7 Best Dividend Tracker Tools for Portfolio Growth in 2025

Discover the 7 best dividend tracker platforms of 2025. Our in-depth review compares features, pricing, and AI tools to help you maximize income.

Dividend investing is a powerful strategy for building long-term wealth, but managing and forecasting your income stream can quickly become a complex puzzle of spreadsheets and manual calculations. As portfolios grow, tracking payout dates, reinvestments, and overall yield becomes a significant chore, making it difficult to see the full picture of your passive income engine.

This is where a dedicated dividend tracker transforms from a 'nice-to-have' into an essential tool. The right platform doesn't just show you past earnings; it helps you project future cash flow, analyze the health of your dividend-paying stocks, and make strategic decisions to optimize your returns. To fully optimize your passive income strategy, it's also essential to consider the tax implications of your dividend earnings, such as understanding the UK dividend allowance. A specialized tracker provides the clarity needed to manage both your portfolio growth and its tax efficiency effectively.

In this comprehensive guide, we dive deep into the 7 best dividend tracker tools available today. We'll move beyond simple feature lists and provide a detailed breakdown of each platform's strengths, weaknesses, and ideal user. For each option, you'll find screenshots, direct links, and actionable insights into:

- Key Features: From automatic broker integrations to dividend safety scores.

- Pricing Structures: Free, freemium, and premium plans explained.

- User Suitability: Who benefits most from each platform, from beginners to advanced analysts.

This article is designed to help you confidently select the perfect tool to elevate your investment strategy, streamline your workflow, and achieve your financial goals. Let's find the dividend tracker that's right for you.

1. PinkLion

PinkLion positions itself as a premier, all-in-one investment management platform, offering a sophisticated yet accessible solution that goes far beyond basic dividend tracking. It is engineered for the modern retail investor who demands professional-grade tools to manage a diverse portfolio, consolidating stocks, ETFs, cryptocurrencies, and cash into a single, cohesive dashboard. This platform is a standout choice for its powerful combination of automated tracking, advanced analytics, and predictive AI-driven features, making it an exceptional best dividend tracker for those who want a holistic view of their financial landscape.

The platform's core strength lies in its seamless, automatic integrations with a wide range of brokerage accounts. This feature eliminates the tedious and error-prone process of manual data entry, providing users with an accurate, real-time snapshot of their entire net worth. Once connected, PinkLion meticulously tracks every holding, transaction, and dividend payment, presenting the information in a clean, intuitive interface.

Key Features and Capabilities

PinkLion distinguishes itself with a suite of features designed to empower investors with deep, actionable insights.

Comprehensive Dividend Tracking & Forecasting: For income-focused investors, the platform excels. It not only logs past and present dividend income but also provides robust forecasting tools. This allows you to project future income streams, plan for reinvestments (DRIP), and visualize how your portfolio’s passive income will grow over time. The dividend calendar feature is particularly useful for anticipating payments on a monthly, quarterly, or annual basis.

AI-Powered Scenario Simulations: A significant differentiator is PinkLion’s use of artificial intelligence. Users can perform stress tests on their portfolios to see how they might perform during specific market downturns, such as a recession or a sector-specific crash. The platform also offers one-year asset forecasting based on expert estimates and market data, helping you proactively adjust your strategy.

Advanced Portfolio Analytics: PinkLion provides deep insights into your investment patterns. It breaks down your asset allocation, sector exposure, and risk-reward balance. You can clearly see which assets are contributing the most to your returns and which are introducing the most volatility, enabling more informed decision-making.

Real-World Use Case

Imagine you are an investor aiming to generate $1,000 per month in passive dividend income. With PinkLion, you can connect your brokerage accounts and instantly see your current annualized dividend income. Using its forecasting tools, you can identify which of your holdings are the primary drivers of this income and project future earnings.

You could then use the scenario simulator to see how a 15% market correction might impact both your portfolio value and your dividend income stream. Based on these insights, you might decide to reallocate capital to more defensive, high-yield stocks to stabilize your income or identify undervalued growth stocks to bolster long-term returns. This proactive, data-driven approach is where PinkLion truly shines.

