Webull Portfolio Tracker (2025 Guide)

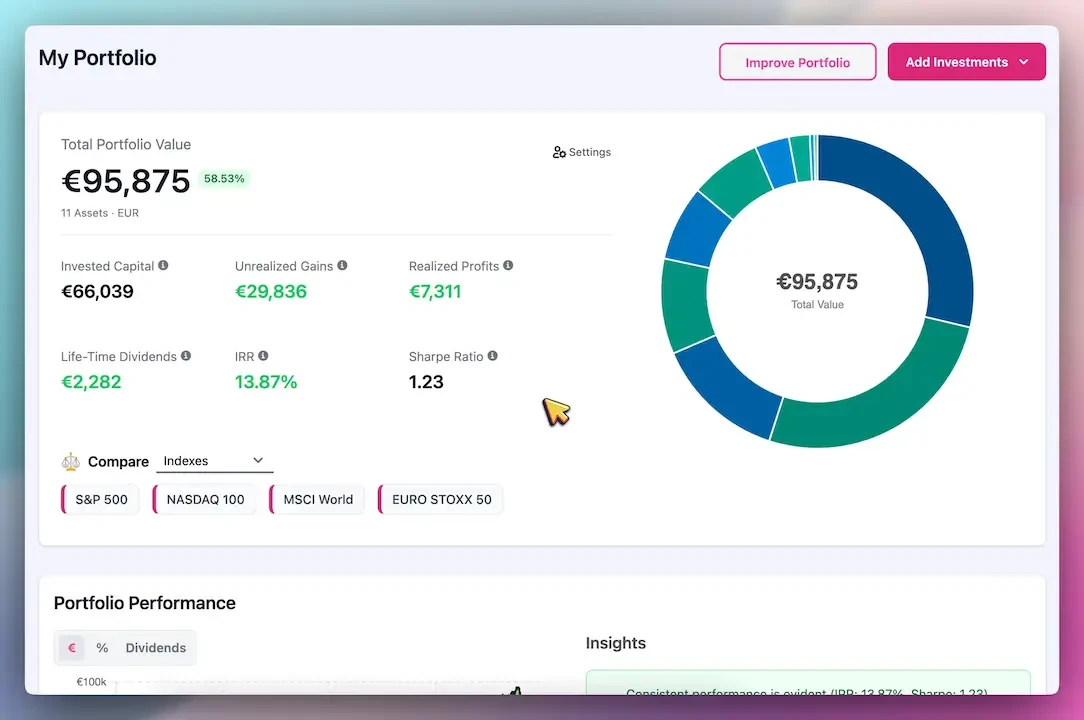

Webull’s built-in tools are great for active traders, but for long-term investors, a dedicated portfolio tracker adds essential insights. This guide shows how to level up your Webull investing with real-time analytics, risk analysis, and AI-driven strategies using PinkLion.

Trade for free on Webull, track like a pro with PinkLion

Webull has earned a loyal following among U.S. investors by offering zero commissions, real-time data, and sleek trading tools. But trading is just the beginning. To grow your wealth, you need tools for risk management, income planning, and strategy.

This guide shows you where Webull shines, where it falls short, and how PinkLion helps you track smarter and plan further, without ditching your broker.

✅ What Webull Does Well

Webull's native platform is powerful for real-time execution and basic account tracking. These are the core features that attract and retain active investors:

Core Webull Features at a Glance

| 🌟 Built-In Strength | Why It Matters |

|---|---|

| Commission-Free Trades | Keep every dollar no stock/ETF fees (regulatory fees still apply). |

| Streaming Quotes & Charts | See price changes by the second essential for active trading. |

| Extended-Hours Trading | Trade pre-market (4–9:30 AM) and after-hours (4–8 PM ET). |

| Fractional Shares | Invest in AMZN, GOOG, etc. without needing $1,000+. |

| Clean, Multi-Device UI | User-friendly on mobile and desktop ideal for everyday users. |

Webull is excellent for order placement and live performance, but doesn’t help much with long-term planning or portfolio insight.

