DEGIRO Portfolio Tracker (2025 Guide)

Eliminate the spreadsheet chaos. Learn how DEGIRO investors use PinkLion for real-time tracking, optimized allocation, and dividend planning.

DEGIRO is one of Europe’s most cost-effective and globally accessible brokers, loved for low fees and broad market access. But when it comes to portfolio intelligence risk control, income planning, asset optimization it falls short. For thoughtful investors, investing is just the starting point. Portfolio mastery a thoughtful, data-driven approach is what helps build and preserve wealth.

This guide evaluates DEGIRO’s native tracking features, identifies its blind spots, and reveals why tools like PinkLion are essential for investors seeking more than just trade execution.

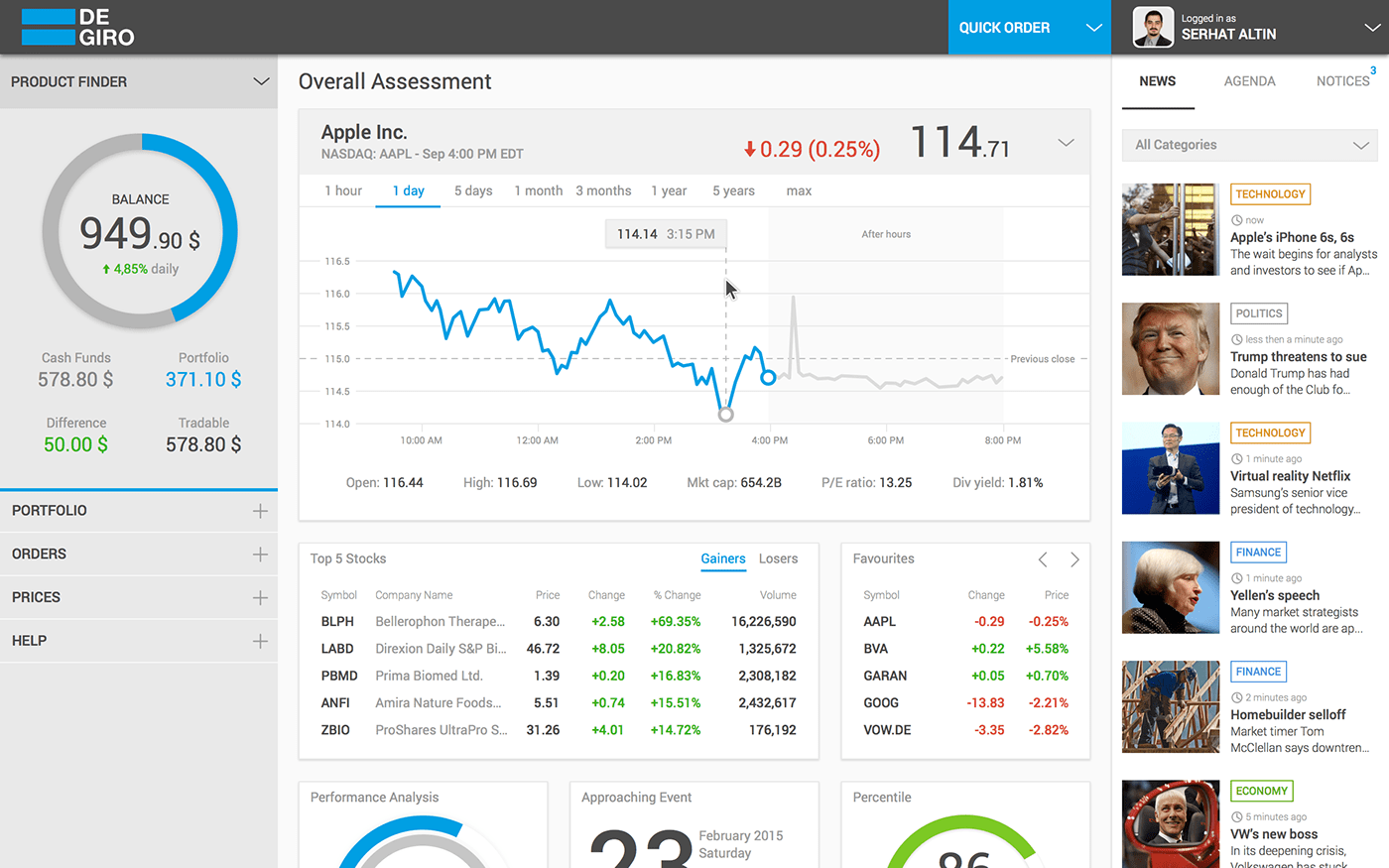

What DEGIRO Offers for Portfolio Tracking

DEGIRO delivers a solid foundation for investors across Europe and beyond, supported by its intuitive platform and low-cost model.

