What Is Modern Portfolio Theory? A Guide to Smarter Investing

Discover what is modern portfolio theory and how diversification can optimize your investments. Learn the essentials today for a resilient portfolio.

At its core, Modern Portfolio Theory (MPT) is a framework for building smarter investment portfolios by looking at how your assets work together. The central idea is surprisingly simple: a portfolio's overall risk and return are far more important than the performance of any single stock or bond.

Understanding the Foundation of Smart Investing

Think of it like building a championship sports team. You wouldn't just stack your roster with superstar strikers. Sure, they might score a lot of goals, but your team would be wide open on defense. A truly winning team needs a strategic blend of players—strikers for offense, midfielders for control, and a solid defensive line for security.

Modern Portfolio Theory applies this exact logic to your investments. Instead of just chasing individual "star" stocks, MPT forces you to think like a general manager, constructing a balanced team of assets. This game-changing concept, introduced by economist Harry Markowitz back in 1952, earned him a Nobel Prize and permanently shifted the investment world's focus from picking single hot stocks to building resilient portfolios.

To help you get a quick handle on these ideas, here’s a simple breakdown of the core pillars of MPT.

Core Concepts of Modern Portfolio Theory at a Glance

These concepts all work together to achieve a single, powerful goal: building a portfolio that works smarter, not just harder.

The Power of Not Putting All Your Eggs in One Basket

The heart of MPT is diversification, but it’s a more sophisticated idea than just owning a bunch of different things. True diversification means combining assets that have low or even negative correlations in plain English, they don’t always move up or down at the same time. A classic example is the relationship between stocks and high-quality bonds; when the stock market stumbles, bonds often hold their ground or even rise, acting as a crucial shock absorber for your portfolio.

This strategy is brilliant at managing what’s called unsystematic risk. That’s the kind of risk tied to a single company or industry. Think of a terrible earnings report or an unexpected event like a sudden change in its stock's split history. For a single stock, that’s a disaster. But inside a well-diversified portfolio, the damage is contained.

By mathematically combining assets that react differently to market events, MPT aims to build a portfolio that squeezes out the highest possible return for whatever level of risk you're comfortable with.

The Goal of an MPT Portfolio

Ultimately, the objective is to build an "efficient" portfolio. An efficient portfolio is one where you aren't taking on a single ounce of unnecessary risk for the returns you’re getting. MPT provides the mathematical map to help you find that optimal mix of assets that perfectly aligns with your financial goals and your personal tolerance for market swings. It’s all about being strategic, not just getting lucky.

The Story Behind This Nobel Prize Winning Idea

Every big idea in finance has an origin story, and Modern Portfolio Theory is no exception. To really get it, we need to jump back to the 1950s, a time when investing looked completely different. The common wisdom was painfully simple: find and pick individual “winner” stocks.

This whole process was more art than science, running on gut feelings and some light company analysis. Investors zeroed in on the merits of a single stock, a bit like analyzing a star basketball player's stats without ever considering how they actually play with the rest of the team. You might look at a company's leadership or its latest earnings, but the idea of comparing how its stock moved in relation to others was almost unheard of.

A Radical New Approach

Then, in 1952, a young economist named Harry Markowitz came along and published a paper that basically turned that entire worldview on its head. He introduced a radical, math-driven way to think about building portfolios. His core argument? Judging an investment all by itself is a fundamentally flawed strategy.

Markowitz argued that investors should look at their portfolio as a single, cohesive unit. His work formally introduced Modern Portfolio Theory (MPT) as a framework for putting together portfolios to get the highest possible return for a given amount of risk—an idea so powerful it would later win him a Nobel Prize.

Markowitz’s true genius was shifting the conversation from individual stock performance to the interplay between stocks. He proved, mathematically, that a portfolio's real risk isn't just the sum of its parts; it's about how those parts move together.

This was a bombshell. It suggested you could systematically lower a portfolio's overall choppiness by combining assets that don't always zig and zag in perfect harmony. It was a direct challenge to the stock-picking culture of the day.

That one idea laid the foundation for decades of financial innovation, becoming the bedrock of how professionals and everyday investors alike think about building wealth and managing risk.

