Charles Schwab Portfolio Tracker (2025 Guide)

Stop toggling between platforms. See why Schwab investors use PinkLion for real-time portfolio tracking, AI optimization, and income forecasting.

Charles Schwab offers a robust investing platform with comprehensive research, zero-commission trades, and full-service advisory options. But trading is only the first step. To truly build and preserve long-term wealth, investors need tools for risk oversight, income planning, goal alignment, and stress testing—not just trade execution.

Schwab provides foundational tracking—but serious investors want more. This guide explores Schwab’s native tracking capabilities, its blind spots, and how platforms like PinkLion amplify your Schwab experience with actionable analytics and sophisticated optimization.

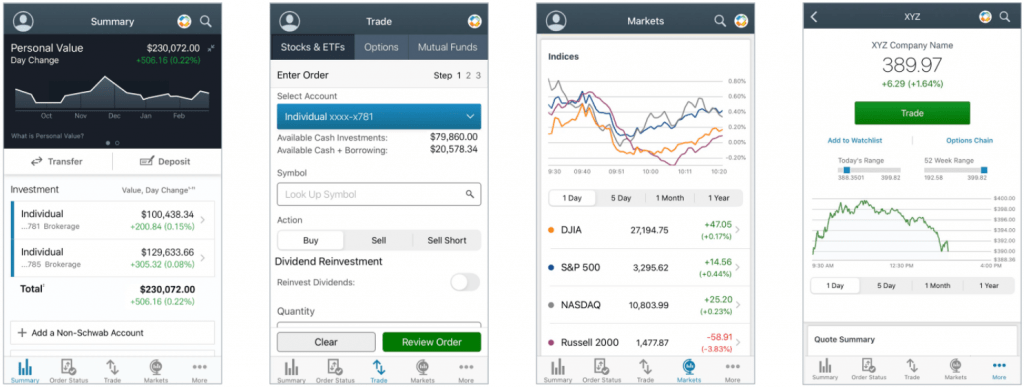

What Charles Schwab Offers for Portfolio Tracking

Schwab's platform is feature-rich and designed for both beginners and experienced investors. Here’s what’s available natively:

✅ What Schwab Gets Right

Comprehensive Holdings View

See all account balances in one place (brokerage, retirement, checking, etc.).

Performance Reporting Tools

Includes time-weighted return metrics and customizable date-range views—though some users find the default trending skewed during deposit-heavy periods.

Portfolio Checkup™

Automated tool to assess sector allocation, concentration, and investable asset diversification. Can generate on-demand PDF reports.

Rich Research & Analytics

Built-in screeners, analyst reports, valuation tools, and comparisons to benchmarks like the S&P and Nasdaq.

Why Schwab Investors Need a Dedicated Tracker

Even Schwab’s strong native features fall short when scaling to complex, long-term investing. A dedicated tracker closes the gaps:

1. Lack of Holistic Forecasting Tools

Schwab provides current views—but doesn’t forecast dividend income, alert you about upcoming ex-dates, or show forward yield.

2. Limited Scenario Analysis

You can check allocation and concentration, but Schwab doesn’t simulate performance through major market events (e.g., 2008 or pandemic).

3. No AI-Driven Optimization

Schwab Advisor tools offer recommendations, but there’s no automated engine suggesting customized allocation shifts versus manual advisor input.

4. Benchmarking Requires Effort

While Schwab offers benchmarking tools, you must set them up manually and monitor yourself—no persistent AI insight reveals if you’re underperforming risk-adjusted returns versus benchmarks.

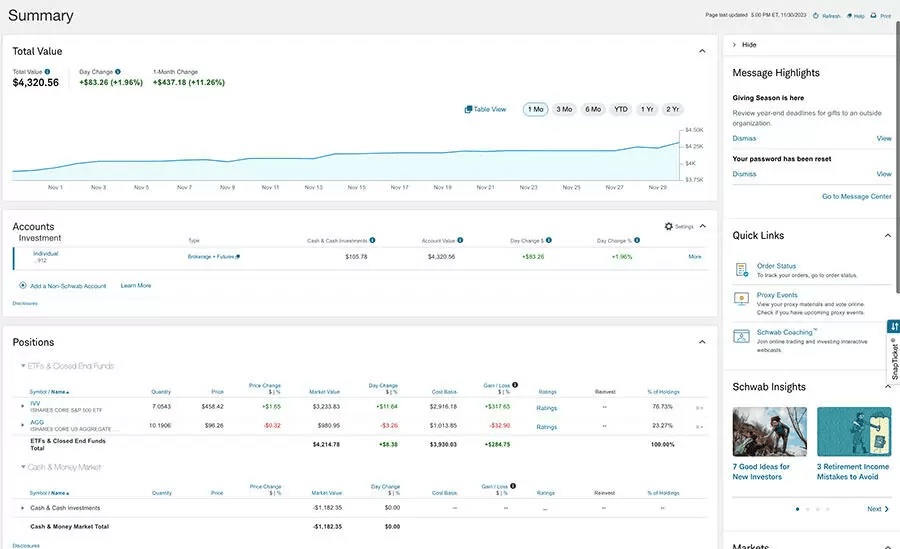

Limitations of the Built-In Schwab Dashboard

Schwab’s dashboard is stronger than many, but it still has important limitations:

❌ No Full Risk Management

You can see exposure by sector or asset type, but Schwab doesn't calculate portfolio beta, max drawdown projections, or expected peril in a poor market scenario.