Strengths of DEGIRO’s Platform

🌐 Wide Market Access & Low Fees

DEGIRO provides access to over 45 global exchanges at minimal cost making international diversification affordable .

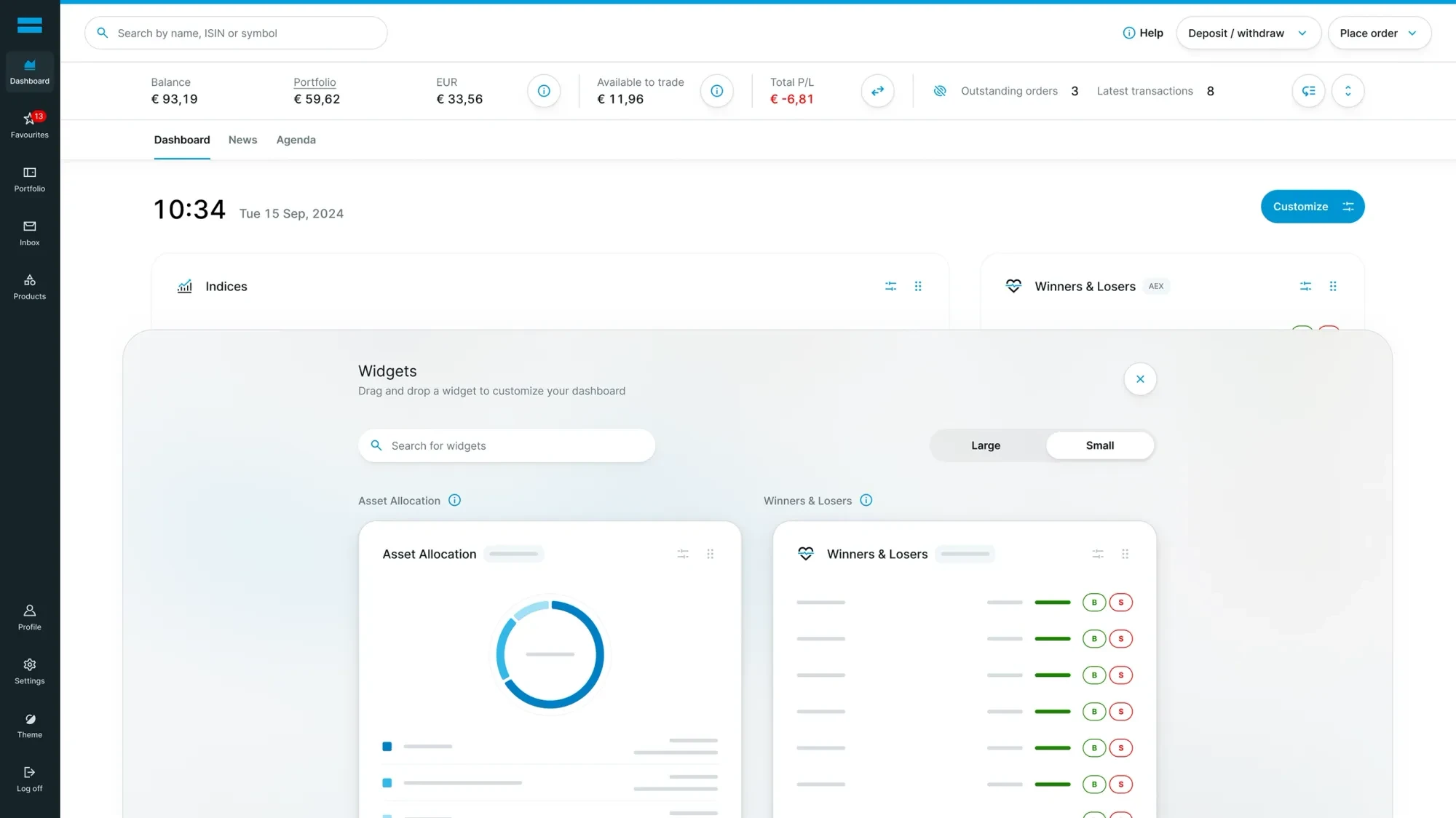

📱 User-Friendly Trading Tools

The platform offers an intuitive interface, interactive charts, real-time quotes, Level 2 data, and optional dark mode for seamless navigation.

