandem:

1. Maximize Tax Efficiency

In a taxable account, every trade or dividend has after-tax implications. Use Vanguard’s short-term vs. long-term gain tracking to inform your decisions (PinkLion will show this across your entire portfolio). Aim to hold investments for over a year to benefit from lower capital gains tax rates, and harvest losses strategically to offset gains. Also consider asset location – for example, keep tax-inefficient assets (like REITs or high-yield bond funds) in tax-advantaged accounts and reserve your taxable account for tax-efficient index equity funds. Aligning your strategy with the tax code can significantly boost your after-tax returns.

2. Beware of Fund Overlap

Vanguard offers many similar funds, so be careful not to double up on the same exposure. For instance, VTI (Total U.S. Market ETF) already contains virtually all the stocks in VOO (S&P 500 ETF). Holding both doesn’t increase diversification by much – it just overweights the same big tech names. PinkLion’s overlap analysis can reveal when your ETFs or mutual funds hold the same underlying investments, allowing you to consolidate and avoid redundancy. A streamlined portfolio not only is easier to manage, but also ensures each investment is truly adding something new to your mix.

3. Plan Your Reinvestments

Make the most of Vanguard’s dividend reinvestment program (DRIP) – it even reinvests fractional shares so no cash is left idle. With PinkLion’s dividend calendar, you can see exactly when each fund or stock will pay out and plan accordingly. For example, if you know a large quarterly dividend is coming next month, you might prepare to reinvest it into an underweight sector or use it to rebalance. Being aware of upcoming ex-dividend dates also helps you avoid “buying the dividend” (purchasing shares right before a distribution only to incur taxes on a payout you missed out on). Timing and deploying your cash flows thoughtfully can boost your returns over the long run.

Vanguard Portfolio Tracker FAQ

Q: Can PinkLion track my Vanguard mutual funds and ETFs?

A: Yes. PinkLion supports over 150,000 assets (stocks, ETFs, mutual funds, etc.) from all major brokers. All your Vanguard holdings, including mutual funds or fractional shares from dividend reinvestments, will import seamlessly into PinkLion’s dashboard.

Q: Is it safe to connect my Vanguard account to PinkLion?

A: Absolutely. PinkLion uses bank-level AES-256 encryption and only requests read-only access to your accounts. Your money stays in Vanguard; the tracker cannot make trades. It’s as secure as checking your account balance, and your credentials are never stored on PinkLion’s servers.

Q: How often will my Vanguard data update in PinkLion?

A: Your data refreshes automatically every day, and you can manually trigger a sync anytime for the latest info. That means if markets move or you make a new trade, PinkLion can update your portfolio in real-time so you’re never looking at stale numbers.

Q: Can I track non-Vanguard accounts alongside my Vanguard portfolio?

A: Yes – and this is a big advantage. PinkLion lets you connect multiple brokerages and even crypto wallets in one place. For example, if you have a 401(k) elsewhere or a Robinhood account for trading, PinkLion unifies all your holdings into a single view (without double-counting). It’s ideal for seeing your total financial picture at a glance.

Conclusion: From Passive to Proactive

Vanguard’s platform makes investing simple and affordable. PinkLion makes it insightful and proactive. By combining Vanguard’s low-cost investing environment with PinkLion’s advanced tracking, you get the best of both worlds: minimal fees and maximal awareness.

If you’re serious about growing your wealth, protecting against risks, and optimizing your portfolio for what matters to you, a smart tracker like PinkLion is essential. It helps you guard against blind spots, stay on top of market changes, and ensure your strategy is on track toward your goals.

For ∼$5/month, you gain:

- AI-powered recommendations

- Real-time income forecasts

- Crash-tested simulations

- Cross-platform portfolio tracking

No spreadsheets. No guesswork. Just smarter investing.