See How Your Portfolio Would Perform in Real Crises

Stress test your investments against historical market shocks like 2008 or COVID. Spot weaknesses, build resilience, and invest with confidence.

Stress test your investments against historical market shocks like 2008 or COVID. Spot weaknesses, build resilience, and invest with confidence.

Select from major historical events such as the 2008 Financial Crisis, Dot-Com Bubble, or COVID crash and see how your investments might have performed. It’s simple, insightful, and requires no financial background to get started.

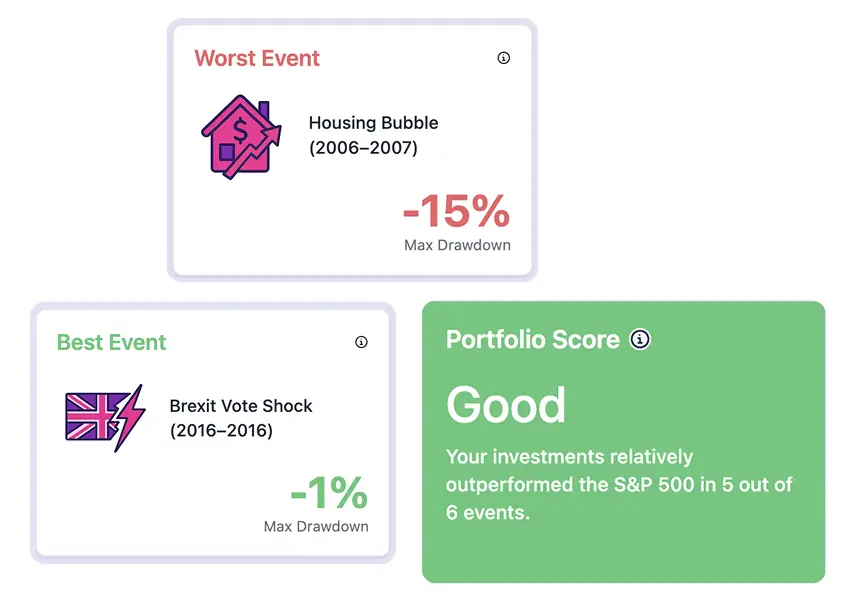

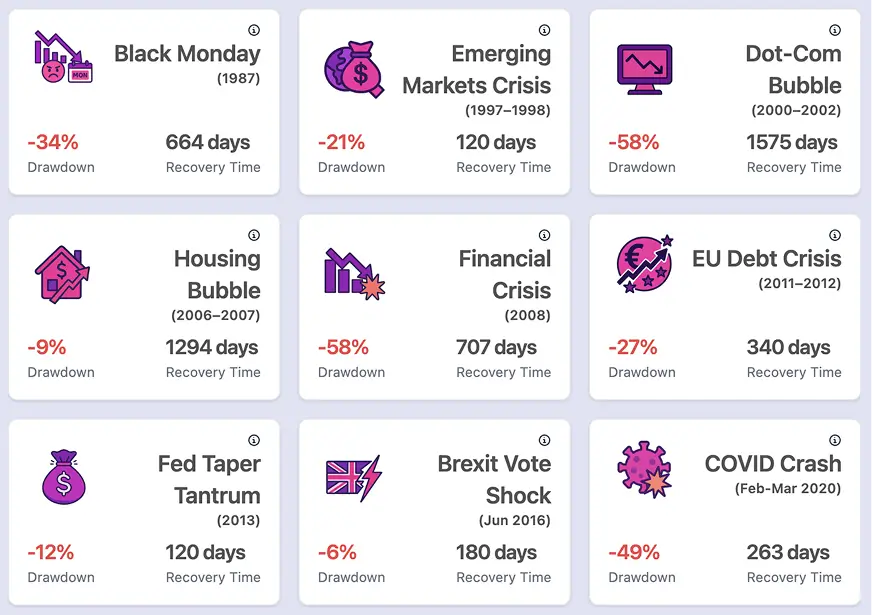

Visualize how your portfolio reacts to different crisis scenarios. Compare performance metrics like drawdowns and recovery time against benchmarks like the S&P 500.

Knowing how your portfolio would have held up in the past gives you an edge for the future. Use stress test results to make informed adjustments and prepare for whatever the market throws at you.