Understanding The Efficient Frontier

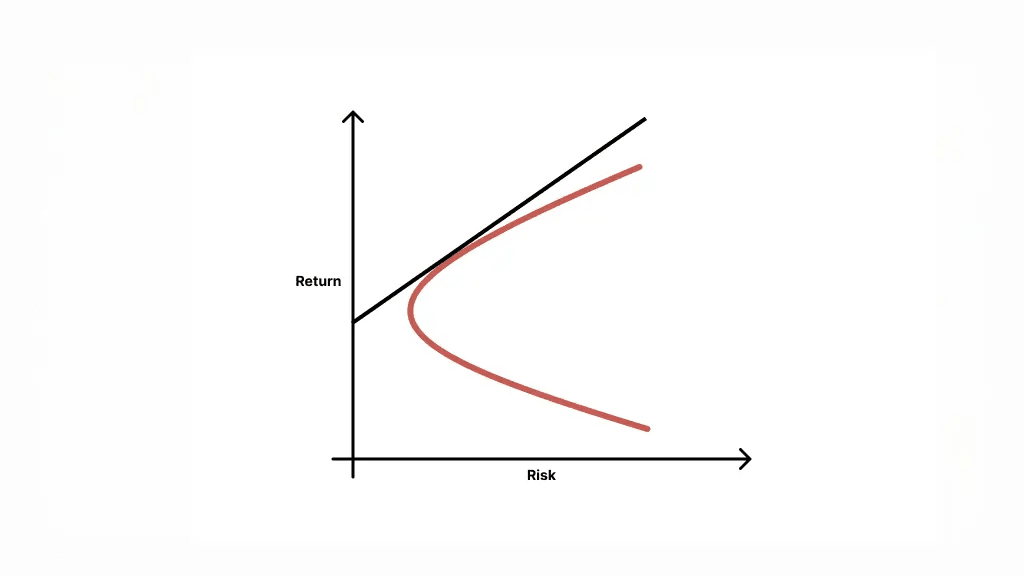

If Modern Portfolio Theory is the playbook for building a smarter portfolio, then the Efficient Frontier is the star play. It's not a single "perfect" portfolio but a visual curve of all the best possible portfolios, each one engineered to give you the absolute highest expected return for a specific level of risk.

Let's break that down. For any amount of risk you’re willing to stomach—from ultra-cautious to full-throttle aggressive—there's one specific mix of assets that is mathematically superior to all others. The Efficient Frontier is simply a line connecting all of those superior points. Any portfolio that lands below this curve is considered "sub-optimal." Why? Because you're either getting less return for the same risk or, worse, taking on more risk for the same return.

The whole point of MPT is to construct a portfolio that sits right on that frontier, so you're not taking on risk you aren't being paid for.

The Magic Ingredient: Correlation

So, how do we get a portfolio to land on this coveted curve? The secret is something far more nuanced than the old saying, "don't put all your eggs in one basket." The real key is correlation—a measure of how two different assets move in relation to each other.

You see, true diversification isn’t just about owning a bunch of different things. It’s about owning things that have low, or even negative, correlation. In simple terms, you want assets that zig while others zag.

Take the classic pairing of stocks and high-quality government bonds:

- Stocks: They generally offer higher potential returns but come with a lot more volatility. They thrive when the economy is humming along.

- Bonds: They typically provide lower, steadier returns. Crucially, they often act as a safe harbor, holding their value or even rising when the stock market stumbles during economic jitters.

By combining these two assets that don't move in lockstep, you create a portfolio that's much smoother and more resilient. The stability from the bonds can cushion the blows during a stock market downturn, effectively lowering your portfolio's overall volatility without totally sacrificing its growth potential.

Visualizing Your Optimal Portfolio

This is where the Efficient Frontier really starts to feel powerful. It gives you a visual map to navigate the fundamental trade-off between risk and return.

The Efficient Frontier transforms portfolio building from guesswork into a structured process. It shows investors precisely how much return they should expect for every unit of risk they are willing to take on, guiding them toward a truly optimized asset mix.