🌿 ESG & Analyst Ratings

Each instrument includes ESG scores and analyst insights (LSEG & Infront), aiding fundamental analysis.

📆 Basic Dividend Calendar

A built-in dividend and earnings agenda shows upcoming ex-dates and payout details on the platform.

Why DEGIRO Investors Need a Dedicated Tracker

Even with its strong foundation, DEGIRO lacks advanced portfolio tools essential for proactive investors:

1. No Automated Asset Allocation Breakdown

You don't get a clear sector, region, or asset-class breakdown essential for true diversification.

2. No Comprehensive Performance Metrics

DEGIRO doesn’t calculate portfolio-level risk metrics like Sharpe ratio, drawdown, or volatility.

3. No Forward-Looking Income Forecasts

While DEGIRO shows past dividends, it lacks forecasting tools like monthly yield projections or ex-date planning beyond simple views.

4. No Benchmarking or Goal Tracking

You can’t compare your portfolio to benchmarks or track progress toward financial goals you're operating without context.

5. No AI or Scenario Simulations

DEGIRO has no engine to simulate crashes, rebalance intelligently, or suggest optimizations.

Limitations of DEGIRO’s Built‑in Dashboard

❌ No Risk Metrics – Missing volatility, beta, Sharpe ratio, or drawdown risk.

❌ No Forward Planning – Limited forecasting; no scenario modeling or rebalancing alerts.

❌ No Income Forecast Tools – Upcoming income view is basic; no monthly or annual aggregated planning.

❌ No Benchmarking – Manual benchmarking is possible only via exports into external tools.

❌ No AI‑powered Optimization – Requires manual analysis or external services to optimize or adjust allocations.

Must-Have Features in a Modern Portfolio Tracker

To move from passive holder to empowered investor, your tracking tool should include:

✅ 1. Real-Time Portfolio Analytics

Understand:

- Risk metrics (Sharpe ratio, max drawdown, beta)

- Sector/region exposure

- Diversification health

- Volatility and historical drawdown risk

These insights turn your portfolio into a measurable strategy not just a list of tickers.

✅ 2. Forward Dividend Tools

Know what’s coming before it arrives:

- Monthly income forecasts

- Yield by holding and portfolio-wide

- Dividend history and growth trends

- Reinvestment opportunities

✅ 3. AI Optimization & Scenario Simulation

Let machine learning suggest better allocations that:

- Improve risk-adjusted return

- Reduce unnecessary overlap

- Maximize dividend yield

Simulate 1,000+ scenarios to test portfolio performance in various market conditions