❌ No Predictive Tools

Schwab doesn’t forecast income, simulate different market crashes, or suggest rebalancing paths proactively.

❌ No Forward Dividend Planning

No ex-date calendars, monthly income charts, or forecasted yield breakdown—even though Schwab supports dividend-paying asset types.

❌ Incomplete Benchmarking

While manual benchmarking exists, Schwab doesn't actively alert you if your portfolio is trailing the S&P500 or sector indices consistently.

Must-Have Features in a Modern Portfolio Tracker

To move from passive holder to empowered investor, your tracking tool should include:

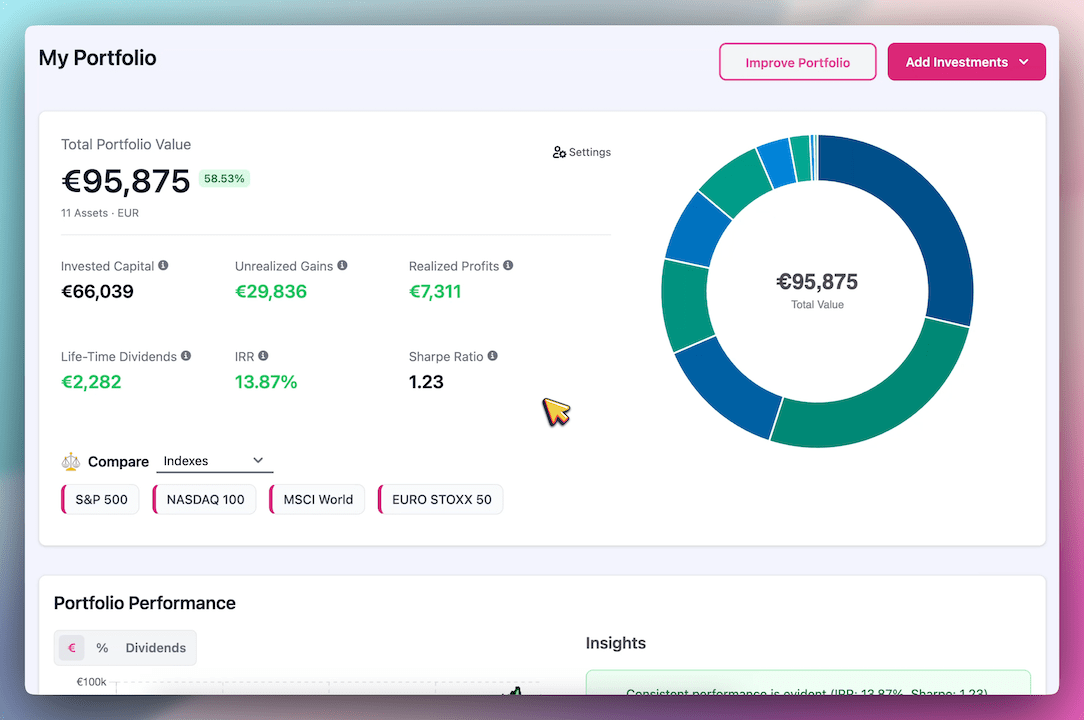

✅ 1. Real-Time Portfolio Analytics

Understand:

- Risk metrics (Sharpe ratio, max drawdown, beta)

- Sector/region exposure

- Diversification health

- Volatility and historical drawdown risk

These insights turn your portfolio into a measurable strategy not just a list of tickers.

✅ 2. Forward Dividend Tools

Know what’s coming before it arrives:

- Monthly income forecasts

- Yield by holding and portfolio-wide

- Dividend history and growth trends

- Reinvestment opportunities

✅ 3. AI Optimization & Scenario Simulation

Let machine learning suggest better allocations that:

- Improve risk-adjusted return

- Reduce unnecessary overlap

- Maximize dividend yield

Simulate 1,000+ scenarios to test portfolio performance in various market conditions