Platform Suitability and Pricing

PinkLion is exceptionally well-suited for a broad range of investors, from long-term stockholders and dividend enthusiasts to crypto holders who need a unified view of their digital and traditional assets. Its user-friendly interface makes it accessible for novices, while its advanced analytical tools provide the depth required by experienced investors. The vibrant Slack community offers a valuable resource for support and strategy discussion.

The platform offers a free entry point with no credit card required to start, allowing users to explore its core functionalities. However, detailed pricing for premium features isn't prominently displayed on its main page, which may require users to sign up or navigate deeper into the site to understand the full cost structure for advanced capabilities.

Website: https://pinklion.xyz

2. Sharesight — Portfolio & Dividend Tracker

Sharesight has built a strong reputation as a premier portfolio and dividend tracker, particularly among detail-oriented, long-term DIY investors. Its core strength lies in its automation capabilities, which meticulously track not just stock prices but also the total return of your investments. This includes automatically recording dividends, stock splits, and other corporate actions, saving you immense time and reducing manual entry errors.

The platform is a top contender for the title of best dividend tracker due to its comprehensive reporting tools, which are designed with tax compliance in mind. While it doesn't replace dedicated tax software, its reports provide audit-friendly data that can be easily exported or even integrated directly with accounting software like Xero. This focus on accurate, verifiable data makes it an invaluable tool for serious investors.

Key Features and User Experience

Sharesight excels in providing a holistic view of your portfolio's performance. The user interface is clean and data-rich, presenting complex information in an understandable format.

- Automatic Dividend Tracking: The platform automatically captures and records dividend payments for over 700,000 global stocks, ETFs, and funds. It can even back-calculate historical dividend data for stocks you add.

- Future Income Report: This standout feature projects your expected dividend income over the next 12 months based on your current holdings and announced payments. It’s an excellent tool for cash flow planning and forecasting.

- Taxable Income Reporting: Generate detailed reports that break down your dividend income, capital gains, and other taxable events, simplifying year-end tax preparation.

- Broker Integration: Sharesight integrates with hundreds of global brokers. You can set up trade confirmation emails to be forwarded directly, and the platform will automatically update your portfolio, creating a near-effortless tracking system.

Practical Tip: To maximize efficiency, configure your broker's trade confirmation emails to forward to your unique Sharesight email address. This automates the recording of all buys and sells, ensuring your portfolio is always up-to-date with minimal effort.

Pricing and Plan Tiers

Sharesight offers a tiered pricing model that allows users to scale up as their portfolio grows.

- Free Plan: Perfect for beginners, this plan allows you to track up to 10 holdings in one portfolio. It provides basic performance and dividend tracking.

- Starter Plan ($15/month): Expands to 20 holdings and unlocks features like the Taxable Income Report.

- Investor Plan ($24/month): Allows up to 4 portfolios and unlimited holdings, making it ideal for managing multiple accounts.

- Expert Plan ($39/month): Aimed at sophisticated investors, this plan includes consolidated portfolio views and advanced reporting features.

Pros and Cons

Its emphasis on total return aligns with a robust investment philosophy; you can learn more about Modern Portfolio Theory to understand the principles behind this approach. For investors seeking an accurate, automated, and report-heavy dividend tracker, Sharesight is an exceptional choice.

Visit Sharesight

3. Stock Rover — Dividend Screening, Projections, and Portfolio Analytics

Stock Rover is a powerful research and portfolio analysis platform designed for serious investors who demand deep, data-driven insights. It carves out a unique niche by combining comprehensive portfolio and dividend tracking with an institutional-grade stock screener. This makes it an ideal solution for investors who want to not only monitor their current dividend income but also actively research and discover new dividend-paying opportunities all within one integrated tool.

The platform’s strength lies in its vast database of over 650 financial metrics, extensive historical data, and sophisticated analytical tools. For dividend investors, Stock Rover offers more than just tracking; it provides the context needed to evaluate the quality and sustainability of a company's dividend. This makes it a top contender as the best dividend tracker for those who prioritize fundamental analysis.

Key Features and User Experience

Stock Rover is packed with features, which can present a steeper learning curve, but its power is undeniable once mastered. The interface is highly customizable, allowing users to tailor their dashboards and reports to focus on the metrics that matter most to them.

- Future Dividend Income Tool: This feature projects your anticipated dividend income over the coming years based on your current holdings, providing a clear forecast for financial planning.

