Wealthsimple Portfolio Tracker (2025 Guide)

Wealthsimple shows today’s gains, but a dedicated portfolio tracker reveals hidden risks, future income and AI-driven optimisations giving Canadian investors a clearer path to long-term wealth.

Canadian investors using Wealthsimple enjoy a sleek platform for both self-directed trading (Wealthsimple Trade) and managed portfolios (Wealthsimple Invest). Wealthsimple shines in user experience and basic tracking, but its built-in analytics have limits.

Enter PinkLion, an external portfolio tracker and optimisation tool that fills those gaps with advanced analytics, income forecasting, diversification checks, AI-driven insights, and risk testing. This guide compares Wealthsimple’s native features with PinkLion’s capabilities, and shows how combining both can elevate your investing game.

1️⃣ What Wealthsimple Gets Right

Wealthsimple is excellent for getting started zero-commission trades, fast deposits, and tax-advantaged accounts make it a top pick for beginners.

| 🌟 Built-In Feature | 🍁 Why It Matters for Canadians |

|---|---|

| Zero-Commission Trading (Trade) | Stretch every dollar no fees on stock/ETF purchases or sales. |

| Sleek, Intuitive App | Start investing in minutes; perfect for first-timers. |

| Multiple Account Types | TFSA, RRSP, FHSA, personal invest tax-efficiently. |

| Automatic Investing (Invest) | Robo-advisor portfolios auto-rebalance & reinvest dividends. |

| Instant Deposits & Fractionals | Fund up to $50k instantly and buy partial shares of pricey stocks. |

| Basic Performance Snapshot | See balance, simple return %, and total dividends earned (beta). |

In short, Wealthsimple provides a convenient one-stop shop to execute trades, monitor basic performance, and manage accounts securely – all with the backing of a regulated Canadian platform

Verdict: Wealthsimple nails cost, convenience, and day‑to‑day execution.

2️⃣ Where Wealthsimple Falls Short 🚧

While Wealthsimple is strong on simplicity, it lacks depth for investors who want to optimise, diversify, and future‑proof their wealth.

| ❌ Gap | Why It Matters |

|---|---|

| Limited Analytics | No volatility, Sharpe ratio, or performance attribution. |

| No Sector/Region Breakdown | Hard to know if you’re 60 % in tech or overweight Canada. |

| No Dividend Calendar | Can’t forecast next month’s income or yearly yield. |

| No “What-If” Simulator | Cannot test reallocations or AI-driven optimisations. |

| No Stress Tests | Unclear how your mix would hold up in 2008-style crashes. |

| Isolated View | Shows only Wealthsimple accounts no outside RRSPs, crypto, etc. |

Great for buying shares; light for long‑term planning.

3️⃣ Enter PinkLion 🦁 — The Perfect Companion

Here’s what you unlock with PinkLion and why it’s the perfect analytical layer on top of your Wealthsimple account.

| 🚀 Upgrade | 🔍 Benefit |

|---|---|

| Multi-Broker Sync | Combine Wealthsimple, Questrade, Coinbase—one dashboard. |

| AI Portfolio Health | Personalised tweaks to cut overlap, boost yield, reduce risk. |

