Trading 212 Portfolio Tracker (2025 Guide)

Stop toggling between browser tabs. Learn why Trading 212 investors rely on PinkLion for real-time analytics, optimized allocation, and income visibility.

Trading 212 offers commission-free access to stocks, ETFs, forex, and fractional shares across over 45 global exchanges. Its intuitive interface and low barriers have attracted millions worldwide. But when it comes to forecasting, risk analytics, or portfolio optimization—Trading 212's native tools start to fall short. This guide examines what Trading 212 provides, where it leaves gaps, and how PinkLion completes the picture for smarter investing.

What Trading 212 Offers for Portfolio Tracking

Trading 212’s platform is designed for ease of use, with strong execution and dividend features. Here's what it does well:

✅ Strengths of Trading 212’s Platform

🌐 Commission-Free Global Access & Fractional Shares

Trade stocks and ETFs on 45+ exchanges worldwide with zero commission, including fractional shares from just €1/£1 .

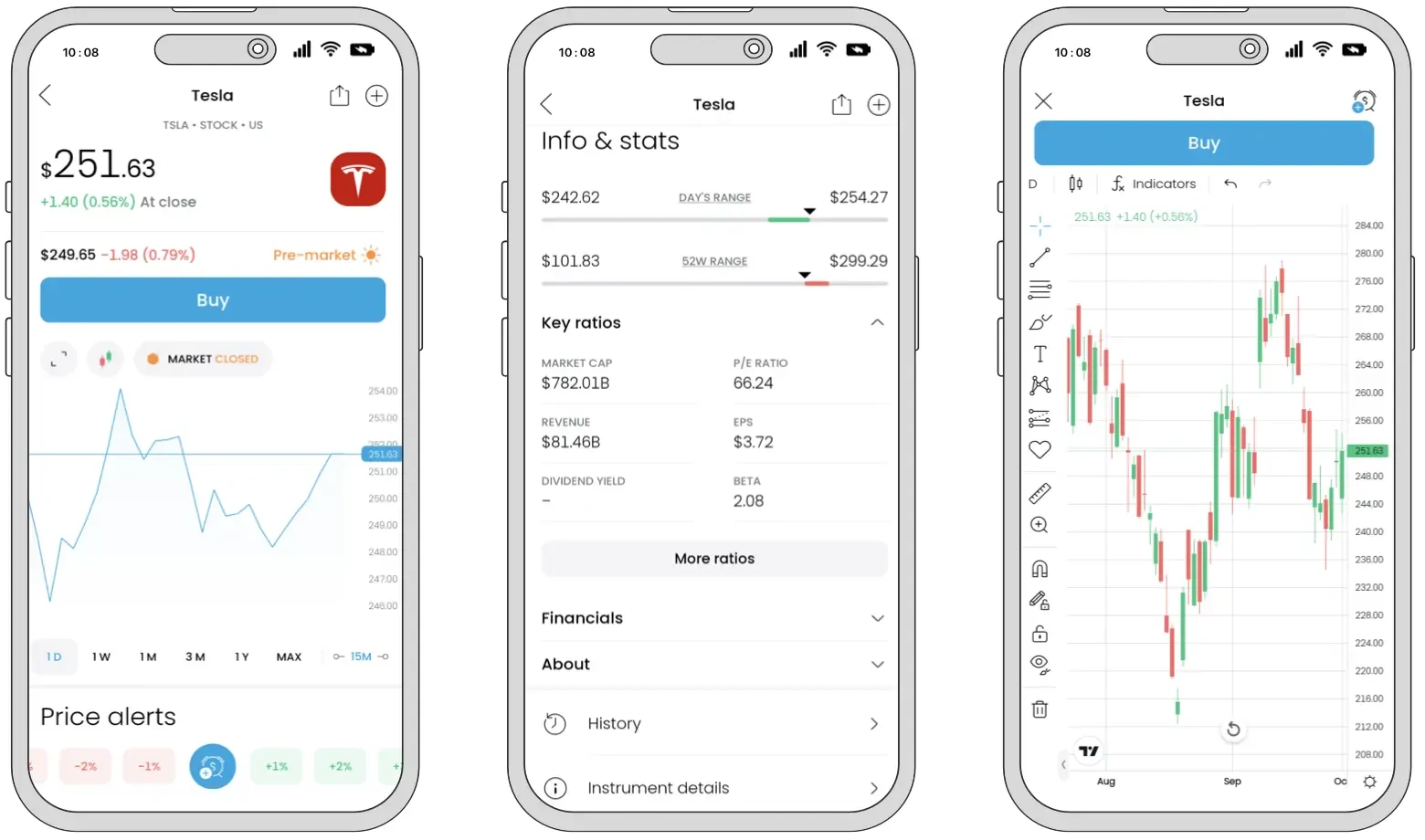

📊 Clean, Intuitive Interface

Both mobile and web platforms are user-friendly, with interactive charts, live quotes, Level 2 data, and price alerts.

📅 Built-In Dividend Calendar

Access key dividend ex-dates and earnings schedules natively, ideal for income-focused investors.

💱 Multiple Currencies & Share Lending

Hold in various currencies and earn interest through stock-lending programs.

Why Trading 212 Investors Need a Dedicated Tracker

While excellent for trading and basic income visibility, Trading 212 lacks advanced portfolio tools for investors aiming to grow wealth strategically:

No Risk Measurement Tools

There’s no calculation of your portfolio's overall volatility, beta, or maximum drawdown risk.

Limited Income Forecasting

Trading 212 shows past dividends but lacks forward-looking income projections or portfolio-wide yield breakdowns.

No Benchmarking Insight

You can’t compare your returns against indices like the S&P 500 or FTSE 100—that context is missing.

