What Is Barista FIRE? Your Simple Guide to Semi-Retirement and Financial Freedom

Financial Independence, Retire Early (FIRE) is a movement that prioritizes cutting expenses, saving aggressively, and investing wisely so you can retire far earlier than the traditional age of 65.

TL;DR – Barista FIRE

Barista FIRE is a semi-retirement strategy where you leave your full-time job early but work a low-stress, part-time job (like a “barista”) to cover part of your living expenses. Your investments fund the rest, meaning you need a smaller nest egg compared to full FIRE. It offers more free time and flexibility now, while your savings continue to grow toward full financial independence later.

In a classic FIRE plan, devotees often save 50%–70% of their income (or more) and aim to accumulate about 25× their annual expenses, a target often called the “FIRE number”. Hitting that number allows them to live off investment income (following the famous 4% rule for withdrawals) and potentially quit full-time work decades early.

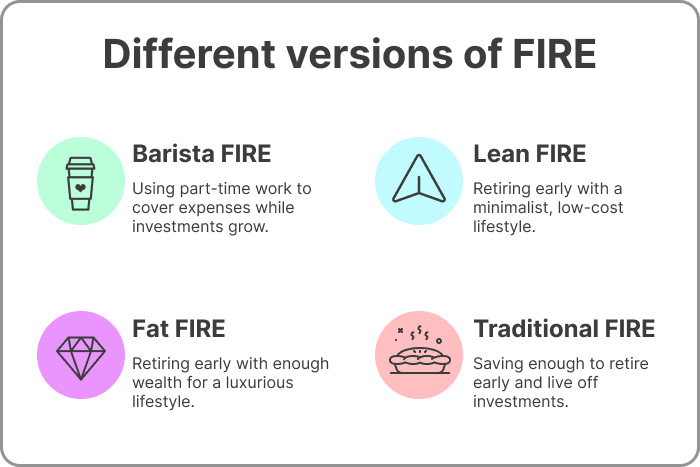

Over time, the community has developed different flavors of FIRE to fit various lifestyles and goals, from Lean FIRE (ultra-frugal minimalism) to Fat FIRE (early retirement with a more luxurious budget), Coast FIRE (saving enough early so investments grow on their own), and Barista FIRE.

In this article, we’ll focus on what Barista FIRE is, how it works, and who it’s best suited for, using easy language and relatable examples to explain the lifestyle and financial choices involved.

Understanding the FIRE Movement (Financial Independence, Retire Early)

The term FIRE stands for Financial Independence, Retire Early a lifestyle movement devoted to extreme financial savings and investing with the goal of gaining freedom from the traditional work timeline.

People pursuing FIRE often slash unnecessary expenses and put away as much of their income as possible (sometimes 50% or more of their earnings) during their working years. By living frugally and investing heavily, they aim to accumulate a nest egg large enough that the investment returns can cover their living expenses. A common guideline in the FIRE community is the “25× rule” save roughly 25 times your annual expenses, which corresponds to being able to withdraw about 4% of your portfolio each year in retirement.

For example, if you need $40,000 a year to live, a traditional FIRE plan might target around $1,000,000 saved (since 4% of $1M is $40k). Reaching this level of savings means you could potentially retire decades early and live off your investments.

However, FIRE isn’t one-size-fits-all. Not everyone wants to commit to the ultra-frugal lifestyle that something like “Lean FIRE” requires, nor do all people earn the high salaries that make “Fat FIRE” attainable. Moreover, some folks discover that completely quitting work in their 30s or 40s isn’t practical or desirable for them.

This is where FIRE variations come in. Over the years, the community coined terms like Lean FIRE, Fat FIRE, Coast FIRE, and Barista FIRE to describe alternative paths to financial independence that balance saving and lifestyle differently. Barista FIRE, our focus today, is one of those creative “hybrid” approaches that offers a middle ground between grinding until full early retirement and staying in a high-pressure career. Let’s dive into what Barista FIRE means.

What Is Barista FIRE? A Blend of Early Retirement and Part-Time Work

Barista FIRE involves leaving a traditional 9–5 career and working a flexible, lower-stress job (like a café barista) to supplement your investment income.

Barista FIRE is a semi-retirement strategy under the FIRE movement umbrella. In a nutshell, someone pursuing Barista FIRE has saved and invested enough to cover a large portion of their living expenses (thus achieving a degree of financial independence), but not 100% of their expenses. Instead of continuing the grind until their investments can fund their entire lifestyle, they step away from their full-time career much earlier and take on a part-time job or side hustle to bridge the gap.