| Dividend Calendar | Know every payout date & 12-month income forecast. |

| Stress Tests | Replay 2008, 2020, or rate-shock scenarios on your holdings. |

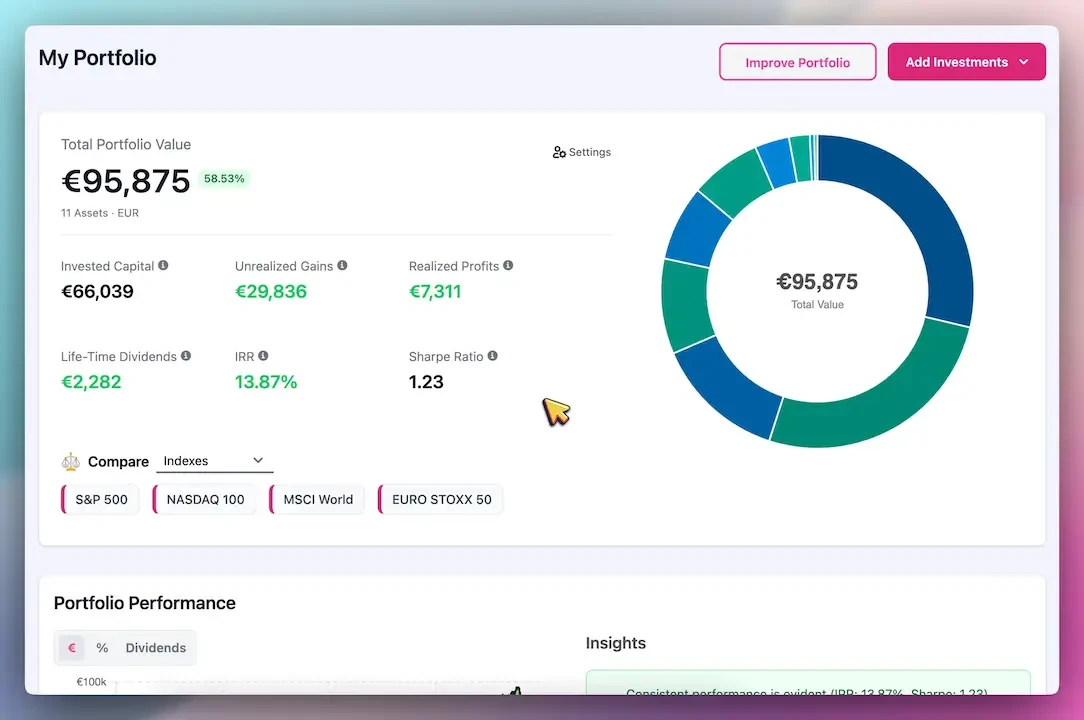

| Deep Analytics | Time-weighted return, volatility heat-maps, correlation matrix. |

| Read-Only Security | Bank-grade encryption—PinkLion can’t trade or move money. |

4️⃣ Wealthsimple vs PinkLion — Feature Face‑Off

Compare Wealthsimple’s simplicity with PinkLion’s power tools here’s where each platform shines.

| 🔍 Feature | Wealthsimple (Trade / Invest) | 🦁 PinkLion |

|---|---|---|

| Portfolio Overview | Basic balance & returns on Wealthsimple accounts only | Consolidated dashboard for all investments (multi-broker, multi-asset) |

| Performance Metrics | Simple return %, unrealised P/L, total dividends (beta) | Time-weighted return, volatility, Sharpe ratio, plus trend analysis |

| Diversification Analysis | Asset mix for Invest; no sector/asset breakdown in Trade | Detailed breakdown by asset class & sector; flags over-concentration |

| Benchmark Comparison | Not available | Compare portfolio to major indices or custom benchmarks |

| Income & Dividend Tracking | Shows past dividends only | Dividend calendar & 12-month income forecasting |

| AI Optimisation | None (Invest uses static models; Trade is DIY) | AI-driven portfolio recommendations & “what-if” simulations |

| Stress Testing | None | Historical crash tests (e.g. 2008, 2020) with drawdown analysis |

| Trading & Execution | ✅ Yes – place trades & see live quotes | ❌ Analysis only – place trades in your brokerage |

As the table shows, Wealthsimple and PinkLion serve different purposes. Wealthsimple is where you actually invest and manage your accounts, offering simplicity and low costs. PinkLion is an external “analytics and planning” layer that sits on top of your investments, offering a more sophisticated lens to view and optimize them. For Canadian investors serious about long-term success, using PinkLion alongside Wealthsimple can provide the best of both worlds – seamless investing experience plus actionable insights.