- Robust Screening Capabilities: Users can screen over 8,500 North American stocks, ETFs, and funds using hundreds of criteria, including dividend yield, growth rate, payout ratio, and "dividend safety" scores.

- Advanced Portfolio Analytics: Go beyond simple tracking with metrics like risk-adjusted returns, correlation analysis, and a trade evaluator to understand the true performance and composition of your portfolio.

- Broker Integration: Link your brokerage accounts to automatically sync your portfolio, eliminating the need for manual data entry and ensuring your analytics are always based on current holdings.

Practical Tip: Use the "Views" feature in Stock Rover to create a custom dividend-focused dashboard. You can add columns for dividend yield, 5-year dividend growth rate, payout ratio, and the Chowder Number to see all critical dividend metrics for your portfolio at a single glance.

Pricing and Plan Tiers

Stock Rover offers several tiers, with its most powerful dividend and research tools available on the premium plans.

- Essentials Plan ($7.99/month): Provides robust portfolio tracking, 260+ metrics, and up to 5 years of detailed financial history.

- Premium Plan ($17.99/month): This is the sweet spot for most dividend investors, unlocking the Future Dividend Income tool, 650+ metrics, and advanced screening capabilities.

- Premium Plus Plan ($27.99/month): Adds advanced features like investment idea generation, stock ratings, and a higher limit on screeners and custom metrics.

Pros and Cons

The platform's analytical tools can help you build a more resilient portfolio; you can learn how to diversify your investment portfolio to complement these insights. For the investor who wants to fuse dividend tracking with in-depth research, Stock Rover offers an unparalleled combination of power and value.