The term “Barista” is inspired by the idea of taking a laid-back job at a coffee shop (like Starbucks) primarily for a steady paycheck and benefits famously, companies like Starbucks offer health insurance to part-time employees, making them ideal for semi-retirees. In practice, you don’t literally need to become a barista; the essence is any low-stress, flexible part-time work that provides some income (and possibly benefits) to complement your investment withdrawals.

Think of Barista FIRE as a hybrid between early retirement and working. You’ve left the rat race of your old career, but you haven’t completely quit working. Instead, you might work 10–20 hours a week at a more relaxed job that you enjoy (or at least don’t mind). This supplemental income, combined with the nest egg you’ve built, covers your expenses.

Because you’re earning some income in “retirement,” you can withdraw less from your investments early on, which stretches your savings further. It’s a trade-off: you get to reclaim a lot of your time years sooner than full FIRE would allow, but you continue working in a limited capacity to maintain financial stability.

Why do people choose Barista FIRE?

For many, it’s about balance and avoiding burnout. Traditional FIRE often requires years of extremely high saving rates and perhaps staying in a high-paying but high-stress job to hit your number as fast as possible. Not everyone finds that approach sustainable or enjoyable. Barista FIRE offers a more “lifestyle-oriented” version of FIRE, where you sacrifice a bit of the financial freedom (since you still rely on a job for some income) in exchange for freedom from a stressful full-time career much earlier. It’s an appealing path for those who crave more time and less stress, but who aren’t comfortable with (or capable of) completely living off investments yet.

Key features that define Barista FIRE:

- Semi-Retirement: You quit your traditional full-time job in your 30s, 40s, or whenever your finances allow, effectively “retiring” from your main career early. But you do continue to work part-time by choice in a simpler job.

- Passive Income + Paycheck: You have investments (stocks, index funds, rental income, etc.) generating passive income which cover most of your expenses, and a part-time paycheck covers the rest. You might withdraw a small percentage from your portfolio each year, but significantly less than 4% because your side income fills in the gap.

- Lower Stress Work: The job you take is typically flexible and low-stress, think working in a coffee shop, bookstore, as a freelancer, or at a community center. Ideally it’s something you find enjoyable or at least not too taxing, quite different from the high-pressure career you left.

- Continued Investment Growth: Because you’re not drawing down your investments completely in your 30s/40s, your nest egg can keep growing in the background.

How Barista FIRE Works (Financially)

The math behind Barista FIRE is what makes it attractive to many. By earning even a modest part-time income in early retirement, you dramatically reduce the amount of savings you need compared to traditional FIRE. Here’s how it works:

- Under a traditional FIRE plan, if you spend $30,000 a year, you’d aim for a nest egg of $750,000, following the 4% rule (4% of $750k = $30k annually).

- With Barista FIRE, part-time work covers part of your expenses. For example, earning $15,000 per year from a 20-hour/week job means your investments only need to generate $15,000, cutting your required savings in half to $375,000. This lower “FI number” lets you reach semi-retirement years earlier, often in your 30s or 40s.

- Once in Barista mode, you withdraw little (or nothing) from your portfolio and use your job to cover daily expenses. This makes you less vulnerable to market downturns and avoids selling investments at the wrong time, reducing sequence-of-returns risk.

- Part-time work may also offer benefits like health insurance, which is especially valuable in countries where coverage is tied to employment. Many Barista FIRE followers seek jobs with perks—Starbucks is often cited—not just for the paycheck, but for benefits like medical insurance.

In short, Barista FIRE works by lowering the finish line for early retirement. You trade off a bit of ongoing work for a much shorter savings phase. This approach makes financial independence more attainable for people who can’t or don’t want to save millions to retire ultra-early, and it provides a cushion of security (through continued income) as you transition into early retirement.

Example:

Alex and Jamie, both 35, have saved $400,000 and spend $50,000 annually. Traditional FIRE would require $1.25M, meaning 10+ more years of saving. Instead, they choose Barista FIRE, earning $20,000/year through part-time yoga teaching and freelance design. Now their investments only need to cover $30,000, making their current savings nearly enough. By 40, they quit their 9–5 jobs, enjoy more free time, and let their portfolio grow. By their 50s, they’ll likely have enough to fully retire if they wish, all while living a lower-stress, semi-retired lifestyle.

For personalized numbers, try the Barista FIRE Calculator.