Absence of AI Optimization

No automated guidance on improving asset allocation or reducing overlapping exposures.

No Scenario or Stress Testing

You can’t simulate how your portfolio would have fared during events like the 2008 crisis or 2020 pandemic.

No Cross-Broker View

Trading 212 doesn't import holdings from other brokers or accounts, limiting your ability to view full financial exposure.

Limitations of Trading 212’s Dashboard

| Missing Feature | Why It Matters |

|---|---|

| ❌ Risk Metrics | Without portfolio-level volatility, risk management is guesswork |

| ❌ Predictive Income Tools | No projections for dividend income, yield, or ex-date alerts |

| ❌ AI Optimization | No proactive insights to balance growth, income, and risk |

| ❌ Scenario Simulation | No stress tests against real market crashes |

| ❌ Benchmark Comparison | Hard to know if you're under- or over-performing |

| ❌ Cross-Account Consolidation | Investment performance is siloed |

Must-Have Features in a Modern Portfolio Tracker

To move from passive holder to empowered investor, your tracking tool should include:

✅ 1. Real-Time Portfolio Analytics

Understand:

- Risk metrics (Sharpe ratio, max drawdown, beta)

- Sector/region exposure

- Diversification health

- Volatility and historical drawdown risk

These insights turn your portfolio into a measurable strategy not just a list of tickers.

✅ 2. Forward Dividend Tools

Know what’s coming before it arrives:

- Monthly income forecasts

- Yield by holding and portfolio-wide

- Dividend history and growth trends

- Reinvestment opportunities

✅ 3. AI Optimization & Scenario Simulation

Let machine learning suggest better allocations that:

- Improve risk-adjusted return

- Reduce unnecessary overlap

- Maximize dividend yield

Simulate 1,000+ scenarios to test portfolio performance in various market conditions

✅ 4. Secure, Read-Only Access

Your data must be safe. Any tool you use should only request read-only access never trading control and encrypt everything using bank-grade standards.