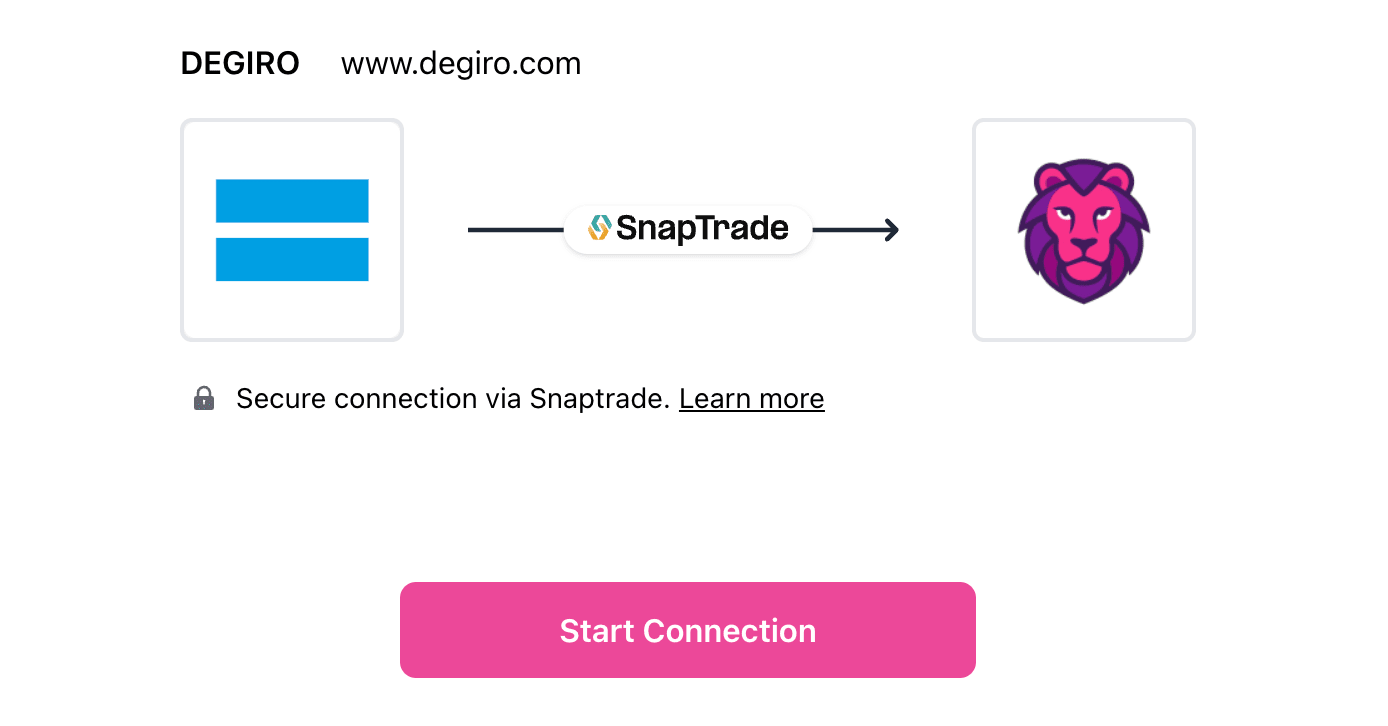

✅ 4. Secure, Read-Only Access

Your data must be safe. Any tool you use should only request read-only access never trading control and encrypt everything using bank-grade standards.

Why PinkLion is Ideal for DEGIRO Users

Pairing DEGIRO with PinkLion unlocks advanced portfolio capabilities:

🔁 Smooth Integration – Import trades via CSV and refresh daily.

📊 Unified Analytics – See risk metrics, allocations, and diversification in one dashboard.

🤖 AI‑Based Recommendations – Receive optimized allocation suggestions tailored to growth, income, or risk goals.

🧪 Stress Testing – Analyze performance through real historical crises like 2008, 2020, inflation scenarios.

💸 Dividend Planning Tools – Monthly income forecasts, snowball tracking, and ex-date alerts.

💶 Affordable – High-end portfolio insights at a modest ∼€5/month.

How to Connect DEGIRO to PinkLion

Step-by-step guide:

- Sign up at pinklion.xyz

- Go to Broker → Connect Broker

- Choose DEGIRO → Confirm Synchronization

- Immediately run an AI optimization or stress test

Pro Tips for DEGIRO Traders

🌎 Diversify Intentionally – Use allocation visuals to rebalance away from regional or sector concentration.

🔍 Recognize Hidden Fees – Import fee tracking to spotlight unexpected costs that erode returns.

📅 Time Your Income – Manage dividend timing to optimize reinvestments and tax planning.

🤔 Plan with What-If Simulations – See the potential impact of adding or removing major positions.

📊 Monitor Investment Behavior – Use analytics to identify costly trading habits like frequent rebalancing or market timing.

DEGIRO Portfolio Tracker FAQ

Q: Are dividends included in tracking?

Yes. PinkLion imports DEGIRO dividends, forecasts income, and aggregates yield for your entire portfolio.

Q: Is security a concern?

No. PinkLion uses bank-level encryption and requires only read-only access. Your brokerage assets remain secure.

Q: Can I add other accounts?

Absolutely. Aggregate your global brokerages, retirement accounts, and crypto holdings in one dashboard.

Conclusion: From Cheap Broker to Smart Portfolio Management

DEGIRO is renowned for its low costs and easy access to global markets. But when it comes to strategic portfolio management, it leaves investors navigating with partial visibility.

PinkLion fills the void providing AI-driven allocation advice, rigorous risk metrics, income forecasting, scenario modeling, and cross-platform visibility all for a friendly price of ∼€5/month.

Move beyond trade execution. Invest with strategy, insight, and confidence.