Living the Barista FIRE Lifestyle: Work-Life Balance in Early Semi-Retirement

What does day-to-day life look like when you choose Barista FIRE? In many ways, it can feel like having the best parts of retirement without giving up work completely. Here are some aspects of the lifestyle and choices involved:

- More Free Time: The biggest perk of Barista FIRE is reclaiming time. Instead of 60-hour weeks, you might work just a few days or mornings and spend the rest on hobbies, travel, or family. It’s a “semi-retired” lifestyle with far more flexibility and better work-life balance.

- Lower-Stress Work (Often Fun): Barista FIRE means swapping high-pressure careers for simple, enjoyable jobs—like working in a café, library, or freelance gigs. Some even turn hobbies into income streams. It’s about earning enough without the stress of climbing the career ladder.

- Growth and Social Interaction: Working part-time keeps you socially active and mentally engaged—something full retirees sometimes miss. It provides structure and helps you stay sharp while still enjoying freedom.

- Frugal but Comfortable Living: Barista FIRE requires sticking to a budget, but the lifestyle is modest, not extreme. Active income plus investments cover necessities and some fun. Many find they can live well with less when they’re less busy and stressed.

- A Flexible Path: Barista FIRE can be a short “working sabbatical” or a long-term lifestyle. Some fully retire after a few years as investments grow; others enjoy part-time work indefinitely. The freedom to choose how to spend your time is its biggest reward.

Example:

One person left their corporate job at 45 for a part-time barista role, covering half their expenses while investments paid the rest. They reached full retirement at 56 instead of 50, but gained a decade of less stress and more free time—an exchange many consider worthwhile.

Who Is Barista FIRE Best Suited For?

Barista FIRE can be a fantastic path, but it’s not for everyone. So, who does it tend to suit best?

✔️ Relief from high-pressure careers: Barista FIRE is ideal for 20–40-somethings feeling burnt out. With a decent nest egg and a moderate income, they trade their stressful 9–5 for simpler, low-stress work to gain time and flexibility while staying on track financially.

✔️ Solid savings base (but not full FI): It’s perfect for those who’ve saved a few hundred thousand dollars but not enough for full FIRE. Even moderate earners who saved diligently can semi-retire earlier by covering part of their expenses with part-time work.

✔️ Prioritizing work-life balance: If you value free time and happiness over maximum wealth, Barista FIRE fits. It suits creatives, travelers, or family-focused people who prefer a lighter schedule to a bigger paycheck.

✔️ Concerned about benefits: Part-time jobs with perks (like health insurance at Starbucks or grocery chains) make Barista FIRE appealing, especially in the U.S., where medical costs are high.

✔️ Want to work on your own terms: For those who don’t hate working but want passion-driven or flexible jobs, Barista FIRE provides a safety net to explore hobbies, small businesses, or creative ventures without financial pressure.

Who it’s not for: If you want to stop working entirely, love your career, or have no savings, Barista FIRE may not be the right fit. It’s a phase you reach after building a financial base, not a shortcut from zero.

Benefits of Barista FIRE

Choosing Barista FIRE can offer several compelling benefits and advantages:

Escape the 9-to-5 Sooner: Barista FIRE lets you leave your full-time job years or even decades early, improving happiness and mental health by freeing you from the daily grind.

Better Work-Life Balance & Health: Working fewer, low-stress hours gives you more time for rest, hobbies, and socializing, while also reducing burnout and boosting overall well-being.

Continued Income (Less Risk): With part-time earnings, you rely less on investments during market dips, keeping your nest egg growing and adding financial security.

Pursue Passions or Side Hustles: More free time allows you to explore hobbies, start a small business, or volunteer—without financial pressure since you still have some income.

Purpose and Structure: Part-time work provides routine and social interaction, making the transition to early retirement smoother and more fulfilling.

Trade-Offs and Downsides of Barista FIRE

While Barista FIRE has great advantages, it also comes with some trade-offs and potential drawbacks to consider:

- You’re Not Fully Retired: Barista FIRE still involves part-time work. If your dream is zero work after 40, this isn’t it. It works best if you enjoy or can tolerate the lighter job, trading full retirement for early freedom.

- Reduced Income & Career Growth: Leaving a high-paying career early means sacrificing peak earnings and promotions. Part-time work pays less, and returning to a full-time role later can be hard due to skill gaps or employer concerns.

- Financial Tightrope: Your budget is tighter, and lifestyle creep can derail plans. Unexpected expenses (like medical bills) can be stressful without a big salary. Staying disciplined with spending is crucial.

