Robinhood Portfolio Tracker (2025 Guide)

Stop juggling spreadsheets. See why Robinhood investors use PinkLion for real-time portfolio tracking, AI optimization, and dividend insights.

Robinhood democratized investing. But building long-term wealth takes more than just buying a few stocks. Once you’ve placed your trades, the real work begins monitoring risk, optimizing allocations, tracking income, and adjusting over time.

Robinhood's built-in tools offer a starting point. But if you want to grow and protect your investments like a pro, you’ll need a smarter solution. This guide explains why, and how platforms like PinkLion give Robinhood users the edge they need.

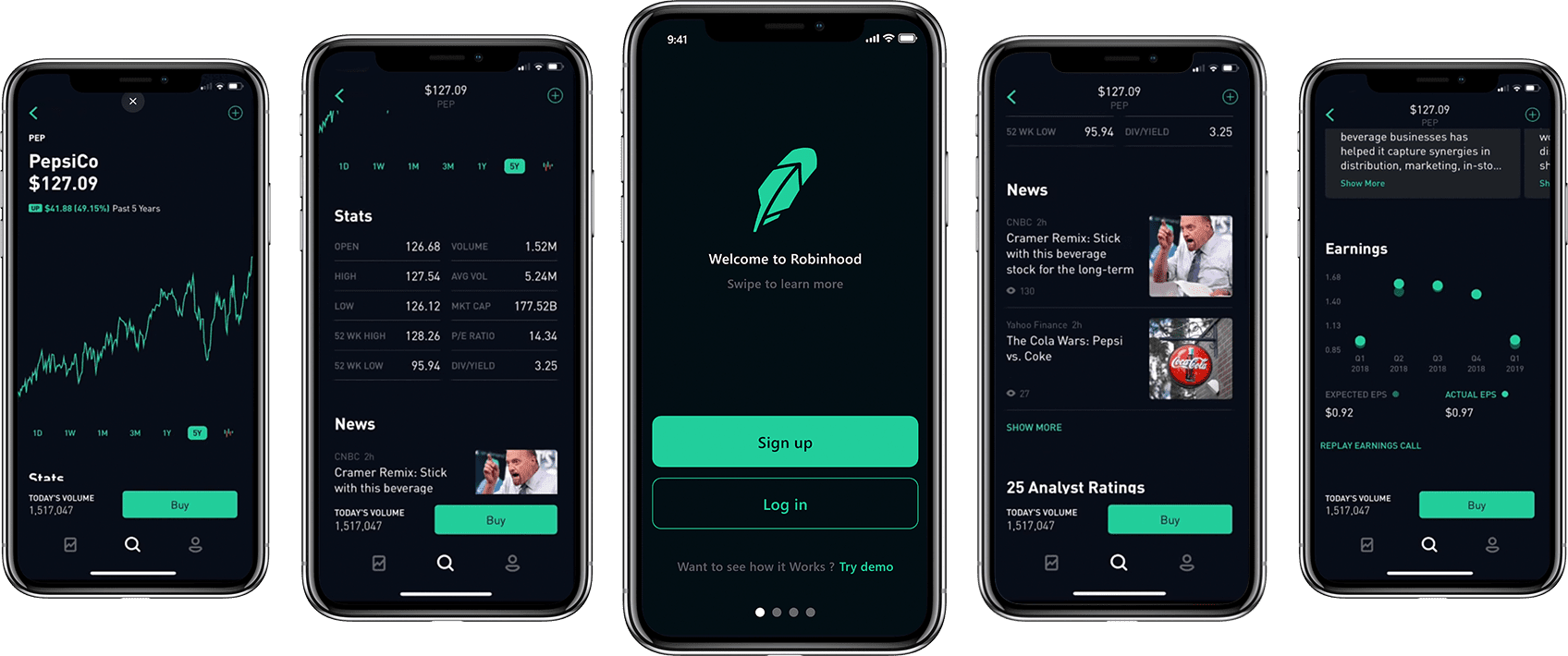

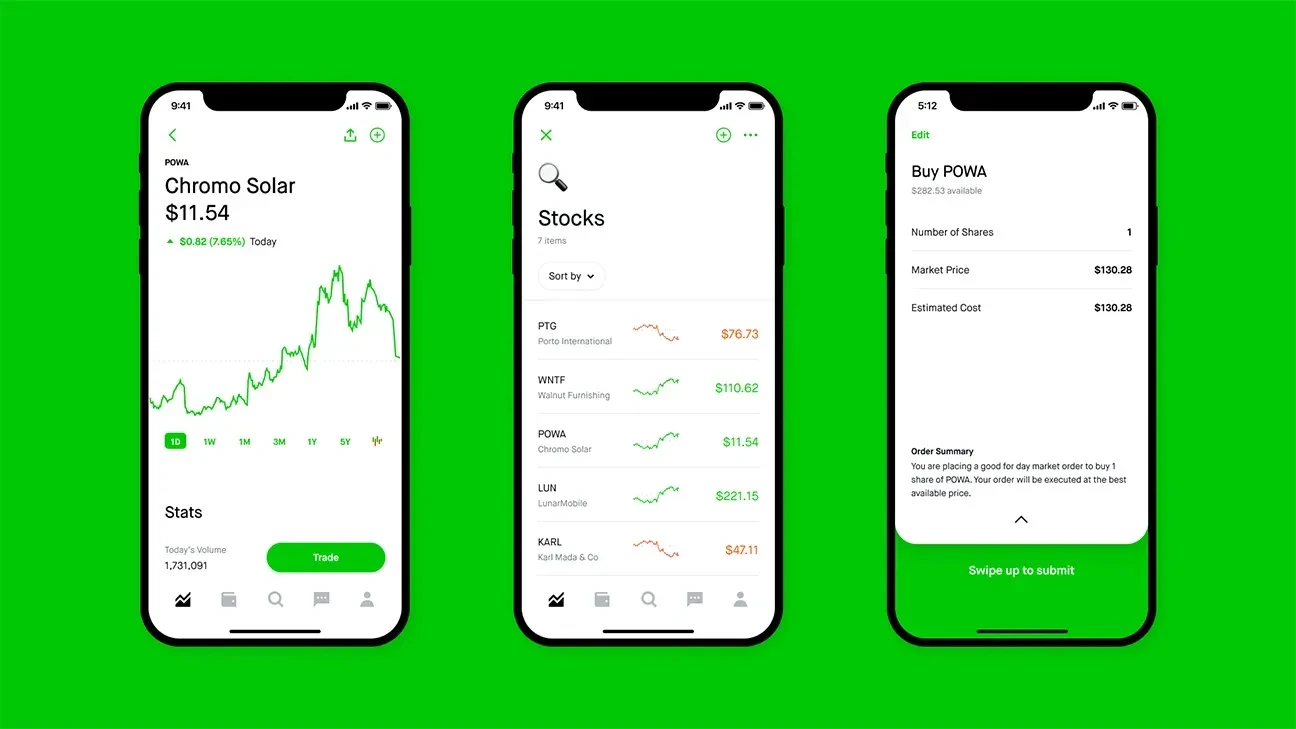

What Robinhood Offers for Portfolio Tracking

Robinhood’s sleek design and real-time pricing make it ideal for beginner traders. It shows you what you own and what’s going on today. For many, it’s the first dashboard they use to manage investments.

✅ What Robinhood Gets Right

- Instant Performance Feedback

You can see how your stocks and crypto are performing throughout the day, in dollars and percentages. - User-Friendly Interface

Robinhood makes it easy to view holdings, execute trades, and track high-level metrics without any financial jargon. - Transaction History

Trade confirmations, dividend receipts, and transfers are clearly displayed in your activity feed. - Real-Time Market Data

Free access to Level 1 quotes and live pricing gives you a clear sense of what’s happening across your holdings.

These features are great for beginners. But as your portfolio grows, the limitations of Robinhood’s native tools become apparent.

Why Robinhood Investors Need a Dedicated Tracker

Once you’ve invested more than a few hundred dollars or start holding multiple assets, managing your portfolio with Robinhood alone starts to feel like navigating a forest without a map. Here’s why adding a dedicated tracker is essential:

1. Hidden Risk Builds Fast Without You Noticing

You might think you're diversified because you own five ETFs, but what if they all hold Apple, Microsoft, and NVIDIA? Robinhood doesn't show overlapping exposures or correlation risk. Without a tracker, you’re blind to concentration.