Why PinkLion Complements Trading 212 Perfectly

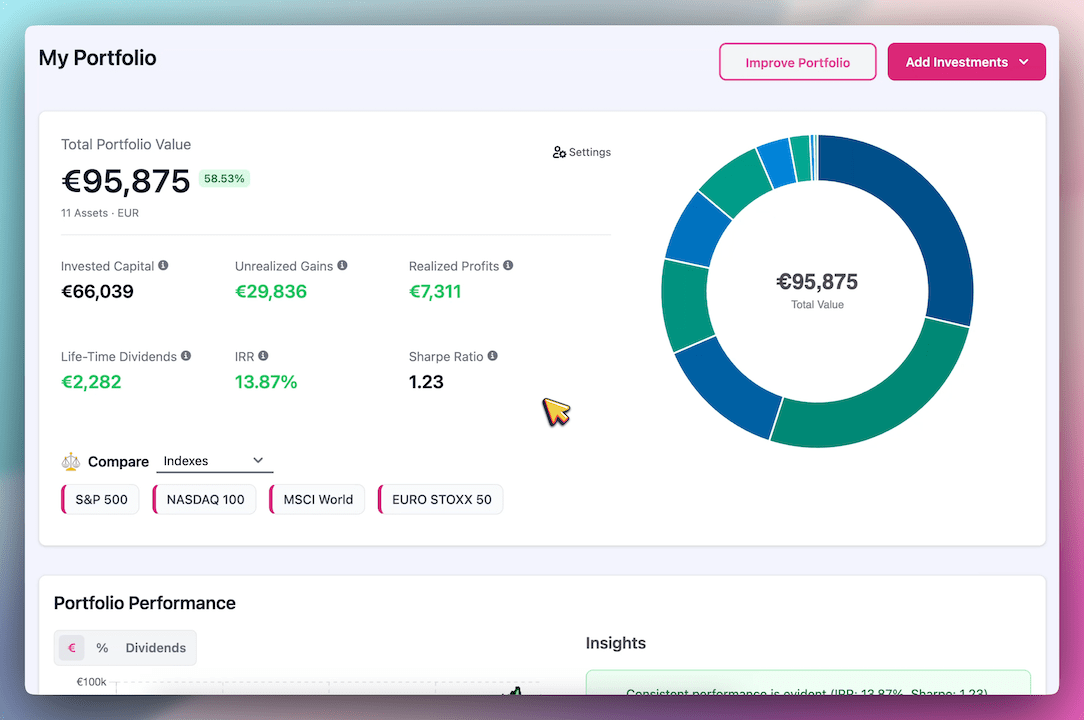

PinkLion fills all the analytical gaps, turning fragmented data into actionable insight:

🔁 Quick Integration

Upload your Trading 212 data and receive daily syncs.

📊 Unified Analytics Across Accounts

Track investments from any source—stocks, ETFs, forex, crypto, and multiple brokers.

🤖 AI Optimization Tools

Receive personalized recommendations to improve risk-adjusted returns and diversify intelligently.

🧪 Stress Test Scenarios

Run your portfolio through historic events—2008, 2020, stagflation—to uncover vulnerabilities.

📈 Forward Income Planning

See month-by-month projections, snowball tracking, and view upcoming dividend dates.

💶 Affordable Analytics

All features delivered for ~€5/month—analytical power at minimal cost.