- Working Longer Overall: Semi-retirement means a slower path to full retirement. You might work part-time for 10–20 years before fully retiring, trading immediate freedom for a longer retirement timeline.

- Reentry Challenges: Returning to a full-time job, if needed, can be tough—both professionally and mentally. Keeping skills current and maintaining a financial cushion helps manage this risk.

Despite these trade-offs, many find the lifestyle freedom and reduced stress outweigh the downsides.

Conclusion: Weighing the Barista FIRE Lifestyle

Barista FIRE is all about balance. It offers an appealing middle ground for those who want more freedom now but aren’t in a position or don’t desire to quit working entirely in their 30s or 40s. By blending part-time work with investment income, Barista FIRE lets you retire from the daily grind early without sacrificing financial security. The benefits are clear: you gain years of extra freedom and flexibility, avoid burnout, and still keep a flow of income and possibly benefits to support you. You can pursue passions, spend time with loved ones, and live life at a slower pace while still being productive and earning, truly the best of both worlds for many.

However, it’s important to remember the trade-offs. You must continue to work in some capacity, and that means accepting a more modest lifestyle and potentially missing out on some career earnings. Your path to 100% financial independence will be more gradual, and you’ll need to remain mindful of budgeting and contingency plans. Barista FIRE isn’t a one-size-fits-all solution; it works best for those whose personalities and life goals fit its unique mix of freedom and responsibility.

In deciding if Barista FIRE is right for you, consider your priorities. Do you value time and low stress over a higher paycheck? Are you willing to live somewhat frugally and work a humble job in exchange for reclaiming your life years earlier? If yes, then Barista FIRE might be the perfect brew for your financial independence journey. If not, if you’d rather maximize wealth or you love your career you might lean toward a different FIRE approach or a more traditional path.

Ultimately, Barista FIRE is about financial independence on your terms. It’s a reminder that you have options beyond the standard 9-to-5 until 65 script. By making thoughtful choices saving diligently, defining “enough” for yourself, and deciding what kind of work (and how much of it) makes you happy you can create a lifestyle that’s rich in time and personal fulfillment. For many, Barista FIRE is the ideal blend of work and leisure, providing a taste of retirement without giving up the simple rewards of a paystub and purpose. It’s certainly an option worth considering in the quest for a happier, more independent life.

Why is it called "Barista FIRE"?

The term comes from the idea of leaving a high-pressure job and taking a low-stress, part-time role—like being a barista—to supplement your income while investments cover the rest. Companies like Starbucks popularized the term because they offer benefits, such as health insurance, to part-time workers. Any flexible, low-stress job that fits your lifestyle works.

How much money do you need for Barista FIRE?

It depends on your expenses and part-time income. Traditional FIRE requires about 25× your annual expenses (e.g., $1M for $40k/year). With Barista FIRE, you only need enough savings to cover the gap. For instance, if you spend $40k but can earn $20k from part-time work, you’d need around $500k invested (4% of $500k = $20k). A cushion for unexpected costs is wise.

What kind of part-time work can Barista FIRE involve?

“Barista” is just a metaphor. Common options include coffee shops, retail, freelancing (writing, design, consulting), gig economy jobs (rideshare, pet-sitting), or turning hobbies into income (teaching music, crafts, photography). Many choose companies with part-time benefits. The goal is simple work that fits your lifestyle and budget.

Can you still reach full financial independence with Barista FIRE?

Yes. Barista FIRE is often a stepping stone to full FIRE. You let your investments grow while working part-time, eventually reaching the point where you can retire completely. It might take longer, but the extra freedom and reduced stress in the meantime make it worthwhile for many.

How is Barista FIRE different from Lean FIRE or Coast FIRE?

- Lean FIRE: Retire fully on a small, frugal budget (no job, but very lean lifestyle).

- Coast FIRE: Save enough early so your investments will grow to cover retirement, while you continue full-time work only to cover current expenses.

- Barista FIRE: Quit full-time work and take a part-time job, using it to supplement investment income.

- Fat FIRE (contrast): Retire early but with a higher-spending lifestyle, requiring a larger nest egg.

Is Barista FIRE worth it?

If you value time, freedom, and less stress over maximizing wealth, yes. It’s ideal for those who’d trade a smaller paycheck for more free time, hobbies, travel, or family. However, if you love your career or want complete retirement ASAP, Lean or Fat FIRE might suit you better. Barista FIRE is flexible, letting you design a semi-retired lifestyle on your own terms.