Visit Stock Rover

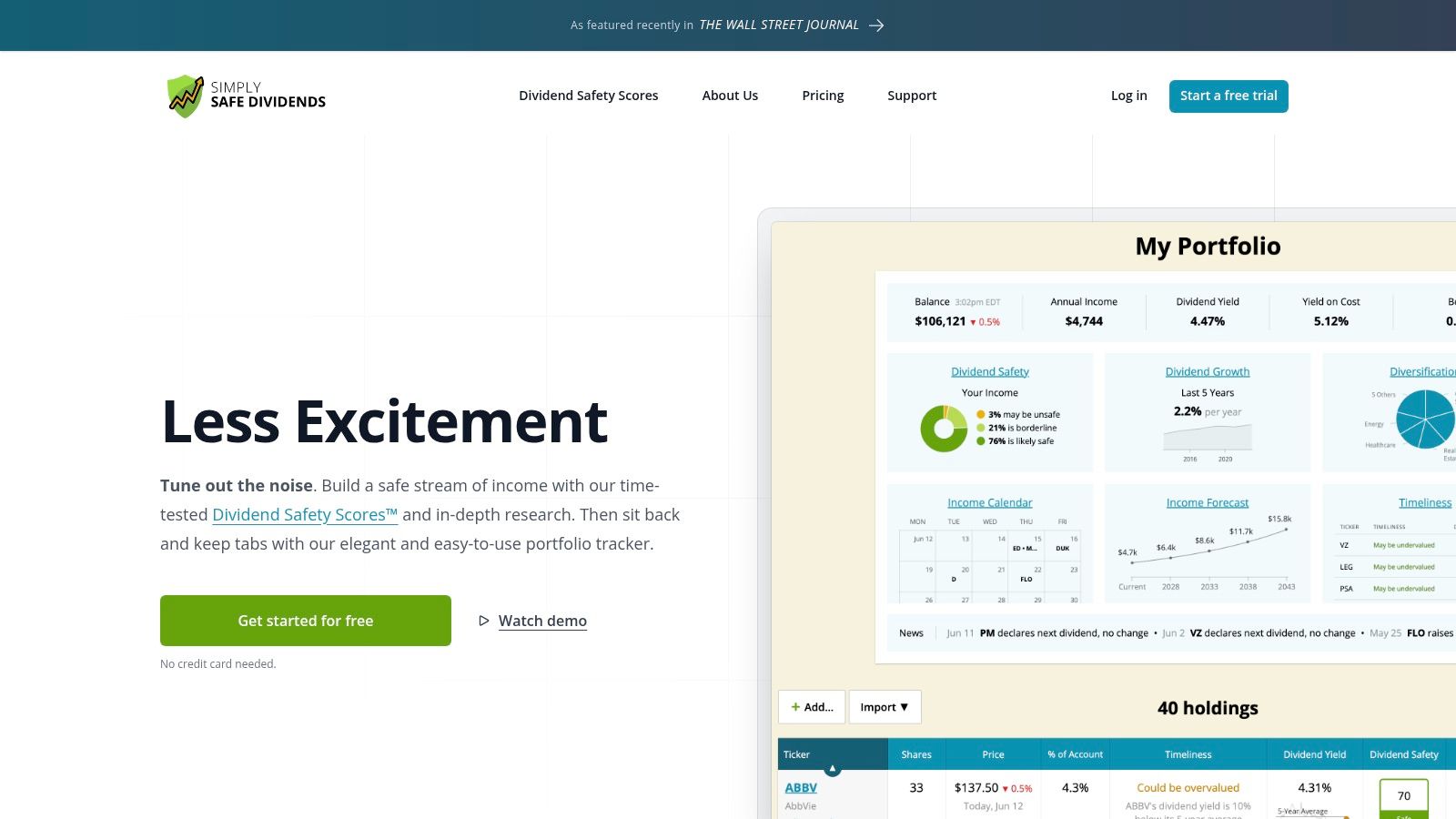

4. Simply Safe Dividends — Dividend Safety Scores and Income Tracking

Simply Safe Dividends carves out a unique niche by focusing intensely on one critical aspect of income investing: dividend safety. Designed primarily for conservative, buy-and-hold investors such as retirees, the platform’s core mission is to help users build a reliable and growing stream of passive income while avoiding risky dividend cuts. Its approach is less about complex performance analytics and more about fundamental risk management.

This platform stands out as a potential best dividend tracker for those who prioritize capital preservation and dependable payouts. Its proprietary Dividend Safety Score system, which has a strong track record of predicting dividend cuts, provides a clear, data-driven framework for assessing risk. This focus on qualitative analysis, combined with robust portfolio tracking, offers peace of mind for long-term income investors.

Key Features and User Experience

The platform is built around ease of use and clarity, translating complex financial data into straightforward, actionable insights. The interface is clean, intuitive, and geared towards helping users make informed decisions quickly.

- Proprietary Dividend Safety Scores: Every stock is rated on a 0-100 scale, indicating its dividend’s reliability. This score is the centerpiece of the platform, helping investors filter out high-risk companies.

- Income Calendar and Forecasting: Visualize your future income with a detailed calendar that tracks expected payment dates. The tool also provides portfolio income forecasting and sends timely alerts about dividend changes, including increases, decreases, and special announcements.

- Portfolio Tracking and Management: Link your brokerage accounts or manually input holdings to get an aggregated view of your dividend income, diversification, and overall portfolio health.

- In-depth Research and Screeners: Access detailed research reports, watchlists, and model portfolios. The platform includes powerful screeners for stocks and Closed-End Funds (CEFs) that allow you to filter by safety scores, yield, and other key metrics.

Practical Tip: Use the portfolio diversification tool to check your sector and industry allocations. A common mistake for income investors is over-concentration in high-yield sectors. This feature helps you identify and mitigate that risk, ensuring your income stream is more resilient.

Pricing and Plan Tiers

Simply Safe Dividends uses a simple, all-inclusive pricing model. There is no free tier, but the platform offers a 14-day free trial and a 60-day money-back guarantee.

- Annual Subscription ($499/year): A single plan provides full access to all features, including unlimited portfolio tracking, all research reports, Dividend Safety Scores, screeners, and email alerts. This annual-only model reflects its focus on long-term investors.

Pros and Cons

For investors whose primary goal is to build a durable and growing income stream for retirement, Simply Safe Dividends provides an invaluable set of tools. Its methodical, risk-first approach makes it an essential resource for navigating market uncertainty.

Visit Simply Safe Dividends

5. Seeking Alpha (Premium) — Dividend Grades, Screeners, and Portfolio Tools

Seeking Alpha has evolved from a crowdsourced analysis platform into a comprehensive research tool, and its Premium service offers a robust suite of features for dividend investors. Its unique strength lies in combining quantitative data with qualitative analysis from a vast community of contributors. This makes it more than just a dividend tracker; it's an idea generation and portfolio monitoring ecosystem.

