Achieve Portfolio Perfection with AI-Based Scenario Simulations

Refine your investments with precision. Adjust for risk, explore new scenarios, and uncover opportunities—all in minutes.

Refine your investments with precision. Adjust for risk, explore new scenarios, and uncover opportunities—all in minutes.

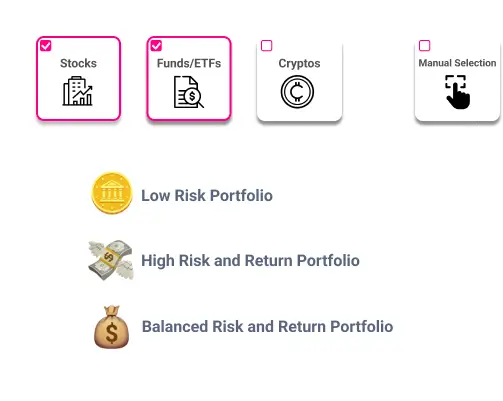

Simply select your criteria—such as asset type, country, industry, or risk level—and receive tailored recommendations built from thousands of assets. It’s personalized, data-driven, and designed to help you succeed.

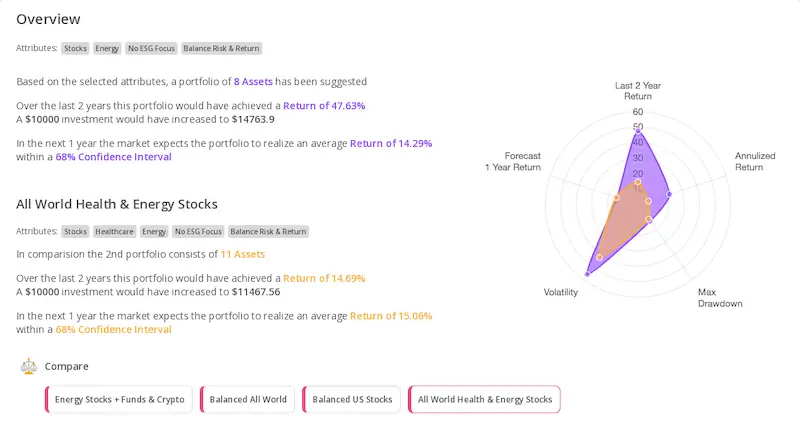

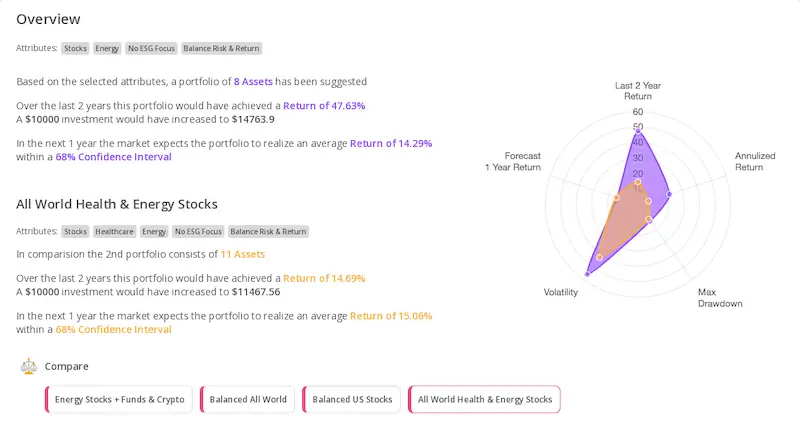

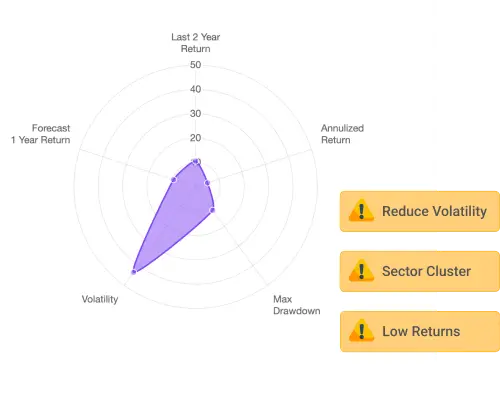

Easily visualize how different strategies perform across key metrics like returns, diversification, and risk exposure. Compare simulations side-by-side to see which option works best for your financial goals.

Optimize your portfolio for maximum returns while staying within your desired risk level. The platform identifies overexposures, highlights diversification gaps, and suggests adjustments to enhance your portfolio’s overall performance.

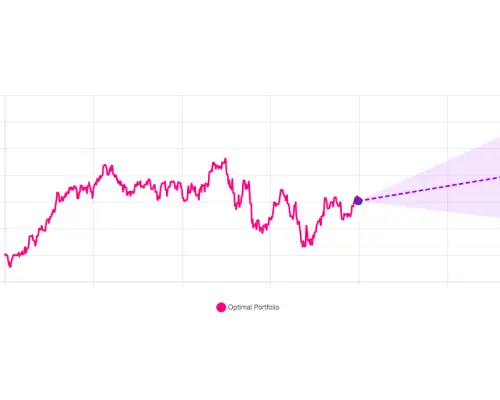

Explore how your portfolio might perform over time with detailed projections and confidence intervals. See the potential impact of your optimization choices and stay informed about future growth opportunities.