2. Diversification Isn’t Visualized

Successful portfolios often balance different sectors, regions, and asset classes. Robinhood doesn’t visualize how much of your portfolio is in tech, U.S. vs international, or cash vs equities. That makes it easy to accidentally “tilt” your portfolio toward high risk.

3. No Help With Optimization

What if there’s a better way to arrange your assets to reduce volatility without sacrificing returns? Robinhood won’t help you simulate or test different portfolio mixes. You’re left guessing or copying social media trends.

4. No Goal-Based Insights

Are you investing for early retirement, passive income, or homeownership in 10 years? Robinhood doesn’t tie your holdings to any specific goals. A dedicated tracker helps you measure progress against financial targets monthly yield, long-term growth, or capital preservation.

Limitations of the Built-In Robinhood Dashboard

Robinhood is purpose-built for simplicity, but that simplicity hides some major blind spots:

❌ No Risk Management

You don’t see:

- How much of your portfolio is exposed to one sector

2. Your expected volatility in a market downturn

3. What you might lose in a repeat of March 2020

❌ No Forward-Looking Tools

Robinhood shows what happened not what could happen. There’s no way to simulate future scenarios, forecast passive income, or plan rebalancing strategies.

❌ No Real Income Planning

Dividend income is shown only after it hits your account. There’s no view of forward yield, monthly breakdowns, or ex-date calendars, which income-focused investors need to plan ahead.

❌ No Performance Benchmarking

There’s no way to compare your portfolio to the S&P 500, Nasdaq-100, or even a simple 60/40 portfolio. Without benchmarks, you can’t answer key questions like:

- Is my portfolio beating the market?

- Am I taking too much risk for too little return?

This lack of context leads many investors to overestimate their success or miss warning signs early.

Must-Have Features in a Modern Portfolio Tracker

To move from passive holder to empowered investor, your tracking tool should include:

✅ 1. Seamless Broker Sync

Connect Robinhood via OAuth or CSV and pull in your full trade history, positions, cost basis, and dividends. A good tracker refreshes automatically.

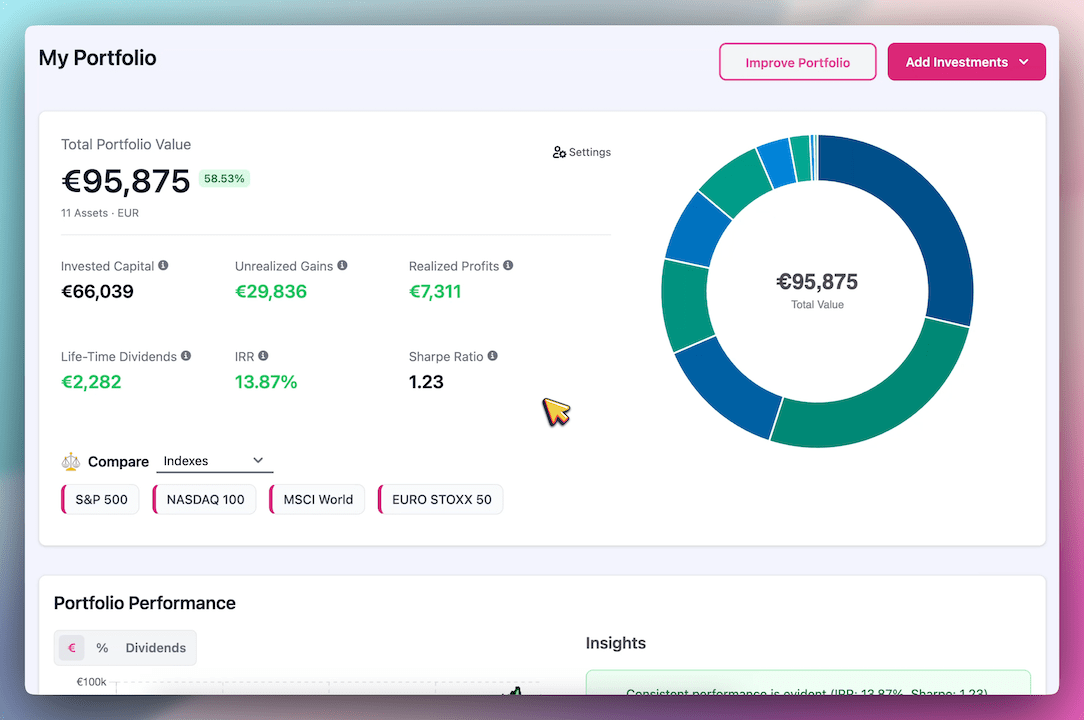

✅ 2. Real-Time Portfolio Analytics

Understand:

- Risk metrics (Sharpe ratio, max drawdown, beta)

- Sector/region exposure

- Diversification health

- Volatility and historical drawdown risk

These insights turn your portfolio into a measurable strategy not just a list of tickers.