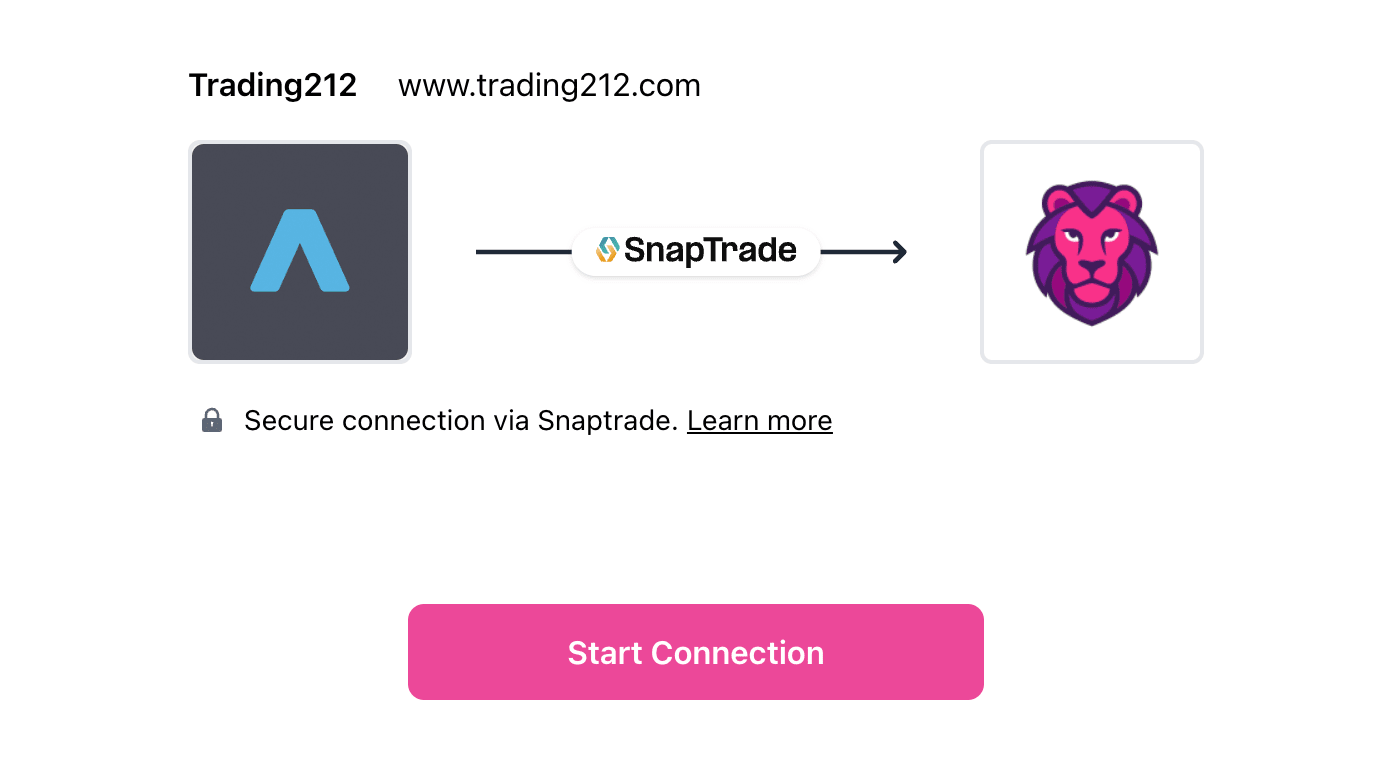

How to Connect Trading212 to PinkLion

Step-by-step guide:

- Sign up at pinklion.xyz

- Go to Broker → Connect Broker

- Choose Trading212 → Confirm Synchronization

- Immediately run an AI optimization or stress test

Trading 212 Portfolio Tracker FAQ

Q: Can PinkLion track fractional shares from Trading 212?

Yes. Fractional holdings sync accurately and update with each import.

Q: Is connecting my Trading 212 account secure?

Yes. PinkLion employs AES‑256 encryption and read-only data access.

Q: How often does sync occur?

Daily automatic refresh, with on-demand manual updates.

Q: Can I sync other broker accounts?

Absolutely. Include crypto wallets, retirement funds, and other brokerage accounts.

Conclusion

Trading 212 is a fantastic platform for commission-free trading and managing basic investments. But for investors seeking deeper insights—risk control, income planning, optimization, and multi-account consolidation—it’s only half the solution.

- Pairing Trading 212 with PinkLion delivers:

- AI-powered portfolio strategies

- Forward dividend intelligence

- Stress-tested resilience

- Cross-platform visibility

For just ~€5/month, you gain clarity, confidence, and control.