❌ Where Webull Falls Short

As your portfolio grows, you’ll need more than daily gains and candle charts. Here’s where Webull’s native tools hit a wall especially for diversified, long-term investors:

Limitations of Webull's Native Dashboard

| ❌ Gap | Why It Matters |

|---|---|

| Limited Analytics | No volatility, Sharpe ratio, or historical drawdown data. |

| No Diversification View | Can’t assess how exposed you are to sectors or regions. |

| Zero Dividend Forecasting | No visibility into expected income next month or next year. |

| No “What-If” Simulator | You can’t model new allocations before buying or selling. |

| No Stress Testing | There’s no way to know how your portfolio would perform in a crash. |

| Isolated View | Only tracks Webull—no external RRSP, 401(k), or crypto accounts. |

🦁 Enter PinkLion: Advanced Tracking for Webull Users

PinkLion isn’t a broker it’s a read-only analytics companion that fills the gaps in your Webull experience. Designed for intermediate retail investors, it syncs with Webull to deliver the insights that matter most.

How PinkLion Enhances Your Webull Account

| 🚀 Upgrade | 🔍 Benefit |

|---|---|

| Multi‑Broker Sync | Combine Webull, Fidelity, Coinbase all in one dashboard. |

| AI Portfolio Health | Get automated suggestions to reduce overlap, boost income, and cut risk. |

| Dividend Calendar | See every upcoming payout and get a 12-month income forecast. |

| Stress Tests | Replay market crashes (2008, COVID, rate shocks) using your current mix. |

| Deep Analytics | Track Sharpe ratio, IRR, heat maps, and risk-adjusted returns. |

| Read‑Only Security | AES-256 encryption; PinkLion cannot execute trades or move funds. |

With PinkLion, your strategy goes from reactive to proactive and stays aligned with your goals.

📊 Side-by-Side Comparison: Webull vs PinkLion

Before adding another tool, you want to be sure it’s worth it. This table gives you a clear side-by-side breakdown of what Webull covers and what PinkLion adds.

| 🔍 Feature | Webull (native) | PinkLion (add-on) |

|---|---|---|

| Account Coverage | Webull only | All brokers & wallets |

| Performance Metrics | Daily gain/loss | IRR, Sharpe, drawdown, benchmarks |

| Diversification Tools | Basic pie chart | Sector, region, correlation heat-map |