The platform’s "Dividend Grades" are a standout feature, providing a quick, data-driven assessment of a stock's dividend health. By grading stocks on safety, growth, yield, and consistency, Seeking Alpha helps investors look beyond a simple high yield to find sustainable income streams. This focus on quantitative ratings makes it an excellent tool for both validating existing holdings and discovering new opportunities.

Key Features and User Experience

Seeking Alpha integrates its portfolio tracking with powerful research and screening tools, creating a seamless workflow for active dividend investors. The interface is packed with information but remains navigable, with clear dashboards for both individual stocks and your overall portfolio.

- Quant Dividend Grades: A cornerstone feature, these daily-updated grades (A+ to F) measure dividend safety, growth, yield, and consistency against sector peers, offering an instant quality check.

- Advanced Screeners: Premium users can filter thousands of stocks using dividend-specific criteria like "Top Dividend Stocks" or create custom screens based on grades, yield, and payout ratios.

- Portfolio Syncing and Alerts: Link your brokerage account for real-time portfolio tracking and receive customized alerts on dividend announcements, analyst rating changes, and relevant news for your holdings.

- Community and Analyst Content: Access a massive library of articles and analysis from a diverse range of contributors, providing different perspectives on dividend stocks you own or are researching.

Practical Tip: Use the Dividend Grades as a starting point, not an endpoint. A stock with a high "Yield" grade but a poor "Safety" grade might be a yield trap. Dig into the underlying metrics and contributor analysis to understand the full story behind the grades.

Pricing and Plan Tiers

Seeking Alpha primarily operates on a freemium model, with its best dividend tools locked behind the Premium subscription.

- Basic (Free): Limited access to articles, basic stock data, and email alerts. Portfolio tracking is available but without the advanced dividend metrics.

- Premium ($239/year): This is the core offering for most investors. It unlocks unlimited article access, Quant Ratings, Dividend Grades, advanced screeners, and full portfolio health checks. Frequent promotional discounts are available.

- Pro ($2,400/year): Aimed at professional investors, this tier provides exclusive "Top Ideas," a searchable library of past analysis, and a more focused content experience.

Pros and Cons

The platform’s depth of information supports a thorough research process, which is critical when you need to learn how to evaluate investment opportunities effectively. For investors who want a tool that blends portfolio tracking with in-depth research and dividend-specific metrics, Seeking Alpha Premium is a top-tier choice.

Visit Seeking Alpha

6. TrackYourDividends — Dividend Portfolio Tracking Focused on Ease of Use

TrackYourDividends carves out a niche as a streamlined, dividend-first tracking platform designed for simplicity and accessibility. Its primary appeal is to investors who want a lightweight, easy-to-use tool without the overwhelming complexity of larger research suites. The platform focuses intently on one thing: helping you monitor your dividend income with minimal fuss, making it an excellent starting point for new dividend investors.

As a contender for the best dividend tracker, its strength lies in its purpose-built design. Instead of trying to be a comprehensive portfolio analyzer, it hones in on the core metrics dividend investors care about most: upcoming payouts, income history, and dividend safety. This targeted approach results in a clean, intuitive interface that gets straight to the point.

Key Features and User Experience

The user experience on TrackYourDividends is defined by its simplicity. Getting started is quick, with options to link brokerage accounts via Plaid or import holdings using a CSV file, allowing users to get their dashboard up and running in minutes.

- Dividend Forecasting and History: The platform provides clear visualizations of your historical dividend income and projects future payouts. This helps you understand your portfolio's cash flow and track your progress toward income goals.

- Payout Ratio and Safety Analysis: It offers at-a-glance metrics like the payout ratio for your holdings, giving you a quick way to assess the sustainability of a company's dividend.

- Brokerage Linking: Integration with Plaid allows for automated syncing with many popular brokers, keeping your portfolio updated without manual entry.

- Alerts and Watchlists: Users can set up alerts for dividend announcements or changes and create watchlists to monitor potential investments.

Practical Tip: When you first link your brokerage, take a moment to review the imported data. While Plaid integration is generally reliable, verifying your initial holdings ensures your future dividend projections and historical data are perfectly accurate from day one.