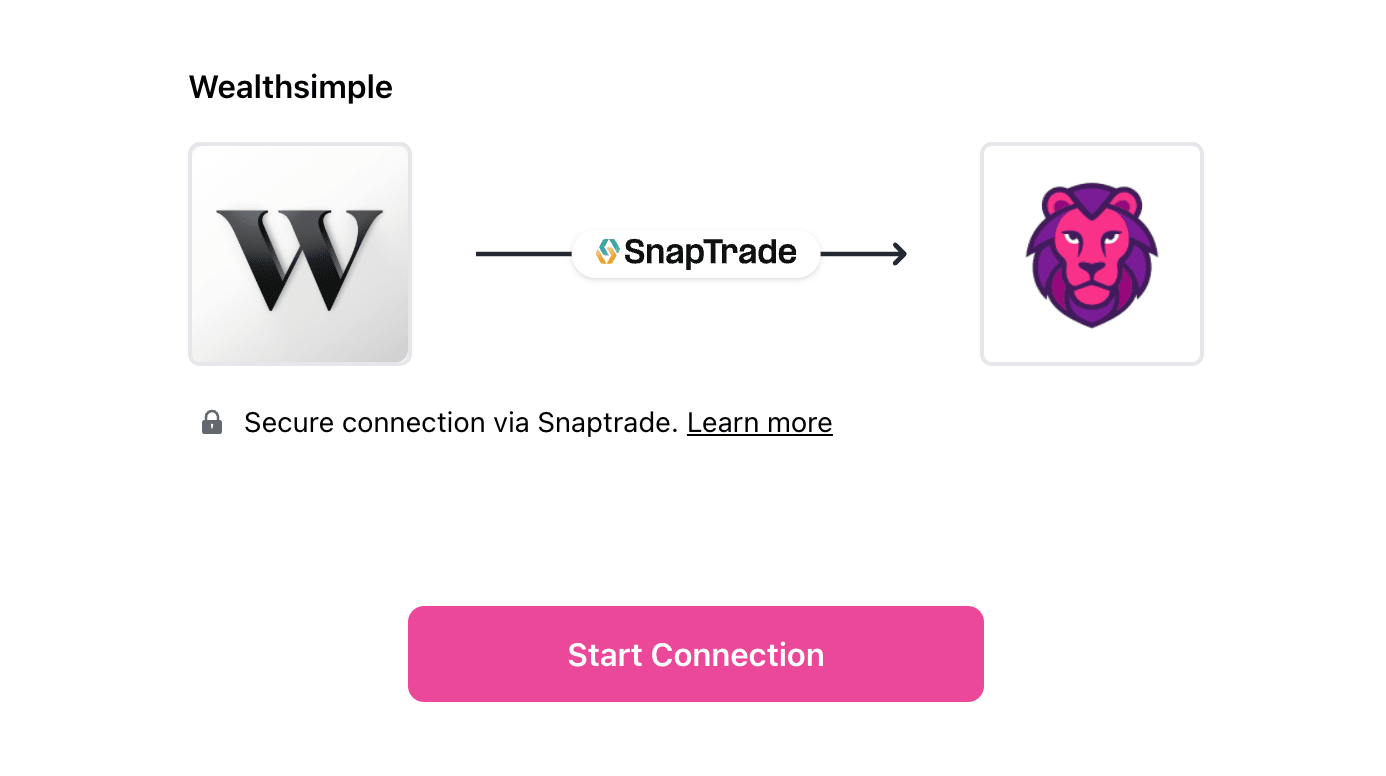

5️⃣ How to Connect Waelthsimple to PinkLion

Step-by-step guide:

- Sign up at pinklion.xyz

- Go to Broker → Connect Broker

- Choose Wealthsimple → Confirm Synchronization

- Immediately run an AI optimization or stress test

6️⃣ Pro Tips for Canadian Investors 🍁

- Quarterly Health Check 🩺 — Run PinkLion’s AI report, then rebalance in Wealthsimple Trade.

- Max Out TFSA First 🚀 — Tax‑free gains + PinkLion’s income forecast = smarter deposit plan.

- Enable DRIP 💰 — Turn on Wealthsimple’s dividend reinvest; track compounding in PinkLion.

- Simulate Before You Shift 🧪 — Test adding bonds or emerging markets before executing.

- Tag Accounts 🏷️ — In PinkLion, label TFSA vs RRSP to compare risk/return per account.

🎯 Final Word — Execute with Wealthsimple, Optimise with PinkLion

Wealthsimple keeps investing simple and fee‑free. PinkLion adds the analytics and foresight you need to build wealth with confidence.

Wealthsimple = Access. PinkLion = Insight. Use both to turn basic investing into a long‑term wealth engine.