| Income Forecast | Past dividends only | Future dividend calendar + yield |

| AI Optimisation | None | Yes – personalised tweaks |

| Stress Testing | None | Yes – 2008, 2020, rate shocks |

| Trading Capability | ✔ Place orders | ✖ Read-only analysis |

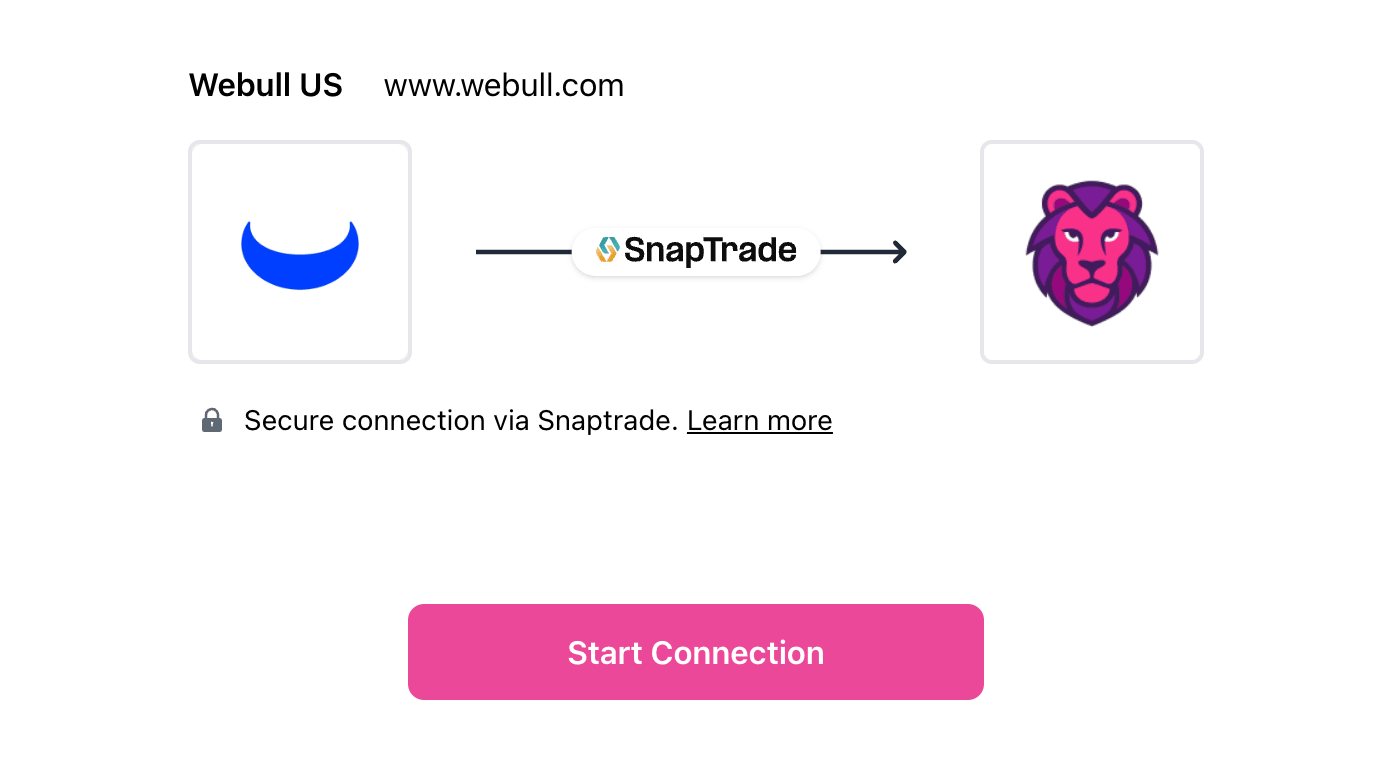

How to Connect Webull to PinkLion

Step-by-step guide:

- Sign up at pinklion.xyz

- Go to Broker → Connect Broker

- Choose Webull → Confirm Synchronization

- Immediately run an AI optimization or stress test

💡 Smart Practices for Webull Investors Using PinkLion

Use Webull for trades. Use PinkLion for insight. Here’s how to make the most of both:

🤖 Quarterly AI Optimization

Rebalance your portfolio with data, not emotion.

💸 Use the Dividend Forecast for Cash Planning

Know your upcoming income for bills, reinvestment, or growth.

🧩 Avoid Redundancy Across Accounts

Link all your brokers to spot overlap or over-concentration.

🔬 Run Scenario Tests Before Trading

See how changes (e.g., shifting into bonds) affect volatility or expected returns.

🧾 FAQ

Q: Is it safe to connect Webull to PinkLion?

Yes. It’s OAuth-based (like Google login) and read-only. PinkLion cannot place trades.

Q: How often does it sync?

Your portfolio refreshes daily automatically, or anytime you click “Refresh.”

Q: Can it handle fractional shares?

Yes. PinkLion tracks your fractional holdings with full precision.

Q: What does it cost?

The free tier includes basic insights, and tracking.

Pro tools (AI, forecasting, stress tests) start from $5–$15/month.

🎯 Final Takeaway

Webull is excellent at trade execution and price monitoring.

PinkLion turns that activity into a measurable, optimized strategy.

Together, they give you the best of both worlds action + insight.

Ready to upgrade your Webull dashboard into a full financial cockpit?