Pricing and Plan Tiers

TrackYourDividends offers a very accessible pricing structure, making it attractive for investors at all levels.

- Free Plan: The free tier provides core functionality, including portfolio tracking, a dividend calendar, and basic income charts. It's a robust starting point for anyone new to dividend tracking.

- Premium Plan ($99/year or $14.99/month): The premium upgrade unlocks unlimited portfolio connections, detailed dividend safety scores, diversification analysis, and advanced charting features.

Pros and Cons

For investors who prioritize ease of use and a clear focus on income tracking over complex analytics, TrackYourDividends is a fantastic choice. It successfully strips away non-essential features to deliver a pure and effective dividend monitoring experience.

Visit TrackYourDividends

7. Dividend.com — Dedicated Dividend Research, Model Portfolios, and Tracking

Dividend.com positions itself as more than just a dividend tracker; it's a comprehensive research platform built specifically for income-focused investors. Its core value lies in combining portfolio tracking with powerful discovery tools, making it an excellent choice for those who want to find new dividend opportunities as well as monitor their existing holdings. The platform is designed to help users make informed decisions based on proprietary ratings and extensive data.

This platform earns its spot as a potential best dividend tracker by seamlessly integrating research and portfolio management. Users can leverage tools like the "Best Dividend Stocks" lists and the DARS™ (Dividend Advantage Rating System) to vet potential investments before adding them to their tracked portfolio. This dual functionality helps investors build and manage a dividend-focused portfolio from start to finish within a single ecosystem.

Key Features and User Experience

Dividend.com provides a suite of tools designed to simplify dividend investing. The user interface is straightforward, prioritizing access to critical dividend data like ex-dividend dates, payout history, and future income projections.

- DARS™ Rating System: A proprietary system that scores dividend stocks based on five key pillars: relative strength, overall yield attractiveness, dividend reliability, dividend uptrend, and earnings growth. This helps quickly assess a stock's quality.

- Ex-Dividend Date Calendar: A crucial tool for income planning, this feature tracks upcoming ex-dividend dates for your holdings and the broader market, ensuring you never miss a payout cut-off.

- Payout Estimates: The platform provides forward-looking estimates of your portfolio's dividend income, allowing for better cash flow planning and goal setting.

- Model Portfolios & Watchlists: Premium users gain access to curated model portfolios based on different strategies (e.g., high yield, dividend growth). Watchlists with custom alerts help monitor potential investments.

Practical Tip: Use the DARS™ rating as a starting point for your research. A stock with a high rating is worth a deeper look, but always cross-reference it with your own analysis to ensure it aligns with your specific investment goals and risk tolerance.

Pricing and Plan Tiers

Dividend.com operates on a freemium model, with core data available for free but advanced tools reserved for premium members.

- Free Access: Provides access to basic stock dividend data, articles, and limited use of some tools.

- Premium Membership (Varies): Pricing often varies based on promotions but typically involves a recurring subscription. This unlocks the full DARS™ ratings, model portfolios, advanced screening tools, and unlimited watchlist capabilities.

Pros and Cons

For investors who prioritize the discovery of new dividend stocks just as much as tracking their current ones, Dividend.com offers a robust and specialized solution.

Visit Dividend.com

Top 7 Dividend Tracker Features Comparison

| Platform | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| PinkLion | Moderate - intuitive interface | Moderate - AI features & broker syncing | High - AI-driven optimization & forecasts | Retail investors wanting all-in-one portfolio tool | Comprehensive asset coverage, AI scenario analysis, strong community |

| Sharesight — Portfolio & Dividend Tracker | Low to Moderate - simple setup | Low to Moderate - broker & email import | Moderate - accurate dividend & tax reports | Long-term investors focused on dividend & tax tracking | Automatic dividend tracking, multi-currency support, audit-friendly reports |

| Stock Rover | High - broad research tools | Moderate to High - deep analytics & alerts | High - in-depth dividend & fundamental insights | Investors needing research + portfolio analytics combined | Extensive metrics, alerts, broker integration, ad-free paid plans |

| Simply Safe Dividends | Low - focused on dividend scores | Low to Moderate - data-driven scores | Moderate - dividend risk management | Retirees & income investors prioritizing dividend safety | Proprietary Dividend Safety Scores, risk-focused research |

