Portfolio Tracker with Precision

Get insights into your investments, monitor performance, and make data-driven decisions—all in one place.

Get insights into your investments, monitor performance, and make data-driven decisions—all in one place.

Track all your accounts, asset classes, and investments in one centralized place. From stocks to ETFs and crypto, see your complete financial picture at a glance.

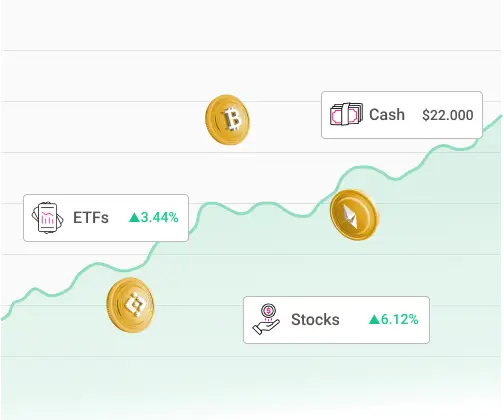

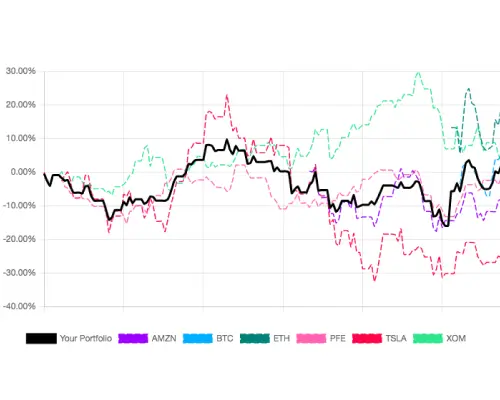

Dive deep into your portfolio’s performance with advanced analytics. Track key metrics like diversification, sector exposure, and risk/reward ratios to stay ahead in the market and optimize your strategy.

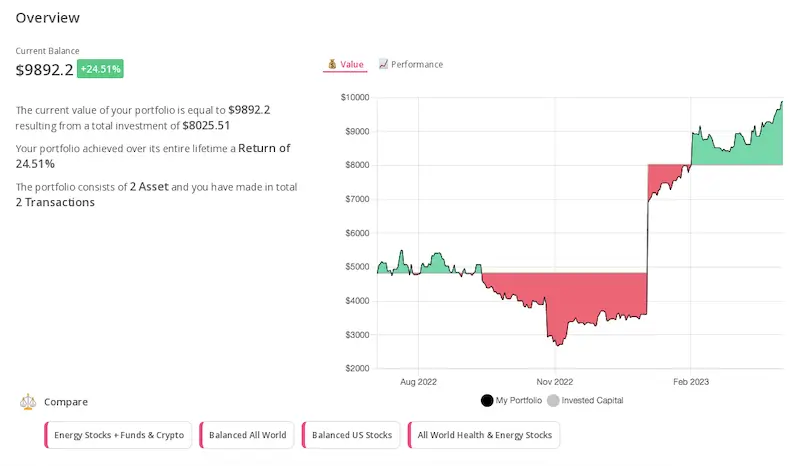

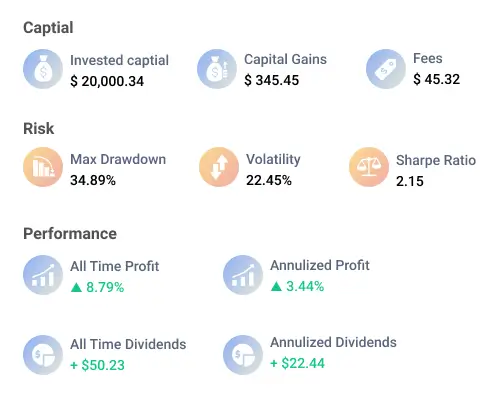

Understand how your investments evolve over time with historical performance tracking and trend analysis. Easily spot patterns, identify high-performing assets, and make informed decisions for future growth.

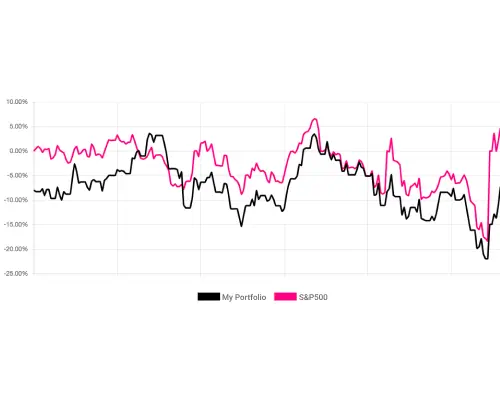

Compare your portfolio’s performance against major indices or custom benchmarks. Gain valuable insights into how your investments are performing relative to the market, helping you make smarter adjustments.