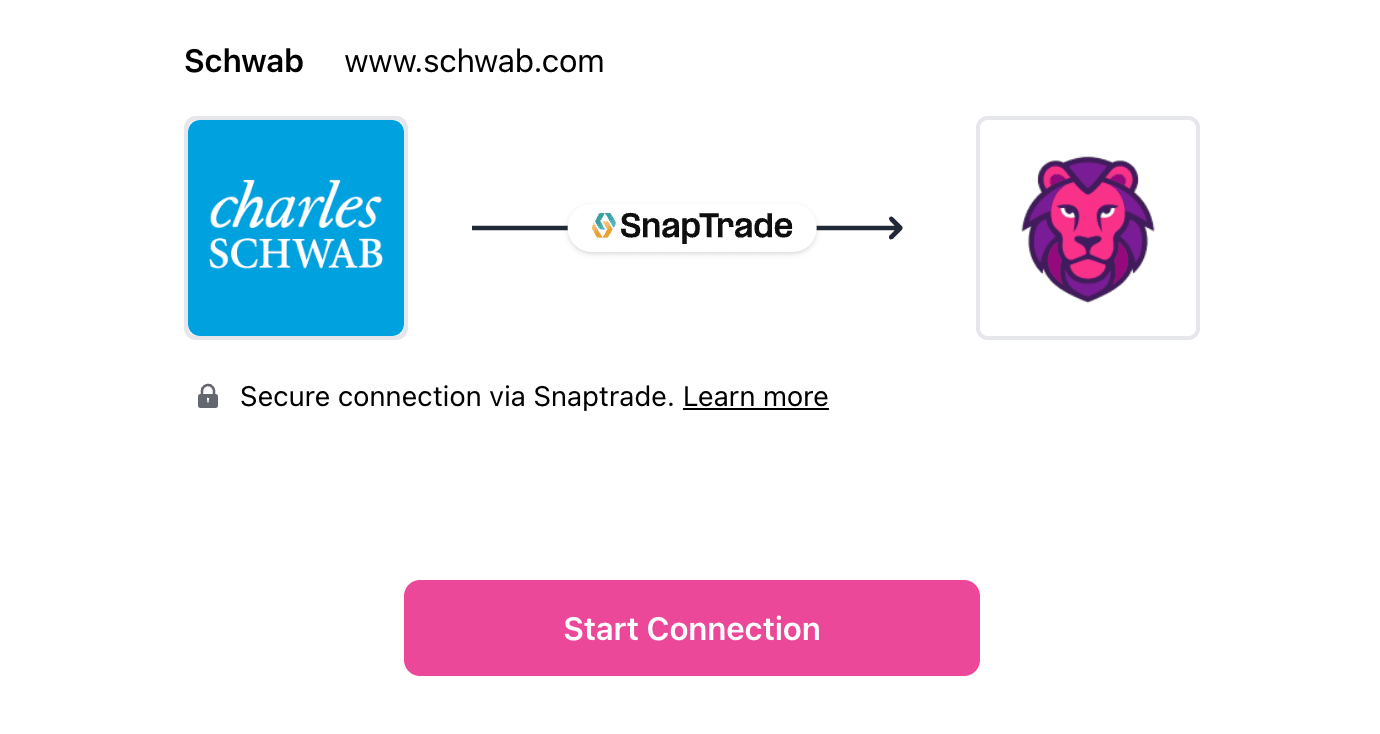

✅ 4. Secure, Read-Only Access

Your data must be safe. Any tool you use should only request read-only access never trading control and encrypt everything using bank-grade standards.

Why PinkLion Is a Perfect Fit for Charles Schwab Users

PinkLion is tailor-made for retail investors using Charles Schwab. Whether you invest $500 or $500,000, it gives you tools to invest intelligently with less stress and more strategy.

🔁 Charles Schwab Sync in 60 Seconds

- Connect your account securely

- Or upload a CSV in seconds

- Tracks trades, dividends, cost basis, and balances

- Refreshes daily or manually on demand

🤖 AI That Makes You Smarter

PinkLion’s AI scans your portfolio for inefficiencies and suggests improvements based on your profile:

- Growth vs Income focus

- Risk tolerance

- Risk-Return profile

It’s like having a portfolio analyst at your fingertips, for ∼$5/month.

🧪 Portfolio Stress Testing

Test your current mix against real-world events like:

- The 2008 Global Financial Crisis

- The 2020 COVID Crash

- Inflationary bear markets

- High interest rate scenarios

This helps you identify vulnerabilities before the next crash, and fix them proactively.

📊 One Dashboard for Everything

Track:

- Stocks, ETFs, crypto, mutual funds

- Across multiple brokers

- With clean, unified insights

PinkLion handles over 150,000 assets across all major categories and brokers.

How to Connect Charles Schwab to PinkLion

Step-by-step guide:

- Sign up at pinklion.xyz

- Go to Broker → Connect Broker

- Choose Charles Schwab → Confirm Synchronization

- Immediately run an AI optimization or stress test

Schwab Portfolio Tracker FAQ

Q: Can PinkLion support fractional Schwab Stock Slices?

Yes. Fractions import accurately and update with every sync.

Q: How secure is the integration?

PinkLion uses bank-level encryption and accesses your Schwab account in read-only mode only.

Q: How often is data refreshed?

Daily automatic updates or instant manual refresh.

Q: Can I sync other investment accounts?

Absolutely—support includes retirement accounts, crypto, and multiple brokerages.

Conclusion: From Trading to Mastery

PinkLion makes investing intelligent.

If you’re serious about growing your wealth, protecting against risk, and optimizing your portfolio for what matters to you, a tracker like PinkLion is essential.

For ∼$5/month, you gain:

- AI-powered recommendations

- Real-time income forecasts

- Crash-tested simulations

- Cross-platform portfolio tracking

No spreadsheets. No guesswork. Just smarter investing.