| Seeking Alpha (Premium) | Moderate - requires learning | Moderate - subscription-based data & tools | High - broad research & dividend grading | Dividend investors seeking community insights & diverse data | Quant Dividend Grades, expansive dataset, active community |

| TrackYourDividends | Low - beginner-friendly | Low - lightweight, affordable | Moderate - ease of dividend tracking | Beginners wanting simple, cost-effective dividend tracker | Easy setup, dividend-first focus, free tier & affordable upgrade |

| Dividend.com | Low to Moderate - easy access | Low to Moderate - web-based research | Moderate - dividend research & model portfolios | Investors seeking dividend research & screening tools | DARS ratings, ex-dividend tracking, model portfolios |

Choosing the Right Dividend Tracker for Your Investment Journey

Navigating the landscape of dividend investing tools can feel overwhelming, but making an informed choice is the first step toward optimizing your portfolio for long-term income generation. We've explored a diverse range of platforms, from the hyper-focused analytics of Stock Rover to the user-friendly simplicity of TrackYourDividends. Each tool carves out a unique niche, proving there is no single "best dividend tracker" for every single investor.

The key to your success lies not in finding a perfect, one-size-fits-all solution, but in identifying the platform that aligns perfectly with your specific investment philosophy, technical comfort level, and long-term financial goals. By understanding your own priorities, you can transform a powerful tool from a mere data repository into a strategic partner in your wealth-building journey.

From Data Overload to Actionable Insight

The fundamental purpose of a dividend tracker is to move beyond the limitations of manual spreadsheets. While a spreadsheet can tell you what you own and when you get paid, a specialized platform tells you why it matters and what to do next.

- For the Deep-Dive Researcher: If your strategy revolves around rigorous fundamental analysis and discovering undervalued dividend gems, a tool like Stock Rover or Seeking Alpha Premium is invaluable. Their powerful screening capabilities and extensive financial data empower you to make decisions based on deep, quantitative evidence.

- For the Safety-First Investor: If capital preservation and reliable income are your top priorities, Simply Safe Dividends offers a focused, risk-averse approach. Its proprietary safety scores provide a clear, immediate signal of a dividend's reliability, helping you avoid potential dividend cuts that could derail your income stream.

- For the Global, Multi-Asset Investor: If your portfolio extends beyond US stocks to include international equities, ETFs, and even crypto, a comprehensive tracker like Sharesight is essential. Its automated tracking and robust tax reporting features simplify the management of a complex, diversified portfolio.

Ultimately, the best dividend tracker for you is the one that translates raw data into actionable insights, saving you time and empowering you to make more confident, informed decisions.

A Modern Approach to Portfolio Management

As investing evolves, so do the tools we use. The most forward-thinking platforms are no longer just about tracking past performance; they are about preparing for the future. Modern tools like PinkLion introduce a new dimension to dividend tracking by integrating AI-powered analytics and sophisticated portfolio stress testing.

This allows you to move from reactive to proactive management. Instead of just seeing your projected annual income, you can simulate how your portfolio would perform under various market conditions, such as a recession or a sharp rise in interest rates. This capability is crucial for building a truly resilient portfolio that can weather economic storms and consistently deliver the income you depend on.

Consider these factors as you make your final decision:

- Your Core Goal: Is it maximum income, dividend growth, safety, or a balanced approach?

- Portfolio Complexity: Do you hold only US stocks, or do you have international holdings, ETFs, and other asset classes?

- Time Commitment: How much time are you willing to spend on research versus automated tracking and analysis?

- Future-Proofing: Do you need a tool that simply tracks dividends, or one that helps you model future scenarios and manage risk proactively?

By carefully considering these questions and revisiting the unique strengths of each platform discussed, you can confidently select the dividend tracker that will serve as the command center for your investment strategy. This deliberate choice will pay dividends, quite literally, for years to come, enabling you to build a more robust, profitable, and stress-free financial future.

Ready to take your portfolio analysis to the next level with a tool built for the modern investor? PinkLion integrates powerful dividend tracking with AI-driven insights and institutional-grade stress testing, giving you a complete picture of your portfolio's health and future potential. Explore how you can build a more resilient and intelligent investment strategy by visiting PinkLion today.