✅ 3. Forward Dividend Tools

Know what’s coming before it arrives:

- Monthly income forecasts

- Yield by holding and portfolio-wide

- Dividend history and growth trends

- Reinvestment opportunities

✅ 4. AI Optimization & Scenario Simulation

Let machine learning suggest better allocations that:

- Improve risk-adjusted return

- Reduce unnecessary overlap

- Maximize dividend yield

Simulate 1,000+ scenarios to test portfolio performance in various market conditions

✅ 5. Secure, Read-Only Access

Your data must be safe. Any tool you use should only request read-only access never trading control and encrypt everything using bank-grade standards.

Why PinkLion Is a Perfect Fit for Robinhood Users

PinkLion is tailor-made for retail investors using Robinhood. Whether you invest $500 or $500,000, it gives you tools to invest intelligently with less stress and more strategy.

🔁 Robinhood Sync in 60 Seconds

- Connect your account securely

- Or upload a CSV in seconds

- Tracks trades, dividends, cost basis, and balances

- Refreshes daily or manually on demand

🤖 AI That Makes You Smarter

PinkLion’s AI scans your portfolio for inefficiencies and suggests improvements based on your profile:

- Growth vs Income focus

- Risk tolerance

- Risk-Return profile

It’s like having a portfolio analyst at your fingertips, for ∼$5/month.

🧪 Portfolio Stress Testing

Test your current mix against real-world events like:

- The 2008 Global Financial Crisis

- The 2020 COVID Crash

- Inflationary bear markets

- High interest rate scenarios

This helps you identify vulnerabilities before the next crash, and fix them proactively.

📊 One Dashboard for Everything

Track:

- Stocks, ETFs, crypto, mutual funds

- Across multiple brokers

- With clean, unified insights

PinkLion handles over 150,000 assets across all major categories and brokers.

How to Connect Robinhood to PinkLion

Step-by-step guide:

- Sign up at pinklion.xyz

- Go to Broker → Connect Broker

- Choose Robinhood → Confirm Synchronization

- Immediately run an AI optimization or stress test

Pro Tips for Robinhood Portfolios

These smart practices will help you get more value from your Robinhood investments, especially when using PinkLion:

📈 1. Rebalance With Purpose

Run a quarterly AI simulation to check if your current asset mix still aligns with your risk and return goals.

💰 2. Build a Dividend Snowball

Track when each stock pays dividends to reinvest strategically PinkLion shows monthly dividend flows and forecasted yield.

🧠 3. Simulate "What Ifs" Before Making Changes

Before you sell that tech ETF or buy more utilities, simulate how the move affects diversification, volatility, and yield.

Robinhood Portfolio Tracker FAQ

Q: Can PinkLion track fractional shares from Robinhood?

Yes, fractions import flawlessly and update with each sync.

Q: Is it safe to connect my Robinhood account?

Yes. PinkLion uses bank-level AES-256 encryption and only requests read-only access. Your money stays in your account always.

Q: How often is my data refreshed?

PinkLion updates your data daily, or instantly when you click “Refresh.”

Q: Can I add accounts from other platforms?

Yes, track multiple brokers and crypto wallets in one place. PinkLion unifies them into a single dashboard with no duplicates.

Conclusion: From Trading to Mastery

Robinhood makes trading easy. PinkLion makes investing intelligent.

If you’re serious about growing your wealth, protecting against risk, and optimizing your portfolio for what matters to you, a tracker like PinkLion is essential.

For ∼$5/month, you gain:

- AI-powered recommendations

- Real-time income forecasts

- Crash-tested simulations

- Cross-platform portfolio tracking

No spreadsheets. No guesswork. Just smarter investing.