Each point along that curve represents a different asset allocation. A point on the lower-left end is a conservative portfolio—heavy on bonds, offering lower risk and lower expected returns. As you travel up and to the right along the curve, the portfolios get progressively more aggressive, dialing up the stock allocation to chase higher potential returns, but with more risk.

Your job as an investor is to pinpoint the one spot on that frontier that perfectly aligns with your financial goals and your personal comfort with market swings.

How MPT Balances Risk and Return

Every investor eventually faces the same fundamental dilemma: the trade-off between risk and reward. If you want higher returns, you almost always have to stomach more uncertainty. It’s the unwritten rule of the market. Modern Portfolio Theory gives us a structured, logical way to handle this delicate balance, moving beyond gut feelings and into strategic, calculated decisions.

Instead of thinking about risk as some vague, ominous cloud, MPT gets specific and quantifies it. The go-to metric here is standard deviation, which is just a fancy way of measuring an asset's volatility—how much its price swings around its average. An asset with a high standard deviation is a rollercoaster, full of dramatic peaks and valleys. One with a low standard deviation is more like a steady train ride.

The Career Analogy for Risk and Return

Let’s make this more concrete with a career analogy. Imagine you're choosing between two jobs.

One is a secure, salaried corporate position. The pay is predictable (low volatility), and the chances of getting laid off are slim. Think of this as your low-risk, lower-return asset.

The other offer is from an early-stage startup. The potential payoff is massive if the company becomes the next big thing (high potential return), but the risk of it failing is also extremely high (high volatility). Most startups go under, meaning your "investment" of time and talent could easily go to zero. MPT helps you think like a portfolio manager about these kinds of choices. It forces you to ask: how much "startup" risk are you willing to take on for a shot at those outsized returns?

Measuring If the Risk Is Worth the Reward

Just because something is risky doesn't make it a bad investment. Likewise, a "safe" bet isn't automatically a good one. The real question is whether you're being paid enough for the risk you're taking. This is where a brilliantly simple tool called the Sharpe Ratio comes into play.

The Sharpe Ratio is a straightforward calculation that helps you judge an investment's performance relative to the risk it took to get that return. A higher Sharpe Ratio means you got more bang for your buck.

It cuts through the noise and answers one critical question: "Am I getting a good deal?" Here’s the logic behind it:

- First, it takes an investment's return.

- Then, it subtracts the return you could’ve earned from a "risk-free" investment, like a U.S. Treasury bill.

- Finally, it divides that excess return by the investment's volatility (its standard deviation).

The number you get allows you to compare completely different investments on an apples-to-apples basis. An asset with a dazzling return might suddenly look less attractive if its Sharpe Ratio is low, telling you that you endured a stomach-churning amount of volatility for that gain. On the flip side, an asset with modest returns but a stellar Sharpe Ratio proves its efficiency—it delivered solid performance without all the drama.

Ultimately, MPT and tools like the Sharpe Ratio give you a smarter lens through which to view your portfolio. They help you build a collection of assets that doesn't just blindly chase returns but intelligently balances risk to align with your actual financial goals.

Applying MPT in Real-World Investing

Modern Portfolio Theory isn't just some dusty concept from an old textbook. It's the powerful, quiet engine running behind many of the investment products you probably already use. In fact, MPT is what helped transform investing from a high-stakes guessing game into a more structured, accessible process for millions of people. You’ve likely been benefiting from its principles without even realizing it.

Think about the most common investment vehicles out there. Index funds and Exchange-Traded Funds (ETFs) are prime examples of MPT in action. An S&P 500 index fund, for instance, doesn't try to pick the single "best" stock out of 500. Instead, it buys all of them, using broad diversification to capture the market's overall return while dramatically cutting the unsystematic risk tied to any one company's flameout.

MPT in Your Everyday Financial Products

The theory’s influence runs deep. The very structure of these products is designed to spread risk across different sectors and company sizes. This creates a much smoother ride than you’d get holding just a handful of individual stocks.

Here’s where you can see MPT at work:

- Target-Date Funds: These popular retirement funds automatically adjust their asset mix over time. They start aggressively (heavy on stocks) when you're young and gradually shift toward more conservative assets (like bonds) as you get closer to retirement—a perfect real-world application of MPT’s risk-return principles.

- Robo-Advisors: These digital platforms are built from the ground up on MPT-based algorithms. They figure out your risk tolerance with a simple questionnaire and then construct a globally diversified, optimized portfolio just for you. They handle all the complicated math of the Efficient Frontier behind the scenes.

- Balanced Mutual Funds: A classic "60/40" fund (60% stocks, 40% bonds) is a direct application of MPT. It seeks to balance the growth potential of stocks with the stabilizing effect of fixed-income assets.

The real-world proof for this approach is compelling. Studies grounded in MPT principles have repeatedly shown that diversified portfolios can achieve better risk-adjusted returns than concentrated ones. Data from U.S. equity markets over decades has illustrated that combining asset classes like stocks and bonds can lower a portfolio’s volatility by up to 30–40% compared to holding just a single asset class. You can dig deeper into how these strategies came about with insights from Grafton Court.

From Theory to Practical Strategy

So, MPT gives us the "why" for diversification, but to actually pull it off, you need a "how." This means creating a clear asset allocation plan. To put MPT into practice, it's critical to understand the importance of asset allocation models for your portfolio, as these models will guide your investment decisions. This is where modern tools can bridge that gap between concept and action.

For example, when you're looking at a single stock, it’s easy to get lost in that one company's story. But MPT reminds us to zoom out and see how that stock contributes to the entire portfolio. A high-growth tech stock like Amazon, for instance, plays a very different role than a stable utility company. Its performance over the years, including its Amazon stock split history, gives us hard data on its volatility and growth characteristics, which helps us figure out exactly where it fits within a diversified structure.

Ultimately, MPT has fundamentally democratized strategic investing. By embedding its core ideas of diversification and risk management into accessible financial products, it has given everyday investors a robust framework to avoid common mistakes and build more resilient, goal-oriented portfolios.

Have More Questions About MPT?

Even after getting a handle on Modern Portfolio Theory, a few questions always seem to pop up. MPT is a brilliant framework, but it’s not a magic wand. Understanding its real-world strengths—and its limitations—is key to using it effectively. Let's tackle some of the most common ones.

Is Modern Portfolio Theory Still Relevant Today?

Absolutely. While it’s true that some of its underlying assumptions get debated, MPT’s core principles are still the bedrock of smart investing. The ideas of diversification and analyzing assets as a team, not as individual players, are more crucial today than ever.

You can see its DNA in countless financial products we use every day:

- Robo-advisors that build you an automated, diversified portfolio.

- Target-date funds that automatically dial down risk as you near retirement.

- Asset allocation models used by professional wealth managers across the globe.

Its influence is undeniable and continues to shape how we all approach building wealth.

What Are The Main Criticisms Of MPT?

No theory is perfect, and MPT has its fair share of valid critiques. One of the biggest is its heavy reliance on historical data to forecast future returns and correlations. The past, as we all know, doesn't always repeat itself.

The theory also assumes that investors are perfectly rational and that asset returns follow a neat, bell-curve distribution. But real-world markets often have "black swan" events—those sudden, gut-wrenching downturns—that happen far more often than the model predicts. During those crises, different assets can suddenly move in lockstep, temporarily wiping out the benefits of diversification when you need them most.

Can I Use MPT For My Own Portfolio?

Yes, and the great news is you don't need a PhD in mathematics to do it. The beauty of MPT is that its principles are accessible to everyone, even if you leave the heavy-duty number crunching to computers.

You can apply the core ideas by focusing on the big picture. That means diversifying across different types of assets (like stocks, bonds, and real estate) that don’t always move in the same direction. Most importantly, it's about figuring out your personal risk tolerance to build a portfolio that lets you sleep at night. Modern tools can handle the complex calculations, freeing you up to focus on your strategy.

Ready to move from theory to action? PinkLion provides the advanced analytics and AI-powered tools you need to apply MPT principles to your own portfolio. Track all your assets in one place, run scenario simulations, and discover your optimal risk-reward balance. Start building a smarter portfolio for free at PinkLion.